You know what I love? When a company opens its chequebook and decides to buy a property that is less of a gamble and more of an investment. When they look for best of class, a region that pumps out good results, and go all in.

This, of course, puts me at odds with 97% of the resources space, where staking a claim around the Grise Ford Eskimos hockey arena dressing sheds and calling it prime lithium country is the norm.

Natan Resources (NRL.V) has the unfortunate distinction of having a foot in both the lithium and gold spaces, but has the fortunate benefit of having not farted about when claiming the properties in question.

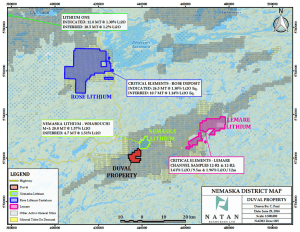

Natan is a company with two main projects. The first is an option to earn up to a 70% interest in Jean Sebastian Levallee’s Crititcal Elements Corp. (CRE.V) Duval project, located southwest of and contiguous to the Nemaska Lithium Whabouchi deposit.

Now, a lot of companies claim they’re closed to the Nemaska deposit. As you can see in the image below, only Duval is right up against it. The others are 5kms away.

Don’t be 5 kms away.

Natan completed a 1 for 10 rollback last May to prep for this moment in time, and has been in building mode, adding new directors and closing private placements, in the time since. That’s helped them acquire these these Quebec properties and get ready for big game, but they also announced in November a fairly large acquisition of the Montalembert gold project. This is a very prospective Abitibi region gold property, and they’ve snared 100% of it from Globex Mining.

Natan completed a 1 for 10 rollback last May to prep for this moment in time, and has been in building mode, adding new directors and closing private placements, in the time since. That’s helped them acquire these these Quebec properties and get ready for big game, but they also announced in November a fairly large acquisition of the Montalembert gold project. This is a very prospective Abitibi region gold property, and they’ve snared 100% of it from Globex Mining.

“Oh sure,” I hear you sniff. “Grab some chintzy piece of cow pasture and sell it to consumers as a golden ticket..”

Wow, you’re cynical.

This gold property isn’t cheap. Natan paid $2.7 million in cash, and issued 8.5 million common share of Natan to Globex, and they committed to spending $15 million on the property over 4 years to lock down that wedge. And Globex doesn’t want to walk away clean.

“Due to the high-grade nature of the potential ore from the property, Globex shall retain a 3.5% gross metal royalty (GMR) on all recovered metals and minerals produced from the property, with a 6-per-cent GMR on the first 150,000 ounces of each of gold and silver recovered from the property.”

Also:

“The Montalembert gold property has historical and recently reported high-grade gold visible in outcrop on surface and reported in historical shallow drill holes. Recent stripping completed by Globex has exposed the gold-bearing quartz vein systems, along with occurrences of coarse native gold. See Globex’s press releases dated Sept. 9, 2015, Nov. 12, 2015, and Oct. 24, 2016, for information on historical and some more recent exploration on the property.”

Visible gold is nice, but there must be something more to this for the Natan pointyheads to pay that much to another public company. Added to which, they not only went for $3m in financing, they ended up taking $1m more, so others were as admiring of the property as Natan was..

A look at the Globex website tells the story…

<mine talk>

Historic Exploration

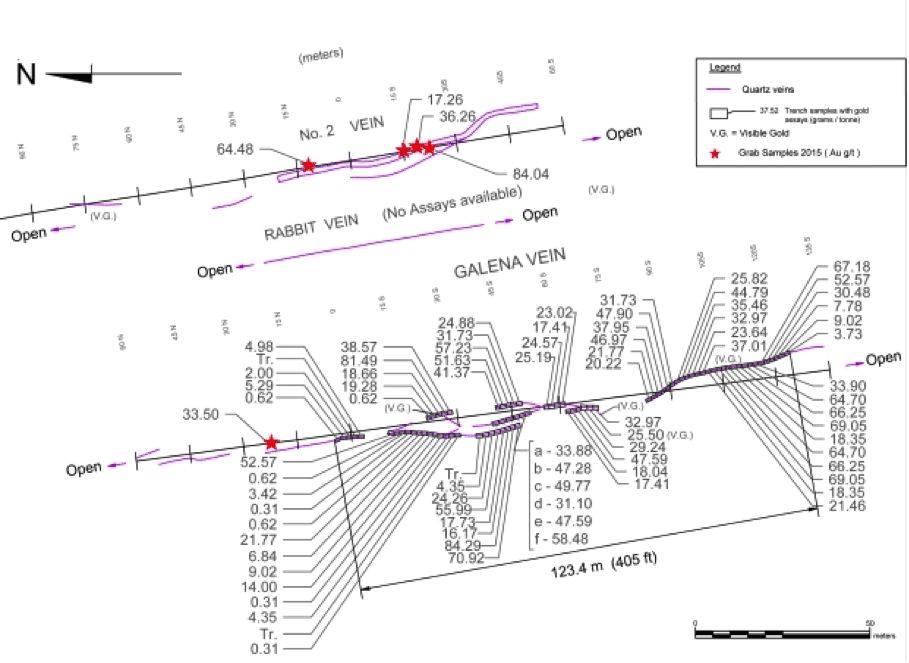

Gold was discovered on the property in 1949 by N.A. Timmins. Prospecting followed by trenching and limited diamond drilling located four quartz veins (Galena, Number 1, Number 2 and Rabbit veins) of varying widths up to 1.5 m and with strike lengths of 90 m to 365 m, within multiple north‐south shears observed along a corridor 1,280 m long and 183 m wide.

