When you’re rich, it’s easy to get richer.

In for $0.35, out for $0.60, and with a half warrant for later.

That’s a nice result for those accredited investors who took part in the April financing of Prize Mining (PRZ.V). As they waltzed away with their money, selling their now free-trading stock, the only thing better than counting their profits was watching the bagholders lose our minds as the share price dropped in response.

You see this happen again and again. Mining company gets a nice plot of land, raises some money nice and cheap to start working it, big money guys buy in by the millions of dollars which moves the stock price up, but that big money comes free trading after four months and, really, what are you going to do with a double other than take your money?

So the price comes down, and the baggies see red numbers and jump off in fear, which makes the price drop way more.

What do the big money guys do next? They buy back their stock on the cheap. And that’s what’s happening with Prize Mining today.

Yesterday, you could use those early profits taken at $0.60 to buy the stock back at $0.25. Today it’s $0.28.

That’s not far from the financing price, and here’s why that notable.

If you’re not an accredited investor, or you’re not pretending to be one so you can get those sweet inside deals, the cheapest you could get Prize Mining stock when it resumed trading back in April was $0.57.

And you would have bitched about it, because those accredited guys got in at $0.35 with a warrant a few weeks earlier.

Well that stock you thought was a buy at $0.57, when it hadn’t yet filed technical reports and extended its land holdings and completed its field work and announced a nice batch of results yesterday (we’ll get to those), you can get that stock today for literally half price, at $0.28.

Let’s repeat that – you’ve got a company way further along now, with a share price lower than the rich guys were getting in their sweet financing deal back when the company was almost only a shell.

You can get shoved around by the bully at the table all day long, by chasing rises and dumping in the midst of drops, but take a step back for a moment and consider what Prize was six months ago compared to what it is today, and how you can buy it for half price today because the bullies have moved on to the next financing.

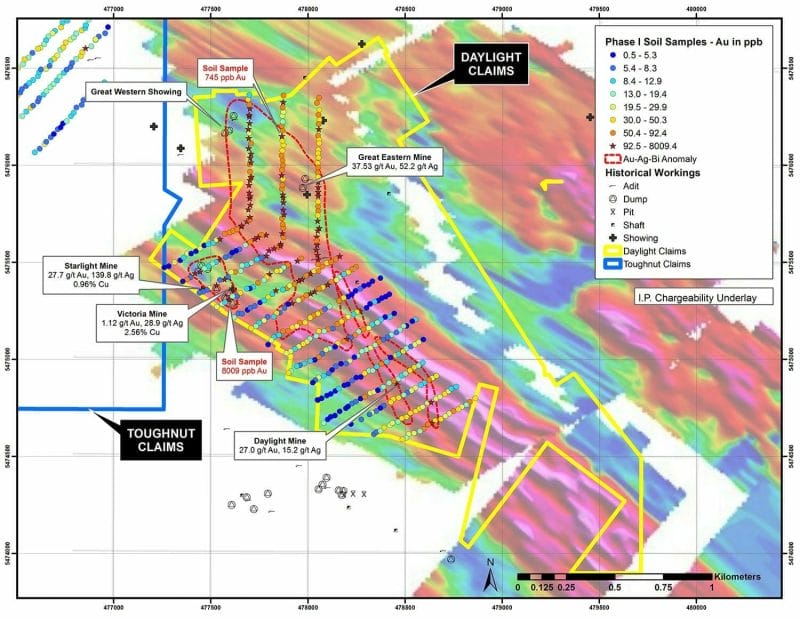

Here’s the latest soil sampling info:

-

The Great Western geochemical anomaly is approximately 1km long by 300m wide and includes 48 samples over the 90th percentile of 100 ppb Au. A cluster of strongly anomalous samples in the northern part of geochemical anomaly returned up to 745 ppb Au. A 300m trench will be dug along that trend during the Phase II program.

-

The Daylight-Starlight trend had nine samples that returned greater than 100 ppb Au, including a best sample return of 8009 ppb Au. This is the highest gold-in-soil sample result in recorded history along the Silver King shear system dating back to the early 1970’s. The pattern of soil anomalies along the 1.3km long Daylight-Starlight trend is narrower and somewhat spotty in comparison to the Great Western Trend, but an alignment of significant anomalous Au-Ag-and Bi in soils does coincide with known IP chargeability trends and with the known historical workings.

That’s a lot of garble blarble to non-mining guys, so here’s a map to show you what’s up. The stars are the killer hits.

The Toughnut results? Toss ’em. Ignore ’em.

But those soil samples in the Daylight claim are interesting. Up top, in the Great Western patch, the numbers are consistent and decent. the Daylight patch, down south, those are smaller in number but spike higher.

Trenching will come next, which will give more data still and help plot out future drilling locations, and that drilling will come quickly because, holla, the company has millions in the bank from its last few financings.

With a company like this, at an early exploration stage, there are a few factors that can bring risk to your investment.

- They can run out of money. Prize has that covered.

- They can not do the work, and instead collect CEO salaries until the stock hits half a cent. Prize is actively doing work.

- They can find there’s no gold where they thought there was. Prize appears to have zeroed in on a bit of shiny early on, which is indicative of there being more, god willing.

Now, the life of a junior miner is always one of ups and downs, of stock churns, and evolving ownership. There are guys who will come in before that early soil sample stage and take it from $0.02 to $0.20, then bail just as the results are coming in. They’ll be replaced by guys who see those results and will accept a higher share price buy-in in return for less risk. They’ll eventually move out when drill results land and the near production guys will come in, for a higher price still and, again, less risk.

But between those phases, there’s often a dark time where group one is out and group two isn’t yet in, where news is slim and there are more sellers than buyers. The long (smart) players spot those phases and take advantage of low prices. The rest react to the market when they see a later upward spike.

This is one of those times for Prize, when one herd has moved on to a new grazing pasture and another is looming on the horizon. Prize will continue to work this property and results will continue looking interesting as they zero in on the sweet spots.

Right now? Cheap. And it may take a week or a month or more before that day comes when a news release drops that bounces it back to a run.

Today you get less risk than in April, for less money than in April, for a company that has progressed.

I was in that earlier $0.35 round and am still sitting on my stock, and today bought more for $0.28 because I see this company as being evidence of a market inefficiency.

Put it on your watchlist. I’m not going to tell you to buy or sell, just put it on your watchlist and wait for your moment.

— Chris Parry

FULL DISCLOSURE: Prize Mining is an Equity.Guru marketing client, and the author has purchased stock in the company on the open market.