Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and markets are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA

Markets are red. They are continuing the drop from two days ago. I do believe the drop two days ago was from a pullback… but I think this continuation could be from what Fed chair Powell said yesterday AND the further uncertainties over the US-China phase 1 deal which may account for nothing. Chinese President Xi Jinping spoke about how this deal might need to be altered due to how the US is accusing China of mishandling this covid-19 situation. President Trump does not want any changes. Today, the President mentioned how he is “very disappointed” with China and he does not want to speak with President Xi at this moment (while reassuring us he has a wonderful relationship with President Xi). This just adds more uncertainty to a very volatile world.

But I think the big drop actually is a reaction from what Fed chair Powell said. Yesterday, Powell spoke about how this event is unprecedented and how more money on the fiscal side will be required. All well and good. Congress is expected to be voting for 3 Trillion more stimulus tomorrow. The Fed will also do its part in printing and propping. Powell disagreed with the President in regards to where rates should go next. Rate normalization is not happening anytime soon. With all this new debt, rates can never normalize. We will have to be at 0 or near 0 interest rates forever. The Europeans, Swiss, Japanese and a few Scandinavian nations amongst others tried the crazy Keynesian experiment of negative interest rates. Many have said the Fed would never follow that path…but we have no precedent for an event like this, and Fed Funds Futures have priced in Negative rates for December 2020-January 2021.

So why is this news negative for markets? We are addicted to cheap money. We want more cheap money. Negative rates ensures for one, that stocks become the only place to go for yield as bonds would now be traded for capital gains (essentially buying bonds to bet that central banks will cut FURTHER into the negative). Secondly, it is a way to handle the debt. Negative rates are not great for banks, we know this. Because people have to pay the banks for keeping money in a savings account monthly in a negative rate environment, people have decided to take money out of the banks and hold cash. The way the Keynesians want to alleviate this problem? Digital currency. So you are forced to keep money with the banks and pay them monthly. The theory is that people will not save, but spend, which will aid in bringing back the economy. Watch for this to be implemented in Europe first. They have been in negative rates for a very long time, and people are betting on the ECB to cut further into the negative. A digital currency would definitely be required for that to happen.

We will see how the markets react to the new fiscal stimulus, and there is a chance that the idea of negative rates becomes more accepted by the Fed. To be honest, I do think negative rates are coming. I think this is more of a good cop- bad cop routine because it is how negative rates are implemented that will be important. Many people in America and Canada do not even know negative interest rates exist. This is a way to ease them in by floating the idea of it.