Sampling of the Galena quartz vein returned 17.2 gpt Au over a 61 m sample length and an average width of 0.75 m. Gold was reported as coarse free gold principally within the quartz veins but also within the enclosing rocks. A drill hole located 105 m to the southwest of the trenched area returned values of up to 61.3 gpt Au over a true width of 1.2 m and 19 gpt Au over 0.6 m.

In 1973, a grubstake syndicate stripped and cleared the Galena, Rabbit and Number 2 veins. The property was then acquired by Rochelom Mines Ltd., which undertook a detailed trenching and analysis of the Galena vein system over a near continuous strike length of 123 m, an average sample width of 0.65 m and to a depth of 0.6 m. Seventy eight samples collected from fine blast material over continuous 1.5 m lengths and two 2.3 m lengths weighing approximately 3.6 kg each were reported to have returned an average of 20.8 gpt Au (28.9 gpt Au uncut).

</mine talk>

<mine charts>

So what does it all mean?

Well, you can look at Natan one of two ways. Either they overpaid for a gold mine that has the shiny lying about on the surface and likely has a bunch more beneath, and which enough investors saw value in that they piled into a financing – OR – you can look at them has having eyed a great deal that they had to pay a premium to get, but hey, now they’ve got the thing and if gold goes up in value, helloooo nurse!

For me? Too early to tell, but well worth a watch, especially since they’ve got value if lithium takes off again and if gold takes off again. My thinking is both are likely to happen, and soonish.

If only they had an oilfield tossed in, they’d be hedged against any drop in just about any resource sector.

Media: “Uranium is up!”

Natan: “Oh, didn’t we have a uranium property in the bottom drawer here somewhere? Right there, under the salmon farm deed..”

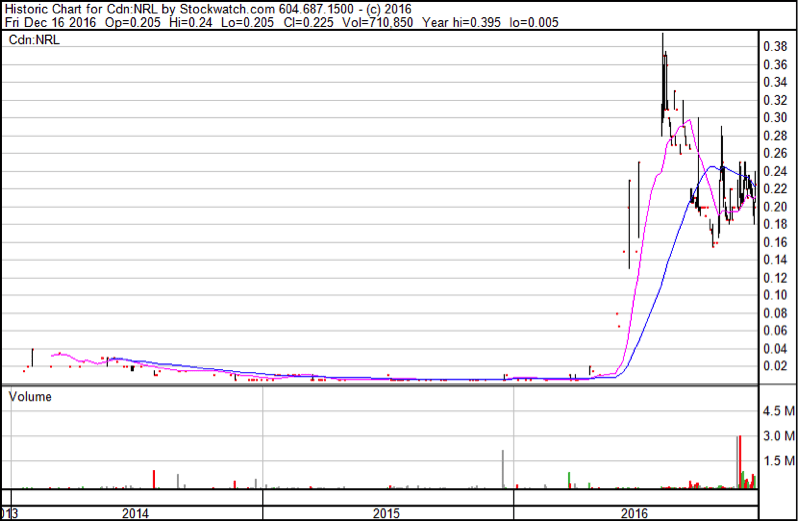

Look, I’m not saying Natan is chasing trends here, more that they’ve covered some nice bases. In early 2016, anything with lithium near it’s name leaped up in value by a factor of three times. You know what beat it? Gold, which leaped up by a multiple of four times.

If 2017 starts the way 2016 did, Natan will skyrocket. And if it doesn’t, if we actually have to focus on fundamentals for a change instead of watching hordes of investors move about as packs, it’s still solid.

I hereby coin a new phrase, for companies with plays in lithium and gold. We shall hereafter call them golthium deals.

Realistically though, this company is less a metals play as it is a regional play. Quebec loves its mines and helps finance them often. If you tell the Quebec government you’re about to pull a metal out of the ground, they invite the mayor to cut a ribbon, do an Air Force flyover, give you a ride to Home Depot to buy the shovels, and provide hookers for everyone.

Well, not the hookers. But the rest, kinda.

I’m not even going to read the next bit because it’s more of the same. There’s gold in them thar hills. How much? Enough to watch closely.

Exploration and Development

In 2015, preliminary exploration by Globex included line cutting, mapping, prospecting, rock sampling and a magnetic survey. Globex cut a 46 line km grid on the property, performed a detailed magnetometer survey and a grid geological survey. During the exploration, all old trenches were located and found to be extensively overgrown. Samples of either loose or in-place country rock taken where exposed have been assayed and, for the most part, returned anomalous gold values. One outcrop exposure north of the Galena vein returned 33.5 gpt Au in a grab sample from sheared and altered rock which contained up to 4% fine disseminated pyrite and no quartz veining.

The areas of the Galena and Number 2 veins as well as two areas across the veins’ strike were stripped before freezing conditions prevented power washing, channel sampling or detailed mapping of the vein structures could be completed.

Assays of 84.0 gpt Au, 64.5 gpt Au, 36.3 gpt Au and 17.3 gpt Au have been received to date, and that’s bad ass. Work has expanded the area of known gold mineralization on the property as previous historic data only provided gold assays on the Galena Vein, an all of the above explains the price of the acquisition.

Assays up to 84 grams per tonne and strike lengths of 90m to 365m appear very prospective, as is the fact that it doesn’t appear deep. In fact, it looks damn near surface.

Finally: Shares Issued: A slender 20.7 million.

Current Price: $0.225, and forming a nice base with serious volume. This is increasingly real now.

— Chris Parry

FULL DISCLOSURE: Natan has signed on with Equity. Guru as a marketing client.