According to the UK-based research group, Jubilee Debt Campaign – 27 countries are in “debt crisis”, with another 80 “at risk”.

U.S citizens now owe about $1 trillion in credit card debt, another $1 trillion in student loans. US companies have added about $7 trillion in debt since the 2008 financial crisis.

European countries with debt-to-GDP ratios over 100% include in Belgium, Greece, Portugal and Italy. Emerging market debt is more than $15 trillion. Moody’s recently downgraded the status of sovereign debt in 24 nations including China.

When the shit hits the fan investors will flock to “hard assets” like real-estate, art and gold. The influx of buyers will create price surges. If you have the balls to buy early, the gains will be yours.

Gold has two advantages over other hard assets. 1. It requires no expertise to assess it 2. It already has a religious following (particularly in India and China).

Historically, the biggest gains will come from publically traded gold companies. There are hundreds of them on the TSX and TSX.V. Let’s be honest: we haven’t done due diligence on all of them.

But here are five companies we do know, and we believe in.

Endeavour Gold (EDV.TSX) is an intermediate gold producer with a bulging portfolio of gold mines in West-Africa. “Intermediate” means every year they produce less gold than Barrick (ABX.TSX) but more than you can carry in a knapsack.

In 2016, EDV produced 580,000 ounces of gold (16,400 kilograms) – creating a cube of gold about 3’ by 3’ by 3’.

We’ve been following EDV for about five years, and the story never changes. They find gold in Africa and then they mine it profitably. The real danger with Endeavour is that it will bore you to death with its professionalism and plodding profitability.

Operating 5 mines in Côte d’Ivoire, Burkina Faso, Mali, and Ghana – the 2017 target is between 600,000 and 640,000 ounces of gold at an all in sustain cost of about US$880.

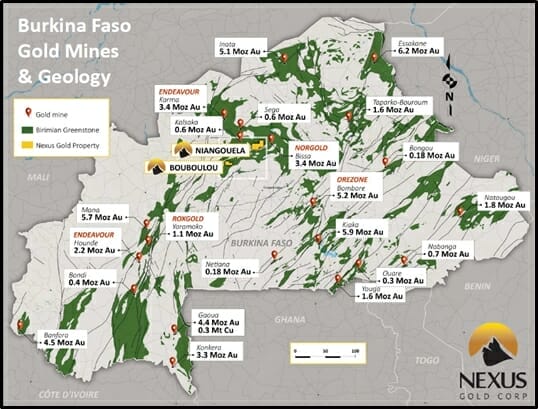

Nexus Gold (NSX.V) has two gold projects located in Burkina Faso, West Africa.

The Niangouela project features high grade gold occurring around a 1 kilometer primary quartz vein.

Nexus recently completed a 2nd phase of diamond drilling at Niangouela. A total of 18 holes, consisting of 2572 metres, were drilled. NSX is testing the dip and strike extensions of gold mineralization identified by in the Phase 1 program.

In Phase 1, eight of the first nine drill holes successfully intercepted gold, with highlights including 26.69 g/t gold over 4.85m (including 1m of 132 g/t gold), and 4.00 g/t gold over 6.2m (including 1m of 20 g/t gold).

The Bouboulou gold concession is a 38-sq km advanced exploration target with multiple confirmed multiple zones of gold mineralization. NSX has now moving the drill rig Bouboulou gold concession. It will drill 2000 metres to depths of about 160 metres.

Burkina Faso is the fastest growing gold producer in Africa.

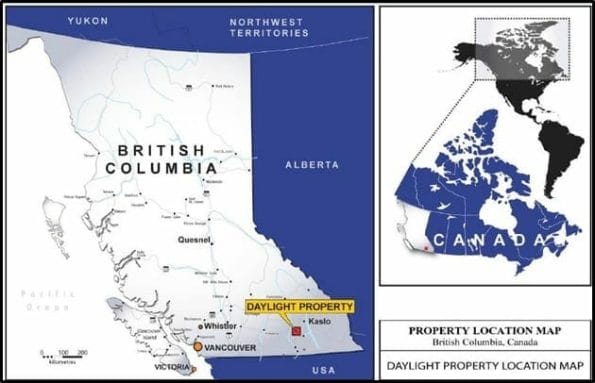

Prize Mining Corporation (PRZ.V) controls an 8,000 hectare property in the Nelson BC gold camp. A recent technical report has stated that the PRZ property contains “Four gold-bearing targets” that require further exploration – with an upside of 3 million ounces of gold.

