The restaurant business sucks balls: perishable inventory, bricks and mortar capital expenses, high labour costs, un-scalable – and a notoriously fickle customer base.

Being a “social media” star is a good business: post Instagram photo of bikini-body next to bottle of Nirvana Coconut Water. Send invoice to Nirvana Coconut Water. Wash, rinse and repeat.

But social media stars don’t sell equity shares. So what profitable business can regular Joes like us invest in?

How about Metal Royalty and Streaming Companies?

Here’s how they work: Streaming companies lend cash to resource developers – usually to finance exploration or mine construction in exchange for a share of the mine’s future production.

Royalty and Streaming companies don’t need to run airborne surveys, lease drill rigs, buy dynamite, apply for permits or hire miners. They do need the geological and financial expertise to identify good projects and negotiate good deals.

Think of them as boutique merchant banks specialising in precious metals.

Franco-Nevada (FNV.TSX), Silver Wheaton Corp. (SLW.TSX) and Royal Gold (RGLD.NASDAQ) are three big commodity streaming companies. They have average revenue of $634 million and an average operating margin of 29%.

Franco-Nevada has fewer employees than a mid-size petting zoo.

With a tiny workforce and no physical inventory, FNV is wildly profitable. In the mid-80s, it invested $2 million for the development of the Goldstrike mine. That royalty has generated over $1 billion. FNV now has a market cap of $12 billion.

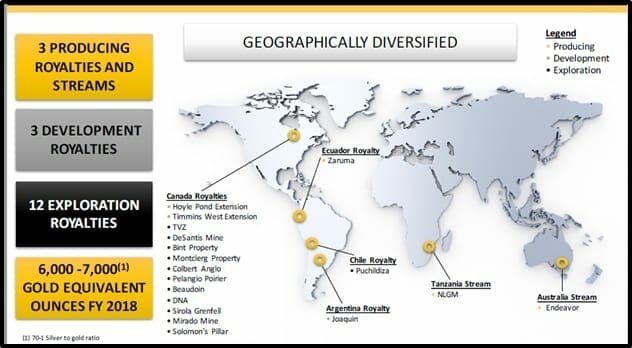

Metalla Royalty & Streaming (MTA.C) has a market cap of only $31 million. This company is growing fast, closing deals and bulking up its portfolio.

A couple of weeks ago, Metalla moved the President, Brett Heath in the CEO chair, replacing Tim Gallagher – who is now the Chairman.

As Conor McGregor is to punching-people-in-the-face – Heath is to metal streaming (he didn’t invent the art, he perfected it).

Heath is the ex-CEO of High Stream where he brokered a slew of savvy metal streaming transactions. Before that, he ran a private streaming company where he deployed $11 million in 4 producing streaming transactions.

Health also studied Austrian Economic Theory in Linz. This influential theory argues that “the worth of a product is subjective in nature: what is valuable for you may not be valuable for your neighbor.” Sounds like a good base camp from which to climb a mountain of precious metal investment opportunities.

As the big fish like Franco-Nevada have moved onto to larger streaming deals, Health has got his pick of deals in the $2-$15 million range.

In a USD $13 million deal, MTA recently acquired a portfolio of 3 royalties and 1 stream from Coeur Mining (CDE.NYSE).

Coeur Mining (CDE.NYSE) is $1.7 billion Goliath that operates five precious metals mines in Mexico, Nevada, Alaska, South Dakota and Bolivia. In 2016, Coeur Mining had revenues of $723 million.

The way the deal is structured, it’s clear that CDE believes Metalla is undervalued. The multi-national producer is taking control of 19.9% of Metalla’s stock through a Convertible Debenture.

MTA picks up these four assets:

- Endeavor Silver Stream – underground zinc, lead, and silver mine – is expected to generate cash flow of $3.3 million for the balance of 2017 and $5 million for 2018.

- The Joaquin Project – provides a 2% Net Smelter Royalty on this Argentine project which contains about 65.2 million oz silver and 61,100 ounces of gold.

- The Zaruma Gold Mine – in Ecuador provides a 1.5% Net Smelter Royalty on a project with a M&I resource of about one million ounces of gold with an average grade of 12.97 grams per tonne.

- The Puchuldiza Project – provides a 1.5% Net Smelter Royalty on an asset in North Chile, with an estimated inferred resources of 686,000 ounces of gold. The Puchudiza royalty is capped at USD$5 million.

Coeur Mining gets a few deals off its books that are too small to affect the share price of a $1 billion plus company – while gaining equity share in an energetic upstart.

Benefits to Metalla include:

- Immediate Cash Flow: (Two out of the four streams/royalties are currently in production

- New Partners: (CBH Resources, Pan American, Dynasty Metals and Regulus Resources)

- Bigger Footprint: (assets in Australia, Argentina, Ecuador, and Chile).

“Coeur’s end game is the same as ours,” confirmed Heath in a recent Equity Guru interview, “They see us as a take-over candidate, particularly in a rising metal price environment.”

Metalla has also recently acquired a 1% Net Smelter Royalty (NSR) on Goldcorp’s (GG.NYSE) Hoyle Pond Extension properties in Timmins Ontario.

The Hoyle Pond currently produces about 160,000 ounces gold a year. The average grade is 14 grams per ton. Goldcorp has spent $194 million on a Deep Hole project to access the extension.

Metalla’s NSR royalty is due after the initial 500,000 ounces of gold equivalent threshold is met, so this one will take a little patience. MTA should start receiving cheques in 2020.

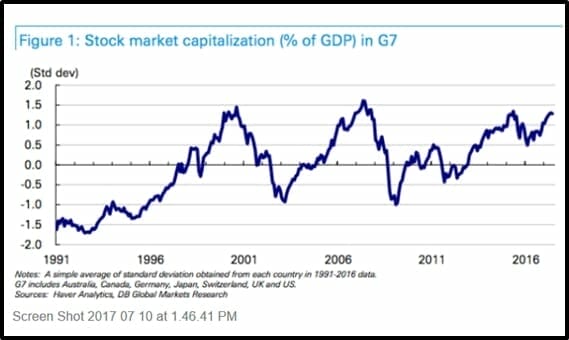

If history is destined to repeat itself, the following chart (Stock Market Capitalisation/% GDP) predicts an impending stock market crash.

When that happens there will be a stampede into precious metals driving explorers, miners and derivatives sky high.

Metalla Royalty and Streaming is a powerful way to triple “lever” a precious metals investment.

The first part of the leverage is the internal company growth. The second part of the leverage is the rising price of gold and silver. The third part of the leverage is the revaluing of the company into higher multiples as it generates more revenue.

We share Coeur Mining’s opinion that Metalla’s share price is going higher.

FULL DISCLOSURE: MTA is an Equity Guru marketing client. But it’s such a sexy beast. We’d write about it anyway.