Global money printing and “quantitative easing” have damaged the integrity of paper currency while creating trillion dollar equity, bond and real estate bubbles. It doesn’t take a genius to sustain 2% GDP growth when you’re tossing duffel bags of cash from a fleet of helicopters. When these bubbles pop – there will be stampede to gold

I can not predict the date, although there are plenty of charts to indicate the day is coming sooner – rather than later.

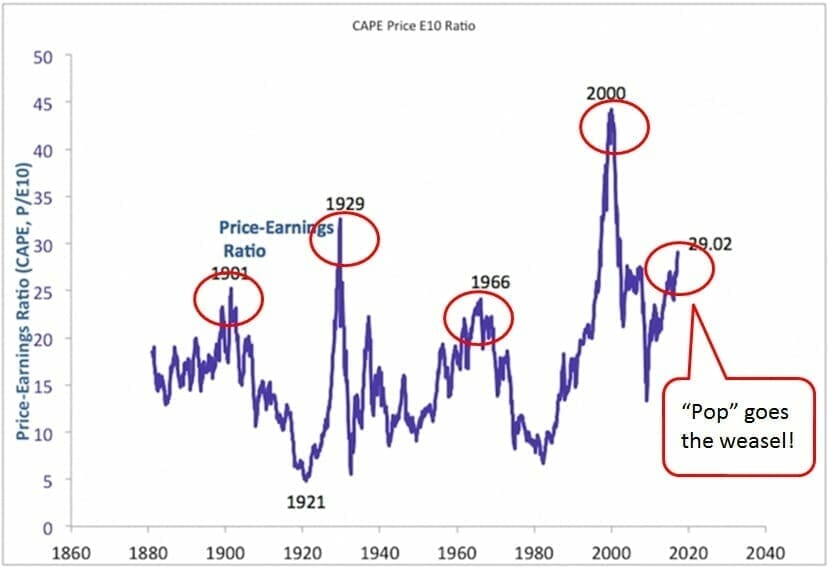

You can see stock market P/E peaks just before “The Great Depression” (1929), “The Credit Crush” (1966) and the “Dot Com Crash” (2000). I’m no chartist – but this ship looks like it’s heading for the rocks again.

If you want to invest in gold as a hedge against stock market euphoria, the question arises: how should I do it? Bullion? Gold ETF? Smelters? Coins?

Historically, the biggest returns have come from junior explorers or miners, building resources in mining-friendly jurisdictions with low labour costs.

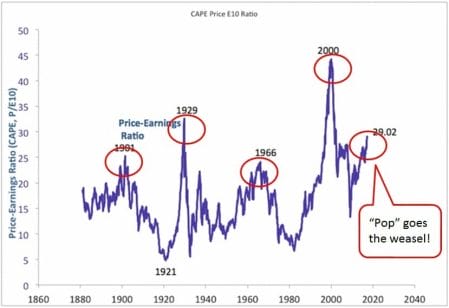

Burkina Faso (pop. 17.5 million) fits that description.

Although Burkina Faso is one of the poorest countries in West Africa – it has a murder rate of less than 1 per 100,000 residents – 1/5th of the U.S rate and 60% lower than Canada’s.

According to Wikitravel: “Burkina Faso is one of safest countries in West Africa.” A TripAdvisor Blog entry from March, 2017 states: “I found the Burkina Faso to be very friendly and the people more honest and trustworthy than you find in most developing countries”.

Burkina Faso will never replace Italy or Thailand as a global tourist destination but it is safe place to visit and invest in.

Nexus Gold (NSX.V) has two gold projects located in Burkina Faso.

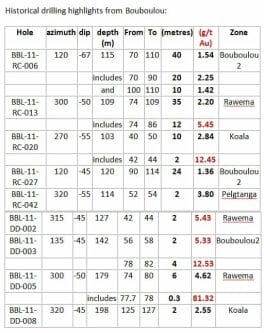

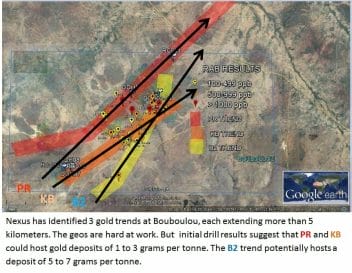

The Bouboulou gold concession is a 38-sq km advanced exploration target with multiple confirmed zones of gold mineralization.

On April 27, 2017 Nexus announced that it has received a new 3-year work permit for Bouboulou. The permit can be renewed twice for a total of nine years.

On April 27, 2017 Nexus announced that it has received a new 3-year work permit for Bouboulou. The permit can be renewed twice for a total of nine years.

“This ensures that the property can be effectively explored, developed and advanced in all areas,” stated President and CEO, Peter Berdusco. “It brings us a step closer to becoming a significant exploration and development company in West Africa.”

On April 5, 2017 Nexus announced the completion of its phase one diamond drill program at the Niangouela concession.

On April 5, 2017 Nexus announced the completion of its phase one diamond drill program at the Niangouela concession.

Eight of the first nine drill holes successfully intercepted gold, with highlights including 26.69 g/t gold over 4.85m (including 1m of 132 g/t gold), and 4.00 g/t gold over 6.2m (including 1m of 20 g/t gold). All mineralization in these first nine holes was present at depths of 57m to 124m below surface.

A 2,000 meter phase two program is now underway to test down the dip and strike extensions of gold mineralization already identified.

Burkina Faso has a mining corporate tax rate of 20%, and a sliding royalty on gold production from 3-5%. That’s good for Burkina Faso – and the international miners who operate there.

The presence of Endeavour Mining (EDV.T) – a massively profitable gold miner – is a significant de-risker. EDV is building its Houndé project in Burkina Faso, scheduled to begin production in Q4-2017 with annual production of 190,000 ounces at an All In Sustaining Cost of US$709/oz.

Endeavor is operating multiple African mines, but its market cap is about 85 times higher than Nexus – which gives you a glimpse of the potential upside. (Nexus definitely has more sex appeal than investing in MacDonald’s (MCD.NYSE) or General Electric (GE-NYSE).)

For decades, the area has been crawling with artisanal miners digging nuggets of gold out of the earth with hand tools – so there’s definitely precious metal on the Nexus properties.

In fact, Burkina Faso is the fastest growing gold producer in Africa. Eight new mines have been commissioned there over the past six years.

According to the Nexus website: ‘Burkina Faso has undergone less than 15 years of modern mineral exploration, remaining under-explored in comparison to neighboring Ghana and Mali; both of which host world-class gold mines in the same belts of Birimian rocks.”

I’m not a “gold bug”. But I will bet against bullshit. No-one is ever going to “Make America Great Again”. That’s not a knock against Trump – or Obama. It’s demographics: to power a national economy you need an army of young people dreaming the dream.

America doesn’t have that army; it is old and dispirited.

If you’re looking for a financial instrument to protect and grow your wealth in uncertain times, a micro-cap African Gold Explorer like Nexus might be just the ticket.

Don’t wait for the disaster, prepare for it.