Electric vehicle sales are expected to increase from 650,000 in 2017 to about 7,000,000 a year in the next decade – an increase of 1,100%. Hybrids will grow from 2.2 million units this year to 19 million in the same time span. They will all need graphite.

Of course it’s not just vehicles – laptops, cellphones, e-readers are all driving lithium ion battery demand.

Lithium-ion batteries require graphite, cobalt and lithium. All three of these critical elements are projected to go into supply shortage due to surging demand from new technologies.

There are lots of graphite companies, lots of cobalt companies – and more than a few lithium companies. But there are very few companies simultaneously developing all three elements.

Berkwood Resources (BKR.V) is fiercely battery-focused – exploring for commodities that tie into modern technology and new electronics.

- Graphite:

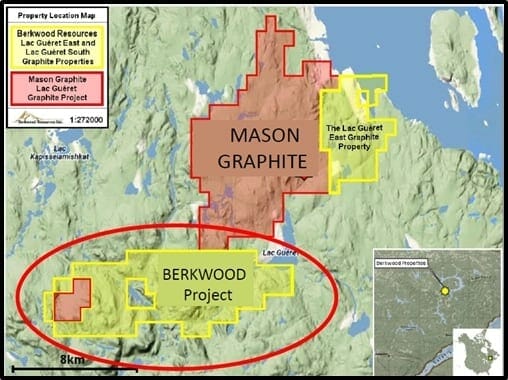

Berkwood’s graphite asset is sandwiched between Mason Graphite’s advanced Lac Guéret Projects which have about 75 million proven tonnes of high grade large flake graphite.

Used in batteries, automobiles, nuclear reactors, fuel cells and solar power systems – large flake graphite is a critical ingredient in new technologies.

Mason projects a $90 million capex to build the mine, a 2.5 year payback and a minimum of 24 years of mine life.

Berkwood’s Lac Guéret project borders Mason Graphite’s property to the east and south and shares similar prospective geology. Berkwood is mostly focused on the southern property.

Make no mistake, Mason’s project is more advanced. Mason is currently completing an Environmental Impact Study. But Berkwood’s market cap is 3% of Mason’s – that gives you an idea how much room there is to run if they are on the same geological trend.

- Cobalt

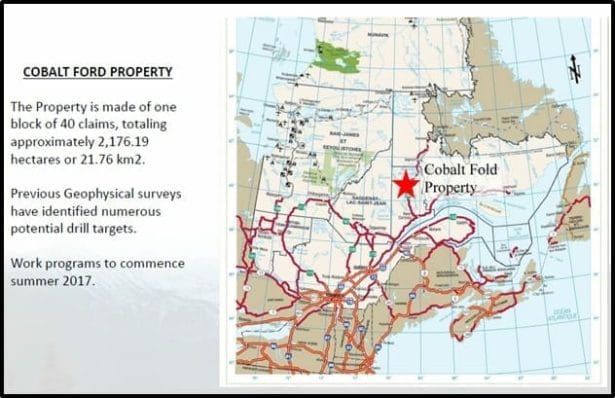

Earlier this summer Berkwood entered into an agreement to acquire The Cobalt Ford Property which consists of 40 prospective cobalt claims.

The property is situated near extensive infrastructure. The Manic 5 hydro electrical dam is located approximately 15 km south of the Property.

- Lithium

On July 11, 2017 Berkwood announced it has acquired a package of 53 claims, east of Simon Lake, Quebec. The “Delbreuil Lithium Project”, located in the Abitibi District, is road accessible and located in an established lithium-rich region.

To acquire the package, Berkwood made a made a payment of $15,000 and issued 2.1 million shares to the previous project owners.

Berkwood’s claims contain pegmatites that host spodumene.

In the world of lithium, spodumene is a big deal. The lithium can be extracted easily. The bulk of lithium production involves brines, but global production of lithium via spodumene is about 80,000 metric tonnes a year.

These projects are generally quicker-to-production than brines. Once Berkwood’s deposit is established – and a mill is built, the lithium carbonate can be produced in a matter of days.

The Delbreuil Lithium Project has been explored for base metals. The available data on the land package is “historic” – which means it does not meet modern geological standards. So you can discount it, but don’t discard it.

Past exploration programs produced anomalous lithium (1,290 ppm), tantalum (126 ppm) and rare earth elements. These are called “pathfinders”. It’s a like hearing an ice-cream truck when you’re looking for ice-cream. You’re gonna want to follow the sound.

Berkwood’s $22 billion Tailwind:

All Berkwood’s properties are in Quebec. That’s a good thing. Quebec is awash with government money aimed at stimulating the resource sector.

The Premier recently announced that the Quebec government will invest $1.3-billion in infrastructure and other projects over the next 5 years with the intention of catalyzing $22-billion in private-sector investment.

By 2035, the government hopes to attract a total of $50-billion in private investments, of which at least $2.5-billion will be public money.

Quebec is largely unexplored. Government geologists believe there are massive untapped deposits of cobalt, graphite and lithium lying in the ground.

Two weeks ago Volvo announced that it will completely discontinue the production of gasoline engines in 2019 – shifting its entire product line to electric engines.

Last year, lithium ion battery sales were $3 billion. By 2040 the market will be worth more than a $100 billion.

Berkwood has a veteran geological team with deep international experience . BKR management was instrumental in numerous producing mines including Diavik Diamond Mine, Resolution Copper, Eagle Nickel, Lakeview Nickel and BunderDiamonds.

Berkwood is fully funded for the current phase of development, and the company has a very tight share structure.

Developing raw materials for the battery industry is like planting bamboo seeds in a colony of Panda Bears.

If it grows, it will be eaten.

Strong assets, a good team and money in the bank.

Good entry point?

You decide.

FULL DISCLOSURE: Berkwood resources is an Equity Guru marking client. More than a few of us are long on the stock.