One of Nexus Gold’s (NXS.V) properties is about to get 61,000 acres bigger – for a paltry $23 an acre. That’s like paying 5 cents for a 16 oz craft beer. It’s almost robbery.

The land acquisition is big news – but before we get into it – let’s review the geology.

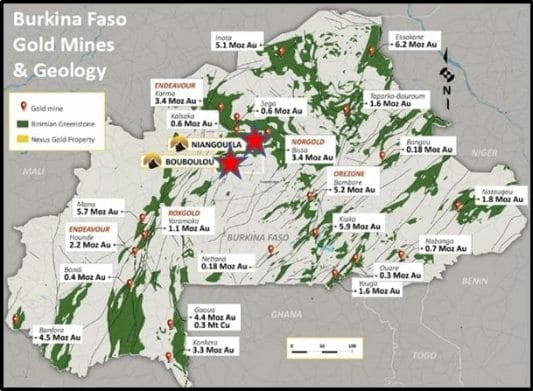

Nexus has put all its chips down on the land-locked country of Burkina Faso – in the heart of West Africa.

Burkina means, “men of integrity”; Faso means “fatherland”. Loosely translated Burkina Faso is “The Land of Honest People”.

Apparently, the country is accurately named. It has a murder rate of less than 1 per 100,000 residents (1/5th of the U.S rate) and according to Wikitravel: “It is one of safest countries in West Africa.”

Nexus is an early entrant to the Burkina Faso gold rush, but it’s not a pioneer.

Endeavour Mining (EDV.T) – a $2.3 billion market cap gold miner – is already building a mine in Burkina Faso, scheduled to begin production later this year with annual production of 190,000 ounces at an All-In Sustaining Cost of US$709/oz.

Africa is not every investor’s cup of tea. There are legitimate reasons to steer clear of it. Political instability, a culture of bribes – and occasional security threats.

But for investors that can handle the heat – Africa is a golden opportunity to mine precious metals at a healthy profit.

Nexus has two properties in Burkina Faso. The Niangouela concession has just been drilled. Highlights including 26.69 g/t gold over 4.85m (including 1m of 132 g/t gold), and 4.00 g/t gold over 6.2m (including 1m of 20 g/t gold).

But today we focus on Nexus’ other project: “The Bouboulou gold concession” which was a 38-sq km advanced exploration target with multiple confirmed zones of gold mineralization.

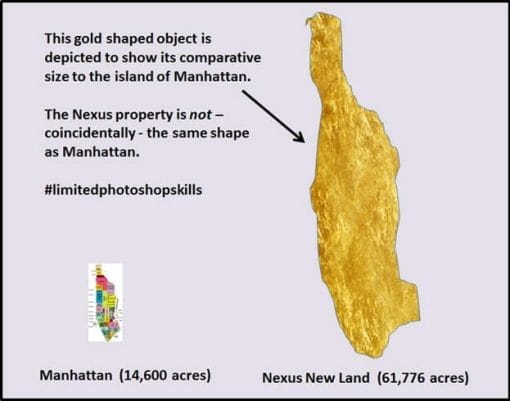

We say “was” – because on July 11, 2017 Nexus announced that it has signed an Letter of Intent (L.O.I) to earn up to 100% interest in the 250-square kilometre Rakounga Gold Property which adjoins the Bouboulou gold concession.

Assuming the L.O.I is converted into a binding deal, the footprint of Nexus at Bouboulou just got 650% bigger.

The Property extension borders Bouboulou on the west and south sides and hosts the Bouboulou 1 gold showing, which is the southern extension of the Bouboulou 2 trend.

Nexus will acquire a 90% interest in Rakounga by paying US$400,000 and issuing 575,000 common shares of Nexus, over a period of three years. It breaks down like this:

- US $ 10,000 and 25,000 shares of the Company upon signing of the deal.

- US $ 15,000 and 50,000 shares one year later.

- US $ 125,000 and 200,000 shares two years later.

- US $ 250,000 300,000 shares three years later.

After acquiring a 90% interest in the Property, Nexus will have the option to take over the remaining 10% through a cash payment of US$1 Million with a 1% net smelter return royalty.

Add it all up – Nexus is paying $23/acre for highly prospective gold exploration property in Burkina Faso.

“This acquisition allows us to follow the Bouboulou 2 and Pelatanga-Rawema trends to the southwest,” said President & CEO Peter Berdusco. “There is significant artisanal activity in this new area which indicates gold mineralization continues along the established trends for some distance.”

The Bouboulou concession is 100 kilometers northwest of the capital city of Ouagadougou – famous for its beautiful people, delicious food, great music and fascinating architectural oddities:

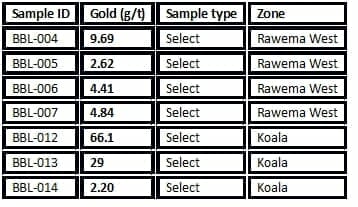

Nexus property contains 4 zones of gold mineralization. A fifth zone, Rawema West, was identified on June 6, 2017 by Nexus geologists.

Company geologists collected 14 select rock samples of dump material from the Rawema West and Koala workings. 50% of the samples returned values greater than 1 g/t Au [see below].

A 2,000 metres diamond drilling program has been executed at Bouboulou since mid-June, 2017. Phase one drilling has been testing the Koala, Rawema and Bouboulou 2 zones, to depths of about 160 metres, as well as the Rawema West zone.

We do not “self-identify” as gold bugs. In truth – we also do not “self-identify” as alcoholics – yet crates of vodka seem to migrate from the freezer to recycling.

Global money printing and “quantitative easing” have damaged the integrity of paper currency while creating trillion dollar equity, bond and real estate bubbles.

When these bubbles pop – there will be a stampede to gold.

Burkina Faso is the fastest growing gold producer in Africa.

Eight new mines have been commissioned there over the past six years. It has undergone less than 15 years of modern mineral exploration, remaining under-explored compared to Ghana and Mali.

Nexus is trading at .15 with a market cap of 19.5 million.

Nexus has share price upside the way Donald Trump has unconventional hair.

It’s staring at you in the face.

FULL DISCLOSURE: Nexus Gold is an Equity Guru marketing client. We also own stock.