Small caps in Canada, especially in tech, are full of faux-companies. You know,

the kind where the problem being solved isn’t really a problem, and the

“technology” being advertised is actually five years old.

PredictMedix (PMED.C) isn’t one of them.

The last time I wrote about PredictMedix, I made an argument about:

- The resilience of pharmaceuticals as a sector, and

- The scalability of the tech, and hence the business

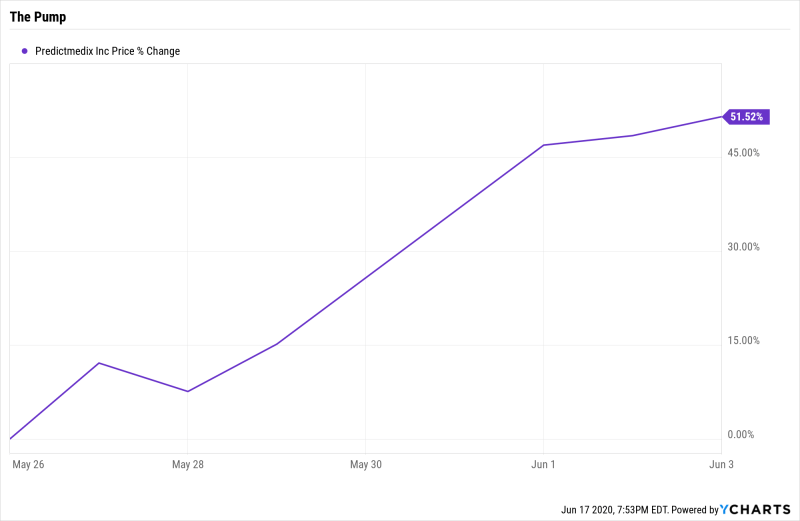

Since then, the stock has been pumped

PMED data by https://ycharts.com“>YCharts

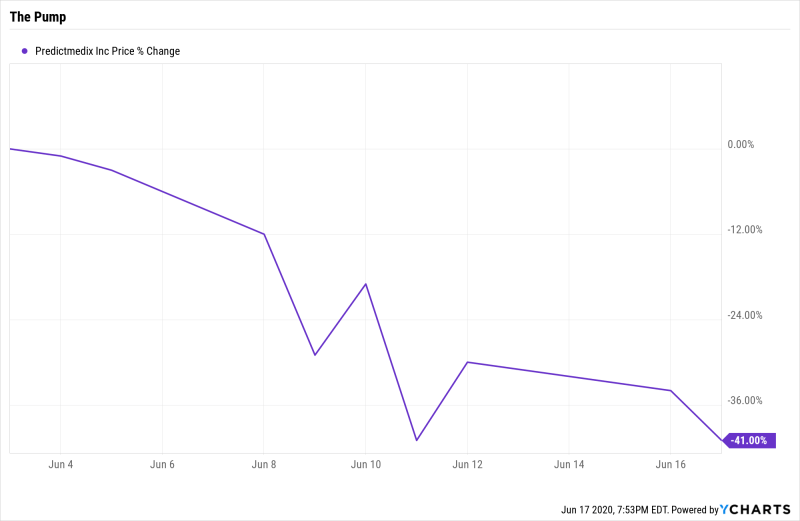

And then dumped…

PMED data by https://ycharts.com“>YCharts

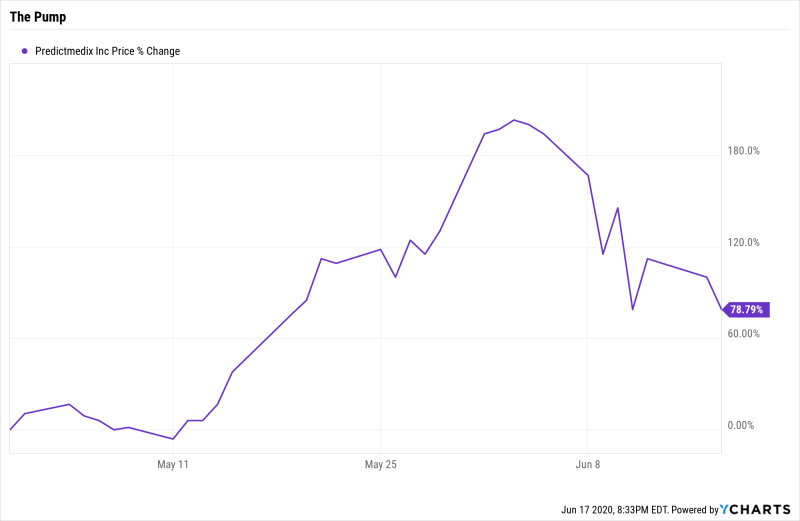

What looks like a pump and dump is actually the entry and exit of dumb money.

When you’re in the value business, this is the payoff from patience:

PMED data by https://ycharts.com“>YCharts

PredictMedix’s value proposition is technology, and in this episode, I interview

Kapil Raval to explore and understand that value from the perspective of an

expert. Kapil serves as the chairman of the Advisory Board for PredictMedix, and

in case you forgot he’s currently the Director of Business

Development for AI solutions at Microsoft.

In our conversation, we explore the business, the tech, the rise of AI, and the

world of tech a decade from now. Tune in!