Maybe you think Donald Trump is amazing. Maybe you think he’s horrible. One thing we can all agree on, however, as I sit here watching him stumble from disaster to disaster, is that his term as President will be very different from those who came before him.

We can probably also agree on this: There’s going to be a crap load more military budget going around for the next several years.

And this: There’s a heightened chance of military conflict between the US and (pick one) Russia, China, Iran, Yemen, Sweden, Iceland, Australia, Pluto…

And this: As the https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration moves away from subsidizing wind and solar power, it’s likely to have a new appreciation for nuclear energy.

And this: It’s a great thing when a tiny company that has been dormant for more than a year suddenly raises some money but won’t say what it’s for – and you bought that tiny company’s stock early.

But we’ll get to that last one soon. For now, let’s talk uranium proper.

When the nuclear power plants at Fukushima melted down, post Japanese tsunami, a lot of people said that would be the end of nuclear power globally.

And yet, there are 444 nuclear reactors across the globe today, with 63 new plants under construction in 15 countries right now, according to the Nuclear Energy Institute. More still are going through expansion and upgrading processes.

What that means is, if Japan says “tsunamis are bad, so no more nukes for us, ever,” the demand for uranium will not precipitously drop worldwide. In fact, many fans of renewable energy are rediscovering nuclear power as a cost-effective, environmentally friendly option, when compared to traditional methods (such as coal, gas, oil, and the like).

Sure, you have to bury the nuclear waste somewhere, but come back to me when you’ve stopped using diapers, which will be in landfills for 500 years, and Nike sneakers which will be down there as long, and we’ll talk about environmental perfection all day.

Nuclear is a thing. It sucks when it breaks, but it doesn’t break often, thankfully, and it needs a healthy supply of uranium to exist.

Meanwhile, solar works during the day, in the summer time, and wind works when it’s windy, but on a still evening in the big city, you better be hooked into a grid that has some nuke buzz connected to it or nobody’s getting their Netflix binge on and the meat freezer is going to get rank pretty quick.

And don’t get the idea that nuclear is only going to happen in Thirdworldistan. Sure, there are 30 nuclear reactors in China with 24 more under construction, as that country looks to eliminate coal power, and there may be another hundred on the way in the next decade.

But, according to the US Nuclear Regulatory Commission, there are also 100+ nuclear power reactors in the US generating electricity right now, and 36 research and testing reactors, and there are applications for more currently under review..

You know where else there are reactors? On US naval ships. And that’s a good segue because uranium is needed in the military as much as it is in power generation. Those bunker buster missiles that we’ve all seen blowing through many feet of concrete to obliterate bad guys? Depleted uranium is what gets them busting bunkers.

Donald Trump, loud and weird as he may be, has decided to add $50 billion-plus to the military budget, which means more naval ships being built with self-powering nuke reactors on board, and more missiles with depleted uranium in their nose cones, and more flat out nuclear missiles with which to poke Russia in the chest.

Look, you may not like this nuclear powered, nuclear threatening, nuclear prevalent future, but if it’s going to happen, you may as well make some spending money off it, right?

So that’s where the Patterson Lake in Saskatchewan comes in.

The Patterson Lake is lovely. Fish jump about. Birds nest. And deep under the water, there’s a verifiable boatload of uranium just sitting, waiting to be dug up, with grades as much as 100x the global average.

But wait.. .what are those little blips in the water there?

I’ll tell you what those are. Those are drills.

I know, I know – how on earth would you get uranium out of a big ass lake, right?

Well, the first thing you do is wait for winter.

This is the Patterson Lake in winter.

When the ice comes, you can slap a drill in the ground and rip through the it to find out where that uranium is, how much of it is down there, and how you might think about extracting it.

When the ice comes, you can slap a drill in the ground and rip through the it to find out where that uranium is, how much of it is down there, and how you might think about extracting it.

Why would you do that? Well, the Patterson Lake is Canada’s uranium future. It’s sometimes called the Persian Gulf of Uranium. Out there, fortunes have already been made.

The world’s richest uranium mine, Cameco’s (CCO.T) Cigar Lake, which the French giant AREVA also owns a nice big stake in, is right there in the Athabasca Basin nearby. It produces ungodly quantities of uranium, at grades as high as 17.8%. That’s legit. And they’re not alone.

NexGen Energy (NXE.V) is up there and brought in a 95% share price increase in 2016, and they look like they’re going to get bigger.

They’re not alone.