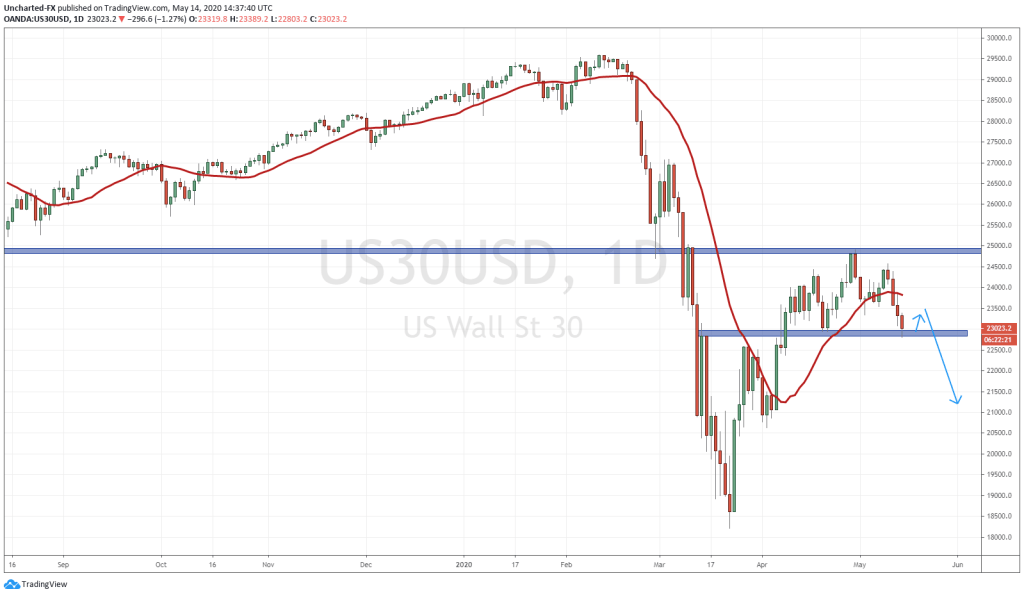

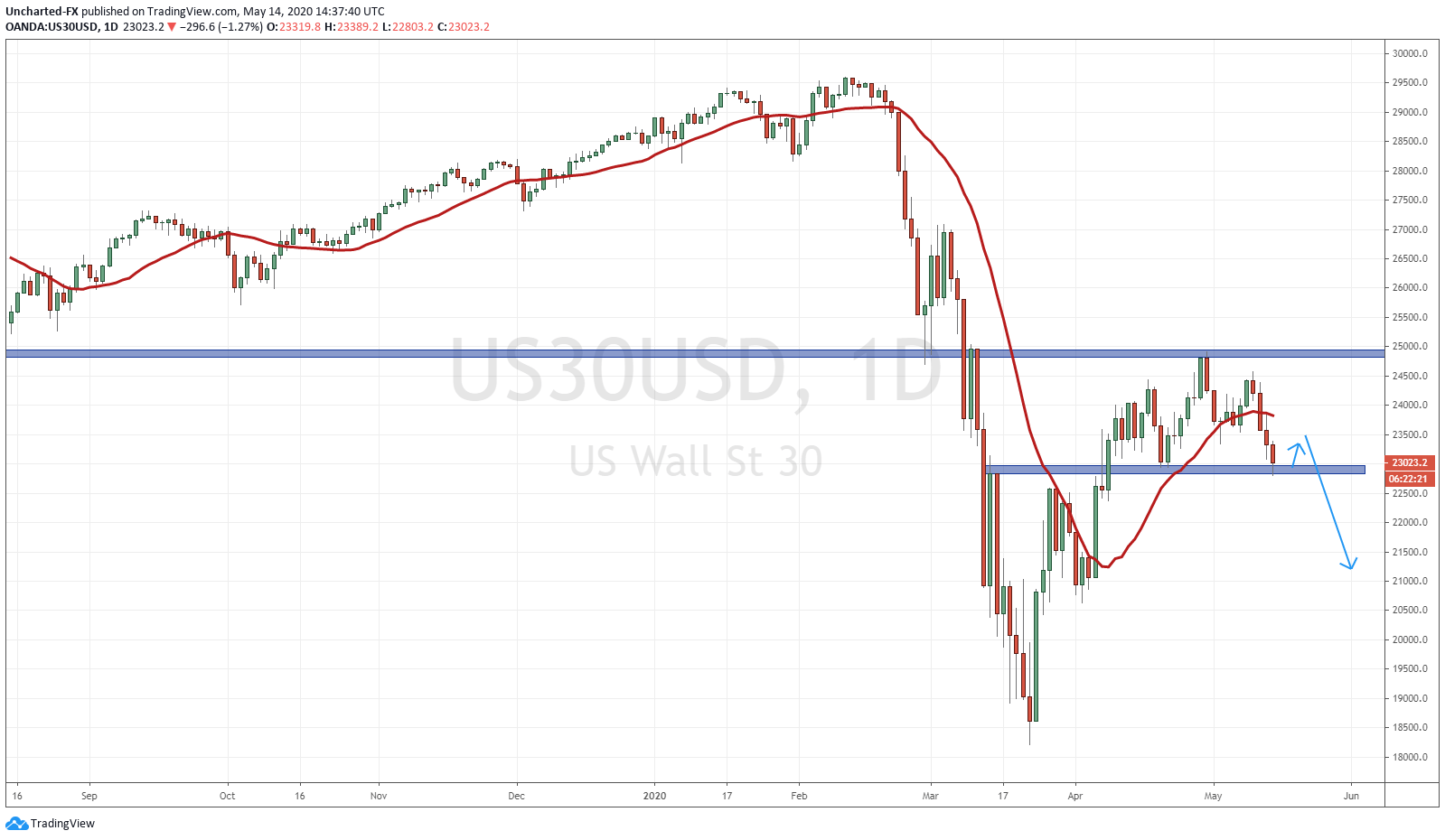

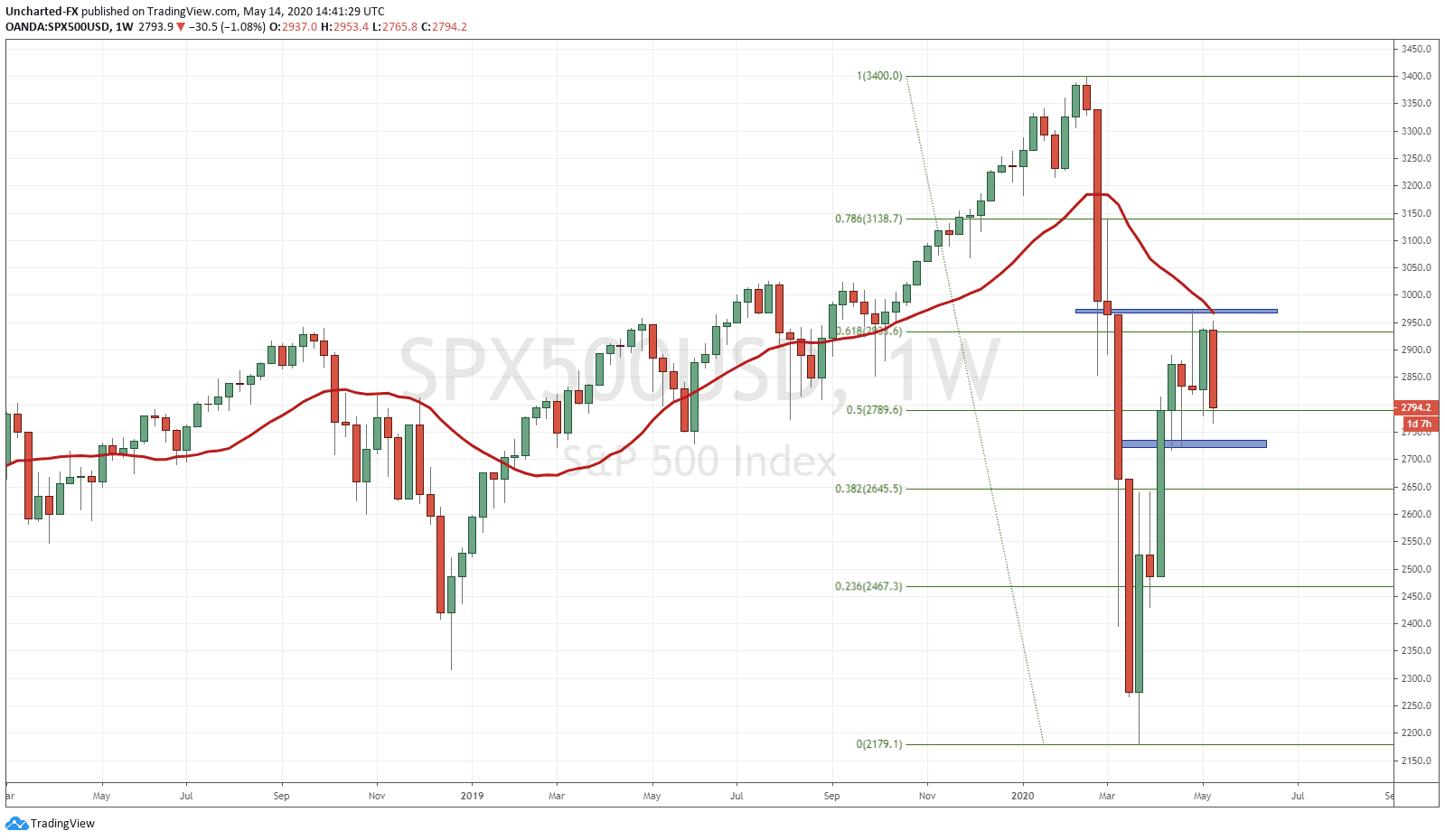

So onto the charts. Many of you know that I am watching the S&P for the weekly 61.8 fib…and boy it is looking bad. We will assess when we get the close tomorrow. I am watching the European markets for their daily candle closes today. Some really good set ups. I am doing the same with today’s chart, the daily chart of the Dow Jones, for a possible short entry.

The Dow is at a major support/flip zone here at 22900. This is a huge zone because it is the higher low swing that is being held to confirm we are still in an uptrend. Once this breaks, the uptrend is essentially over unless the subsequent candle following the break turns out to be a fake out candle. Ideally, I would like to see buyers step in here protecting this zone. I would also like to see a green candle tomorrow. I would then like to see a sell off next week. This would create a pattern for us to use, and a lower high swing to work with. You could then say we have a head and shoulders pattern that has rejected the resistance zone at around 25000.

If one is not short, I would not chase this. The second option is we DO break and close below this support level either today or tomorrow with no green candle pullback, and no head and shoulders pattern. In this case, I would want to see a pullback to the breakout zone before continuing the move lower. Once you get more than 3 red candles in a row (we would have 4 if we get the breakdown) the chance of a pullback is much higher. This is just market structure, how markets move and work. Even if the sell off continues for a few days, the pullback to give us that lower high swing eventually occurs. This was how we played the large equity sell off on the discord channel a few months back. We let markets drop and then waited for the pullback and lower high before entering.

I am also scoping this support/flip zone on the 4 hour chart. There is a chance of early entry if price bounces on the 4 hour chart and then sells off continuing the leg down. So these next two days are important. As I have said, if markets continue the sell off given that monetary policy and fiscal policy are being implemented at max levels, it means there is a confidence crisis, and people have lost faith in central banks and governments to manage this and keep assets and markets propped.