On August 24, 2017 US regulators halted trading in a Canadian bitcoin company, First Bitcoin Capital (BITCF) after its stock price increased 6,000% in 12 months (from .03 to $1.79).

The Securities and Exchange Commission (SEC) expressed doubts about the structure and capital assets of the company – which is now valued at half a billion dollars.

For the uninitiated, bitcoin is digital money not controlled or issued by any bank. Fast and easy – it’s sometimes called “internet-era money”.

It’s been on a tear since we last wrote about it, changing hands for USD 4289 a coin. Wow!

People who are suspicious of paper money typically gravitate to gold or cryptocurrencies. Digital coins can be purchased anonymously. The virtual coins can travel across borders without attracting attention from customs or tax officials.

According to “Coinbase”:

“Bitcoin is traded for dollars, euros, yen, and other currencies in real time 24 hours a day. Depending on the demand for buying or selling bitcoin, the price can fluctuate from day to day. This is similar to the manner in which the value of a stock or property can go up or down based on supply and demand. Bitcoin’s value can be volatile compared to traditional currencies such as the US dollar because it is still an emerging technology”.

The system is also favored by criminals. Remember the old days, when Cessna 410s would fly out of Miami packed with cardboard boxes of U.S $100 bills?

How quaint.

Now cocaine buyers just bring their MacBook Pros to the jungles of Colombia, press a couple of keys, and transfer $10 million to the local drug dealer. No taxes, no hassle, no risk of a back-alley ambush.

Phoenix with a dubious past

First Bitcoin was built from the wreckage of Grand Pacaraima Gold Corp (GPGD), which had an eclectic revolving door of different business ventures, including an operating interest in an Oklahoma gas company and four gold mines in Venezuela.

Your read that right: gold mines in Venezuela – the country where President Hugo Chavez announced that he would “exploit gold and all related activities for the sole benefit of Venezuela”.

Grand Pacaraima pulled gold out of the ground with the same efficiency that this cat is hydrating:

But it’s not just gas and gold. GPGD also owned IP (intellectual property) rights to radio frequency identification tags targeting jewelry retail stores.

“The tags will revolutionize the way the jewelry industry is managing the inventory and supply chain. The innovative technology means that store personnel can control the jewelry inventory in real time. Store management can adjust inventory levels or pre-order new inventory in a more efficient way.”

In 2014, when the company was renamed “First Bitcoin”, and an Investor-hub article revealed that its core management group contained multiple convicted criminals.

“Grand Pacaraima’s ugly past easy to uncover. So why, when a corporate action request was filed with FINRA for a ticker change from GPGD to BITC, did that request sail through? A tremendous unofficial pump is underway.”

First Bitcoin denounced the rumors that its executives owned 500,000 bitcoins while declaring, “there is no association between BITC and the Winklevoss twins”.

Who is Simon Rubin?

Currently, the Chairman of the Board of Directors of First Bitcoin is a man named Simon Rubin. For the head honcho of a small cap company, he keeps a low profile.

Internet searches of “Simon Rubin First Bitcoin” have failed to unearth anything substantial. This guy seems harder to find than D.B Cooper.

According to a company bio Mr. Rubin is “a serial entrepreneur with a background in programming and web design.” That also describes our thrice-divorced Italian neighbour who regularly vomits on his jeans and then naps on the public sidewalk.

After the news of the August 24 SEC suspension, a small army of U.S-based lawyers popped out of the bushes.

Bronstein, Gerwitz & Grossman – specialize in the “aggressive pursuit” of class action security litigation and securities arbitration.

Howard G. Smith Law Offices announced an investigation “on behalf of First Bitcoin Capital Corp. investors concerning the company and its officers’ possible violations of federal securities laws”.

Goldberg Law PC also announced that it is “investigating claims on behalf of investors of First Bitcoin Capital Corp.”

Rubin Responds

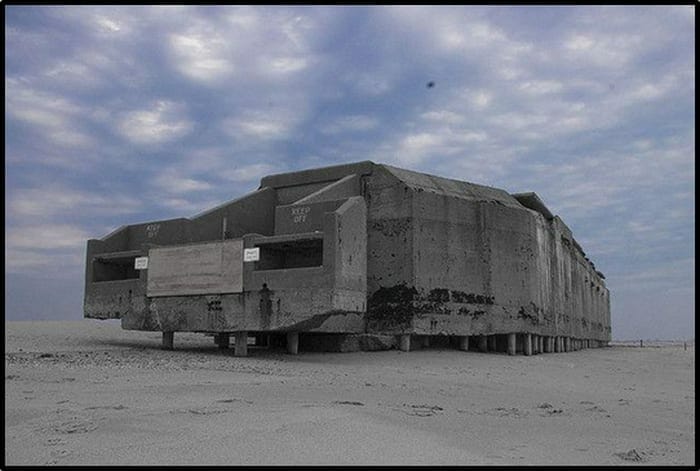

This saber-rattling flushed Mr. Rubin out of his bunker.

“The SEC suspension is unfortunate for those shareholders that need immediate liquidity and those day traders that held overnight,” stated Mr. Rubin. “While we are disappointed in the SECs decision to suspend trading, we understand the need to diminish the extraordinary demand for shares that have increased more than 24,000 percent in the 12 months -according to the Dow news release.

Mr. Rubin reminded shareholders that First Bitcoin has “been very busy generating more than 100 unique cryptocurrencies ranging from disrupting the air-miles-loyalty industry to providing solutions to the cannabis industry.”

Mr. Rubin continued:

“We believe that there is likely a misunderstanding or a simple clarification necessary and that it would have been better for the SEC to ask us for this information before taking such drastic action.”

Mr. Rubin also addressed the swarm of litigators:

“Their investigations are standard when a company of BITCFs magnitude is suspended but they will find nothing worthy of a class action lawsuit. These types of press releases from law firms of their ilk mostly result in no action taken and are often intended for publicity and finding new clients.”

According to its latest financial report, (Q3, 2016), First Bitcoin has no income. The filing stated:

“On June 30, 2016, the Company has an accumulated loss of $3,250,173 of which $2,740,000 result from the purchase of mineral properties with the issuance of common stock and subsequent impairment for the lack of extraction activities. This raises substantial doubt about the Company’s ability to continue as a going concern.”

Full Disclosure: First Bitcoin is not an Equity Guru client and we don’t own shares. If that ever changes please punch us hard in the face.