There were times last year that nobody thought we’d ever hear the words uttered again, but suddenly it’s hip to be a gold explorer again.

More than hip. It’s wealth-inducing.

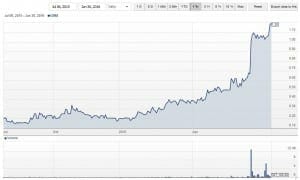

This is the stock chart of Integra Gold (ICG.V) over the last year. Pretty darn great, right? If you got in there at or near that $0.23 low (I was talking them up around $0.33), you’re riding the gravy train right now with the stock at $0.80, up 248% from the 52 week low.

ICG has done that with a smart, low cost drill program that has basically rehabbed the reputation of one of the worst white elephant mineral plays in recent years, so while they started out low priced and have done nicely to return on their investment.

They’ve done that by racking up great results on a continual basis. As a result, all their warrants have been exercised.

But they’re not even close to the most profitable gold investments over the last few months. In fact, they sit #29 on the top 30 list of explorers with a cap between $50m and $500m (with a hat tip to Peter Epstein for the numbers).

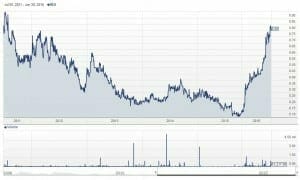

This is Goldrock (GRM.V), which has benefited nicely from a takeout offer by Fortuna, but was, as you can see by the chart, already rocketing hard without the help of a 52% premium acquisition offer, and continues to accelerate past a buck.

GRM is up 700% from it’s 52 week low. So far.

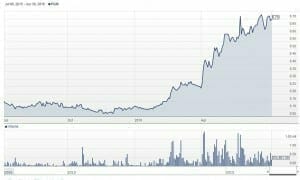

Look at the five-year on Orex Minerals (REX.V), which has jetted upwards so hard, it’s matching price levels from 2011. That’s a 627% return against the 52-week low. Christ on a bike!

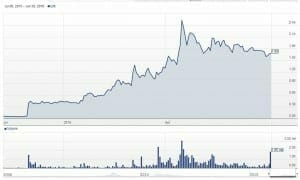

And we haven’t even yet got into the big returned based on current price compared to the 52-week low: Pure Gold Mining (PGM.V).

Shut. Up.

That’s a 900% return from the 52-week low.

I could go on and on, but what’s interesting to me about these numbers is two things.

First, they don’t appear to be reaching a plateau, or anything like it, just yet. Those charts are all still lifting. They’ve moved through the ‘clean’, and the ‘jerk’ still appears to be coming.

Second, they put lithium’s big lift in the shade. I mean, it’s bee a great year to be a lithium holder, but those stocks are beginning to plateau. Sector leader Lithium-X (LIX.V) is under pressure to keep its northward trajectory going, a few me-toos have started to tilt sideways, and the bottom feeder end has started receding over the last few weeks, with many new lithium companies on the march.

Oh, there’s a third thing – the price of gold has only risen 30% in the last six months, while these companies are rising far quicker, which is indicative of how undervalued they’ve all become over the last few years, but also in that investors are valuing their potential as much as the product that they’re going to pull out of the ground. These increases are based on companies actually doing the work in a smart and successful way, not just a lithium-like ‘buy everything in the space’ attitude.

That’s not to say lithium is done. In fact, you can credit the lithium boom for ‘loosening the lid’ for gold so that Brexit and the general economic weirdness out there have resulted in actual investment rather than just sentiment. Lithium’s rise has brought newer, younger investors into the Canadian markets, and they’re only now starting to figure out what gold mining is to a level that sees them content to dabble – and their returns will ensure that dabbling continues.

Just yesterday, CNBC was suggesting gold will continue to rise over the next 18 months as the need for financial safe havens increase. That may be so, but let’s be conservative and say gold only jumps $200 per ounce over that time. Well the $300 rise since New Years’ Day managed to see the top 30 gold explorers on the midcap list rise by an average of 422%. Another $200 per ounce and we’re on a bona fide rush.

If you think the current pricing of gold stocks is heavy, I’m guessing you ain’t seen nothing yet.