Nick Hodge, Investment Director at Wall Street’s Underground Profits, is taking an interest in Canadian gold juniors after a series of merger and acquisitions is revealing a pattern. Recent examples include Goldcorp’s (TSX: G, NYSE: GG) $520 million acquisition of Kaminak Gold Corp., and Eldorado Gold’s TSX: ELD, NYSE: EGO) $590 million purchase of Integra Gold Corp. (TSXV: ICG).

Nick caught up with Atlantic Gold (TSXV: AGB) Chairman & CEO Steven Dean at the International Metal Writers Conference to ask for his views on trends in the gold mining sector.

Steven explained that growth-hungry mining companies are once again eyeing gold projects developed by juniors in Canada as they aim to rebalance their portfolios with a view to replacing depleting reserves and focusing on growth strategies, while reducing geopolitical risk.

“It is getting more and more difficult to find and own production in safe jurisdictions around the world,’’ Steven said. “So there has been a fair amount of focus on companies with projects in mining friendly jurisdictions, and countries with a long tradition of mining, such as Canada.’’ That would help to explain the announcement of a business combination involving Tahoe Resources Inc. and Lake Shore Gold Corp. on April 1, 2017.

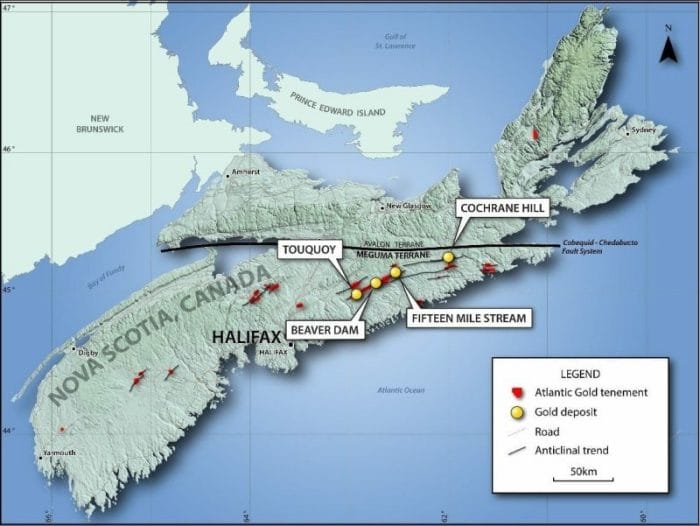

In the highly competitive world of mineral exploration, Atlantic Gold has set itself apart from the competition by developing what is now the only construction stage, fully financed and permitted open pit gold project owned by a junior in Canada.

With commissioning scheduled to get under way in a few months, the Moose River Consolidated Project (MRC) is expected to produce approximately 87,000 ounces of gold per year for a minimum of 8.5 years at an all-in sustaining cost of C$690 / oz or US$518 / oz. and this is only its base case production scenario.

That would make MRC highly profitable, at the current gold price of US$1,280 an ounce or ~ $1725 Canadian, that’s over $1,000 / oz margin and very good for any business.

It can look to a profitable future because the company is deploying low cost open pit mining techniques in an area of Canada previously overlooked. Recognition of disseminated style mineralization in recent years has changed the understanding of the potential of the region. Shale hosted mineralization combined with traditional quartz veins results in 50-100m wide bulk mineable zones in open pit.

The gold processing facility at MRC will be the first in Canada to be built under a fixed price contract. A strong emphasis on risk management has kept construction on budget and on track for the mine’s first gold pour this September. Construction is currently 70% complete.

Another key differentiator that sets Atlantic Gold apart from its peer group of gold companies is insider ownership. Board and Management own +35% of the company and if you do the research you will see that very few mining companies have that high degree of insider ownership.

Aside from aligning its interests with those of investors through a large ownership stake, management has a long and proven track record for growing companies from a small base to a larger one. Maryse Belanger, Atlantic’s chief operating officer, was instrumental in helping to grow the businesses of Kinross Gold Corp. and Goldcorp Inc., two of the industry’s leading producers, as a senior VP.

Steven Dean is no stranger to growing gold companies for acquisition. He was a founding member of the Normandy Mining Ltd., which became the largest gold producer in Australia before it was swallowed by Newmont Mining Corp. and Franco Nevada in a 3-way merger.

He was also co-founder of PacRim Mining Corp., another Australian gold producer, which was absorbed by Teck Resources Ltd. in 1999.

Atlantic Gold (TSXV: AGB) shares have been a top performer all year in anticipation of the first gold pour. If you’ve been watching this company you won’t want to miss this conversation with Wall Street’s Underground Profits to hear about scenarios to double production and upcoming valuation catalysts

Learn why Nick Hodge says this “screams undervalued” in this interview