Lukas Lundin knows a thing or two about building massive mine projects. He’s the executive chairman of Denison Mines (DML.T), and he just sold off his Mongolian projects to focus on the Athabasca.

When Lundin sets up shop, you don’t ask questions, because he doesn’t have to raise money to play. He is money. His name is the play. His Phoenix project has an indicated 70 million pounds of uranium at grades nearing 20%, which is officially the definition of a ‘shit ton.’

Fission Uranium (FCU.T) and Alpha Minerals brought the Patterson Lake area into vogue in 2012 when they started hitting out-of-the-park results, before merging to create the next big thing, in an area that had largely been forgotten by others because, well, it’s under a gigantic body of water.

Tough to get at that uranium under a lake, you say? Not if you put any credit into the 19.9% equity stake that China’s CGN Mining took out for $82 million, which puts the company at a valuation of over $400 million before it even produces a pound.

But let’s gear back a little. After all, we talked about how we like little companies that have been ignored but are about to become a bigger story, and the Patterson Lake area has one of these.

Azincourt Uranium (AAZ.V) is not a household name. In fact, it’s barely a Patterson Lake name. A company that was enjoying riding bigger coattails when it got a 10% stake in a Patterson Lake North property that Fission spin-off Fission 3.0 (FUU.V) was playing with, things stalled for the outfit in 2016 when F3 got focused elsewhere.

The last thing you want to be as a company is one that is reliant on another company doing work in order to maintain your share price. So when Fission (which admittedly has LOADS of targets to drill) stopped talking about the play, the AAZ executives understood their situation. Either climb out of their stasis, or watch the stock drift to nothing.

If you look at Azincourt’s news release history, you find they’ve only released four pieces of news since a February 2015 rollback. And all four of those news pieces dropped in the last few months.

They are most easily described as follows:

1: (OCTOBER 2016) We could really use a few bucks about now, but we know we’re not going to get much, just please give us anything.

2: (NOVEMBER 2016) We’re raising some money to pay for office rent and it’d be great if someone, somewhere, would give us some, please and thank you.

3: (FEBRUARY 2017) We’re raising a LOT more money to pay for office rent – and explore new opportunities.

4: (FEBRUARY 2017) We got all the money we wanted on that last raise, and then some, and it’s going to pay for office rent – AND DID WE MENTION THERE ARE SOME NEW OPPORTUNITIES OUT THERE?

None of the news releases actually contain these words. I’m completely shoveling words into the mouths of the executives at Azincourt for comedic effect. The news releases were actually the standard, staid, boring stuff you always see in news releases about mining financings. But you have to read between the lines here, and when I wrote about these lines a few week ago, Azincourt stock took a ride the likes of which haven’t been seen on this ticker symbol since 2013, when it ran 200% in a matter of days on the back of the original Fission partnership.

What’s interesting is a line tucked away in that original deal that nobody talks about anymore, but which was really important back in the day.

For Azincourt to acquire a 50% interest in the [Fission 3.0] project, it would have to incur $12 million of staged exploration expenditures and pay $4.75 million in cash, or Azincourt shares (at Azincourt’s election), on or before April 29, 2017.

Could Azincourt be preparing for a run at 50% of the Fission 3.0 deal? I mean, they’ve got the time to get it done, they just raised $1 million, and they had no trouble doing so despite a long down time.

If I was a betting man, I’d say… no.

Because another important line is tucked away in the recent financing announcements:

Azincourt will apply the net proceeds of the Offering to advance the Company’s Patterson Lake North property (“PLN”) and for general working capital purposes. PLN lies adjacent and to the north of the Patterson Lake South property, owned by Fission Uranium Corp. In addition, the Company is currently reviewing opportunities to acquire interests in other uranium projects in the Athabasca Basin, Saskatchewan.

That last line is key, because if the money they’re raising was REALLY going into the PLN property, there’d be a much bigger song and dance about how that will increase the company’s stake in the project. Chuck another million in, get another 10%!

But no. They are ‘reviewing opportunities’ in other uranium deals in the Athabasca.

And there are many. A lot of pubcos jumped in and created me-toos around Fission back in the day, and many of those are burned out, much as Azincourt was in 2015 and 2016. But all of a sudden there’s a heartbeat at AAZ, and money coming in, and if you don’t think that means something’s up here, I don’t know how you get through a day without walking into traffic.

