In 1998, a 42-year-old Canadian entrepreneur named Chip Wilson observed the surging popularity of Yoga classes and realised that there was no equipment, no uniform, no auxiliary sales to financially exploit the modern fitness trend.

Seizing the opportunity, he designed comfortable machine-washable yoga-wear. That innovation would have been enough to make him rich. But then he had a secondary idea: make the yoga clothing so aesthetically pleasing that women would wear it on the street

Two years later, Lululemon (LULU.NASDAQ) opened its first store in in Kitsilano, Vancouver. In 2014 Mr. Wilson sold a 27% stake for $845 million. He now lives in this $75 million Vancouver home.

In February, 2015 Mr. Wilson resigned from the LULU board. Since then, the stock is down 17%. It has closed stores and lost market share. LULU has 2017 guidance of $2.55 billion net revenue. So it’s not exactly in “free-fall”.

But as the global yoga craze gathers steam – it should be no surprise other companies jostling for a piece of this pie, including giants like Under Amour (UA.NYSE), Nike (NKE.NYSE), GAP (GPS.NYSE) and even Amazon (AMZN.NASDAQ) which is working on a line of “Athleisure Clothing”.

Naturally there are many smaller fish trying to carve out a niche in this nutrient rich ocean.

Respect Your Universe (RYU.V) is one of these small fish. Based in Vancouver, British Columbia, RYU is an apparel brand targeting the “multi-discipline athlete”.

We are focusing on RYU because its flagship retail store is in our city and we often see cross-trainers on the beach wearing RYU clothing.

RYU’s core business is selling stylish fitness clothing to women.

But RYU is also courting men.

And selling bags and accessories.

On May 1, 2017, RYU announced its 7th consecutive quarter of increasing gross profit. Revenue in the first quarter of 2017 was $467,003, 80% higher than revenue of $259,727 during the same period in 2016.

In Q1, 2017 RYU met the following milestones:

- Balanced sales between men and women at 46% and 54% respectively.

- Raised 208% of its initial pre-sale goal for its new men’s Ethos pullover and women’s Ethos full zip hoodie.

- Achieved 16% of revenue from e-commerce with a target of reaching 30% by the end of 2017.

- Retail store expansion plan is on target to have five stores open by the end of 2017.

Despite all this good news, the stock price is languishing .08 with a market cap of $14.9 million. It is a really ugly chart. And there is a simple reason for that: last quarter, RYU lost about $2 million. Most of that was due to the recovery of warrant derivatives.

Leisurewear is cluttered market and investors in RYU – or any other small retail company – should expect protracted losses while it struggles to gain market share.

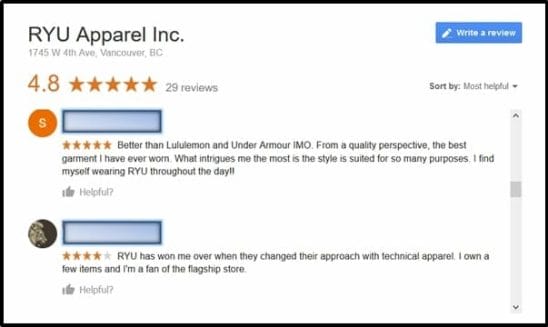

RYU is on our screen because it is making noise and gathering fans. RYU has a 100% positive rating on Yelp. It has 29 Google reviews with a 4.8/5.0 rating.

No discussion of leisure-wear is complete without a mention of China – which has 400 million millennials; a swelling middle class that is getting hooked on fitness. Currently, 10 million Chinese practice Yoga. Lululemon has recently opened stores in Beijing, Hong Kong, Singapore.

Asian consumers are famously quick to adopt foreign brands.

We would like to see RYU hire an Asian operations team with the objective of entering the Asian market aggressively in 2018.

Since leaving Lululemon, Chip Wilson – who is still a major LULU shareholder – has been vocal in criticizing the current board:

“Lululemon has lost its way. Three years ago our stock was double the value of Under Armour’s – now it is worth less than half. I have not seen actions that lead me to believe we will regain our competitive position.

Mr. Wilson is enticing competitors like RYU to nibble at his lunch.

FULL DISCLOSURE: RYU is not an Equity Guru marketing client. We frequently write about ambitious companies with good products.