First off, big welcome to any VancouverIsAwesome folk who have found their way over to our humble abode via my new weekly column Investing is Awesome.

Nose around and see if you can’t find a thing of two to sink your teeth into. Ask questions in the comments and I’ll be happy to answer. The more new investors in the market, the better for everyone, so all are welcome.

Let’s get to the companies:

Iplayco (IPC.V) released Q3 financials and showed sales up 40%, and turned a loss last quarter into a profit this time around, as we predicted would happen last week.

“Sales increased by 39.6% to $4,612,437 for the three months that ended on June 30, 2016, as compared to $3,304,442 for the three months that ended on March 31, 2016,” said Iplayco President, CEO and Director, Scott Forbes.

As a result, the company earned a net income of $98,610 during the third quarter. This compared favorably with the second quarter results, where Iplayco reported a net loss of $884,752, or net loss per share of $0.04.

So why is their stock down 10% on the day?

Few reasons, most of them unsexy. Yes, the company has sold a ton of new deals – millions of dollars worth of them. But no, they’re not included in this quarter’s numbers because the products sold have a long lead time and the pipeline is filled for the next while.

This means next quarter’s numbers will look great, on the back of the sales made this quarter but not booked until the products are being delivered.

Make sense?

Also, if you look at the stock chart, that was a nice climb leading up to numbers day, so you’ve likely got some Iplayco investors in it for the short term who decided to take their profits. Fair enough.

To reiterate: I don’t have a deal with Iplayco. Don’t know the team. Never talked to them. I just think there’s an undervalued situation there that can be capitalized on, and readers who got in last month have had a nice win. I continue to hold stock in the company.

Veritas Pharma (VRT.C) also had news today, in which it has started animal testing trials on which strains of medical marijuana are most effective in helping limit vomiting and nausea.

From the company:

Veritas Pharma, working with Cannevert Therapeutics Ltd., the Company’s exclusive partner and high-level R&D arm, has begun animal testing targeting pain and nausea related to cancer and chemotherapy, respectively. The process is an important stage in evaluating safety and effectiveness compared to standard therapies before human trials. Veritas believes the Company’s ‘whole plant’ approach and methodology, versus research at the molecular level, will provide greater speed-to-market, estimated to be one-tenth the time of traditional pharma.

Veritas stock also took a drop today, despite the news, seemingly centered around shareholders taking profits after the 50% jump yesterday. Hell, even I took some off the table and I consult for the company.

TransAtlantic Mining (TCO.V) took me up on my challenge of last week and pounded out news over the last few days, credit to them. You’ll recall I said it was time to put up or shut up, and they put up.

First, they locked down the lease on their Grant property. I’d like to see them own it outright, but okay.

Second, and this was a nice one – they received a half million dollar payoff when the new owners of their old aussie gold property, Doran Minerals, advanced that property’s resource and triggered a one-time payment. That’s free, unbudgeted, non-dilutive cash, ladies.

Third? They’re producing.

Not producing with five-storey trucks and cranes and climate-changing grandiosity, just taking existing ore piles and rolling them through their new mill while they figure out the kinks in their new asset.

Commissioning of the crusher and mill is well under way, on a limited-day-shift basis. In July, Transatlantic Mining produced its first gold/silver concentrate. While continuing improvements are being made, lower-grade mine material is being run through the mill processing facility. Optimization of the flotation circuit to realize maximum efficiency is in progress. This will serve as a comparison with previous metallurgical testwork performed to date, prior to mining and milling higher-grade material.

Two tons of lower-grade concentrate have been sent to a commercial toll-leaching facility in neighbouring Idaho to produce a dore product. {Note: A dore bar is a semi-pure alloy of gold and silver usually created at a mine site and sent to a refinery for further purification.} The tonnage sent to Idaho will lead to a leaching trial and performance report. This analysis will provide estimated commercial cost metrics for subsequent processing of higher-grade concentrates.

Bottom line: They’re doing what they said they would.

This is a story that has most definitely had it’s lows under previous directorship, including a two year halt. But, as of now, the $0.06 it will cost you to buy Transatlantic stock is officially a bargain. Do your own due diligence, but I’ll be jumping in from here. Nice run of news and a very real push to production.

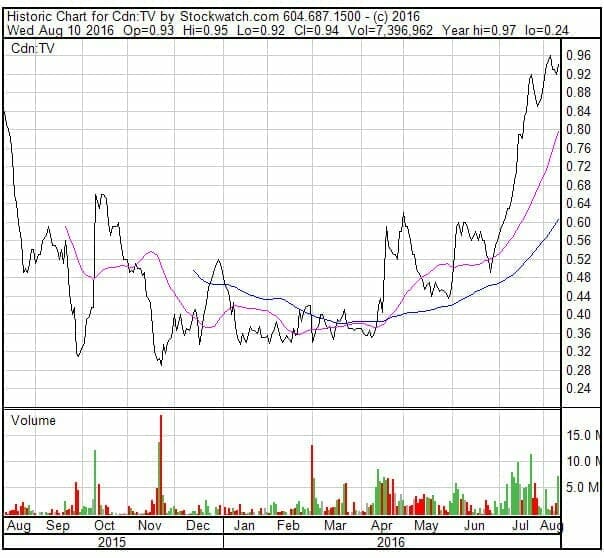

I keep talking about Trevali Resources (TV.T) and it just keeps going up.

That’s filthy. I have no news to impart on this other than, it JUST WON’T STOP!

Nano One Materials (NNO.V) has been approved for a Sustainable Development Technology Canada (SDTC) grant of $2.08 million towards it lithium battery material pilot plant, and received the initial installment of $488,944 for the first phase this week.

We like Nano because wherever you land on lithium and which company might actually justify all the existing hype, every company will need to talk to NNO about their tech which helps replace expensive and hard-to-get battery materials with others.

My podcast with Dan Blondal, the CEO of Nano, is an incredible listen. Go do that now. Holding long.

— Chris Parry