The land package has multiple historical high-grade mines and is close to a highway, water and cheap power in a mature mining jurisdiction.

Yes – the geology on this project looks promising – but the shiny differentiator here may be the CEO, Feisel Somji. Stating that he Somji has a good track record with metal projects – is like pointing out that Leonardo Dicaprio once had an attractive girlfriend.

As the President of Rio Alto Mining, Somji developed a mine in Peru which achieved annual production of 150,000 ounces of gold. Rio Alto was sold in 2015 for $1.3 Billion. With no knowledge of Somji’s personal finances, we are guessing he has the liquidity to pay his next Hydro bill. So he’s looking for a big prize.

Guys like Somji are courted by multiple juniors; we consider his presence at the helm of Prize Mining to be a significant de-risker and a magnet for building a deeper shareholder base.

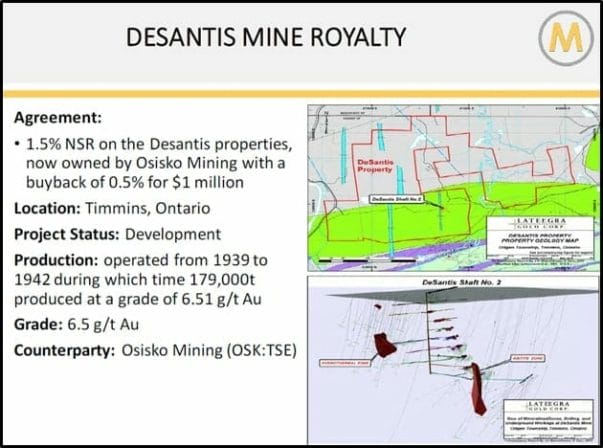

Metalla Royalty & Streaming (MTA.C) has made strategic investments in multiple metal projects – providing financing in return for future Net Smelter Royalties.

This business model that exploits the banking industry’s ignorance about geology and mining. A typical commercial loan officer at a major bank cannot read drill results – so resource companies are forced to fund exploration or mine expansion by surrendering future mine revenues.

MTA has acquired 15% of a Tanzanian underground mine. The Tanzanian agreement states that by-product silver is purchased at 10% of the silver spot price. It covers 100% of monthly silver production up to 11,250 ounces and 80% of the silver production thereafter.

Metalla’s deals include a 1% Net Smelter Royalty (NSR) on Goldcorp’s Hoyle Pond Extension properties in Timmins Ontario, a 1.5% NSR on the Desantis properties, owned by Osisko Mining (OSK.TSE).

Inca One (IO.V) is a Canadian-based company operating a 100 tonne/day gold milling facility in southern Peru. Investing in Inca One is a way to own a gold growth stock without exploration risk.

Five years ago Peru decided to regulate and tax small-scale miners. About 70,000 small-scale miners enrolled in initial Formalization Process. These miners must now get their ore processed at government sanctioned milling operations, like Inca One’s.

IO is an industrial manufacturing company, turning ore into bullion.

The business model is pretty simple. The trucks roll in loaded with ore from small mines, IO buys the ore, separates the gold, and sells it. Inca One’s recent average grade of 14 grams of gold per tonne is about 700% higher than Barrick’s (ABX.NYSE) average reserve grade.

With no hard extraction costs, Inca One’s bottom line is not sensitive to the price of gold.

We’ve been hearing about the “global debt crisis” for so long it’s become background noise – like a sherry-soaked uncle babbling about UFOs at Thanksgiving.

But if a building has been burning slowly for a long time, it’s legitimate to occasionally point out that the flames are still visible, smoke is billowing – and there is no fire-truck in sight.

“The world is woefully under-prepared for a new round of debt crises,” stated Tim Jones Jubilee Debt Campaign Economist, “As US dollar interest rates increase, the threat of crises will escalate.”

Question: would you feel uncomfortable at a dinner party explaining how you got richer while the other dinner guests lost their shirts?

If the answer is “no” – remember: real estate, art and gold.

FULL DISCLOSURE: Nexus Gold, Prize Mining and Metalla Royalty and Streaming are Equity Guru marketing clients; Endeavour Gold and Inca One are not.

isn’t crypto currency the new gold?

Thanks for the question Jeff – we appreciate reader feedback. I’ve tried to answer it in our latest article: https://equitystaged.wpengine.com/2017/06/11/gold-bugs-gathering-break-fake/