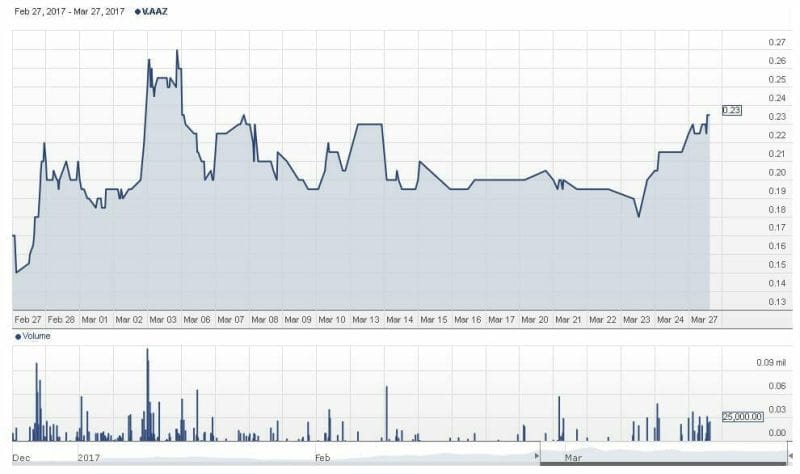

When I wrote about AAZ late one Friday a few weeks back and just hinted that maybe there’s more going on than a bog standard raise (and, trust me, nobody else is writing about this company yet), the stock flew up by a third the following Monday.

That’s nice.

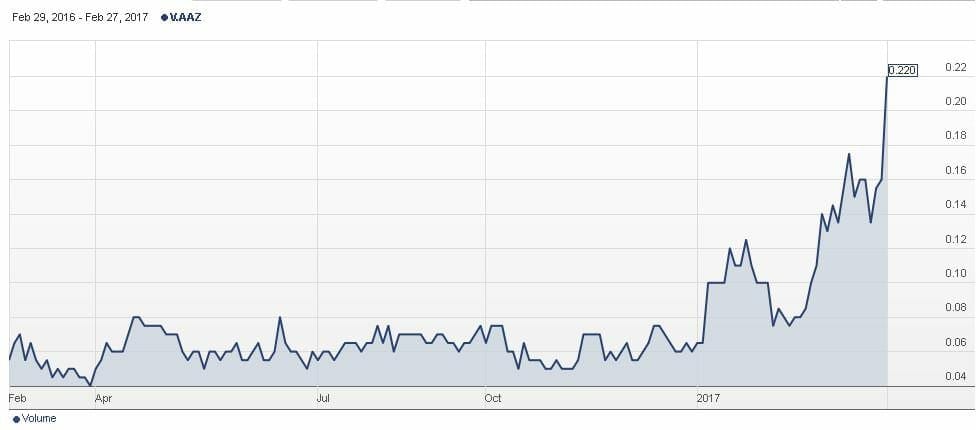

Even nicer when you scale that chart back a full year.

Holy shitsnacks. We’re looking at a $0.05 stock for nearly a year that, suddenly, has rocketed to $0.22.

SOMETHING IS GOING ON HERE.

Now, I don’t know what it is, and the company ain’t saying. Trust me, I’ve asked, it’s a wall of silence.

In the weeks since I first raised the ‘what’s going on at Azincourt’ question, it dropped a bunch, but once again took off on us over the last few days.

What I do know is this: There’s only about 10m shares out (not counting the recent financing), which is crazy tight, and the thing has a market cap of just $3 million at the current (much bigger than it was a month back) share price.

Hell, a few weeks back, you could have bought this whole company for the price of a Calgary 2-bedroom condo. Not anymore. Now it’ll cost four condos.

Still. Whatever fresh hell Azincourt has been through, whatever long period of national tragedy the shareholders once had to endure, anyone who kept their stake long enough is dancing a jig right now, and maybe even looking out for whatever private placement financing might be on the horizon after this last one.

Because, those guys that took out the million dollar financing are already up a triple on their $0.075 shares (that are now worth $0.23), and on top of that, their $0.10 warrants are looking like they’re about to kick in, which will add another $500k to the company war chest, and deliver a further double to investors on current share price.

It’s not often you can parlay a triple into a further double in just a week, but such is life on the Venture. And the company is STILL ONLY WORTH $3 MILLION IN MARKET CAP.

I’m not going to tell you what Azincourt will do next, because I don’t know. But I know they’re going to do something, and I know whatever it is, it’s got to be worth more than $3 million. That’s why I bought some.

— Chris Parry

FULL DISCLOSURE: The author has taken a position in Azincourt on the open market, though the company is not an Equity.Guru marketing client.