The markets love a profit-maker, but it really appears to adore a tech company that makes no money. Enter Twilio (TWLO), a PaaS customer support company that other companies use to connect with customers and staff via text message.

Twilio stock debuted on US markets Thursday and immediately came in hot and heavy, with the $15 IPO stock trading as high as $28.86 before rolling back a smidge at the time of writing.

Buyers like that the company is used in the business processes of firms like Uber, which uses it for rider notifications.

The IPO raised $150 million at $15 per share, which it plans to use for growth. It’ll need growth, because though it’s been around for eight years, it’s never made a profit.

Early stage investors won’t be too concerned, however, as the IPO values the company, which lost $39 million last year, at more than $2 billion, with half a million developers having signed up to the API behind the service.

Canadian tech companies don’t enjoy the same leeway as US tech firms do in focusing on growth (read: early losses) over profitability,

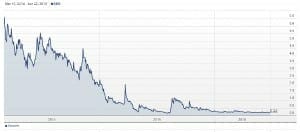

Take for example the social video company Keek (KEK.V), which has tens of millions of users, and a stock chart that resembles a graph of Mickey Rourke’s annual sexual conquests.

— Chris Parry

http://www.twitter.com/chrisparry