Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Warren Buffett moves markets. It is a fact. When the man speaks, market participants listen. So much so, that when markets are tanking, financial media generally try to bring him on to attempt to stop the bleeding. Watching CNBC these past few weeks, the anchors were all mentioning how they were hoping Warren Buffett would come on to ease fears. That he would come on the show, and announce to the world that he was buying stocks in this environment. His old saying of buying when there is blood on the streets.

Did not happen. We had to wait for Berkshire Hathaway’s legendary annual shareholder meeting which took place this last weekend. It is almost an investor pilgrimage, as many travel to Omaha to hear from the oracle himself. Cannot understate how much this affects the local economy. Of course, with what is happening around the world, this was broadcast via live stream. The good thing? Many of us could watch the full meeting online after it took place.

Warren Buffett did not ease fears. In fact he may have caused fear in the short term. Buffett praised the actions of the Federal Reserve but then mentioned how Fed policies may have extreme consequences, and is largely why he backed away from buying stocks. Especially their action to buy corporate debt. Berkshire Hathaway is now sitting on its largest cash position ever with $132 Billion dollars.

Buffett has been in a large cash position for quite some time, but this ‘record’ has now increased. Buffett is not buying. He claims he is not buying yet, and that there will be an opportunity to come. We cannot write down the US economy, and it will come back ripping once this passes over. Another record? The largest quarterly loss for Berkshire Hathaway. Not what the markets wanted to hear, if there was one positive thing to latch on to, it was the statement about the US economy eventually ripping back. But when? Even Buffett doesn’t know.

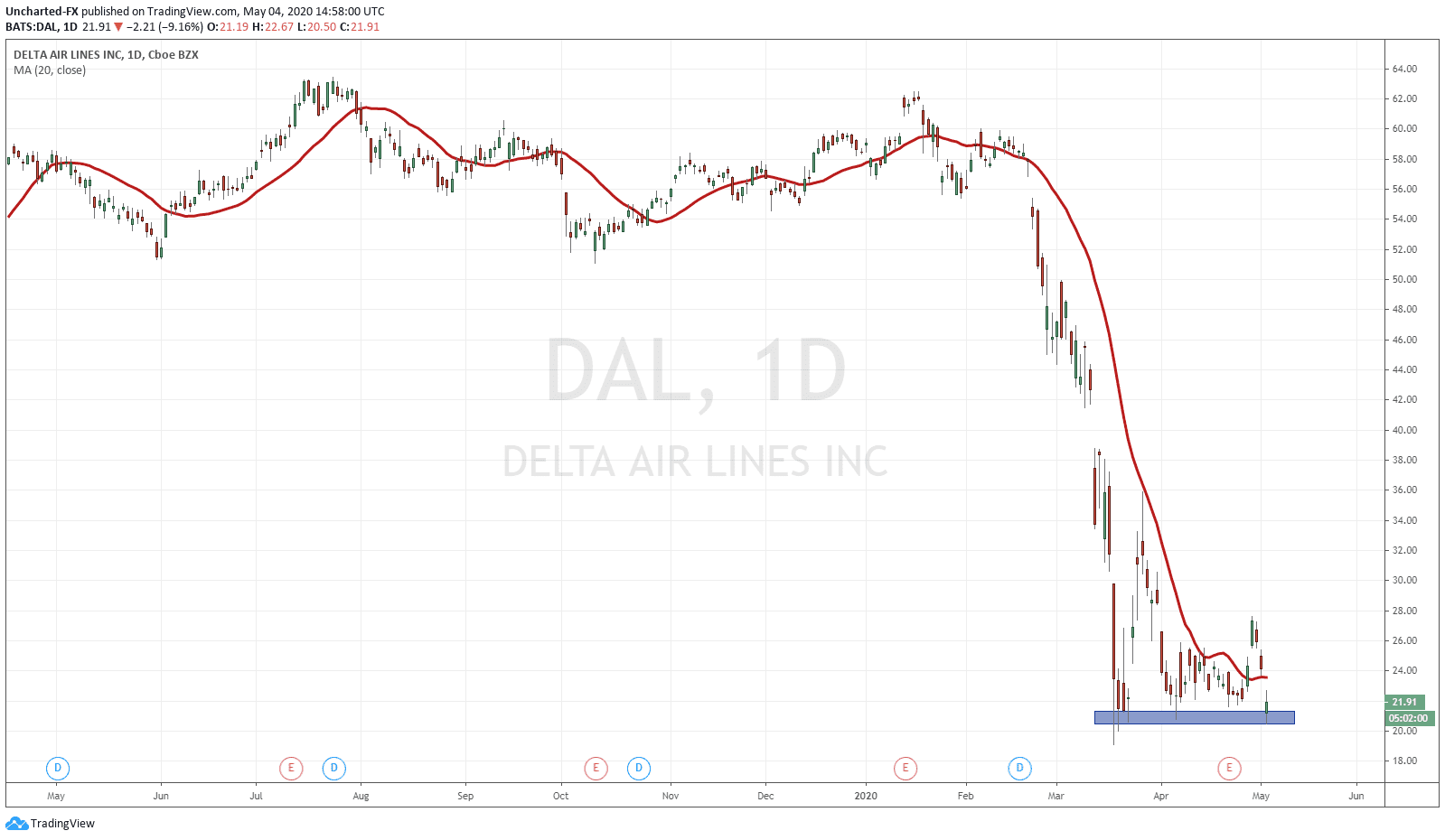

So the big news was Buffett closing his entire position in Delta Airlines. He has closed this position under four years, which is pretty major for the value investor who likes to hold more long term. This is a stock we have been watching over on the Discord group for a double bottom pattern. We are back at this support level after gapping down on Buffett’s statement. Will we break this? It may break if we get an overall market drop. We need to remember that billions were given to airlines, and the major fact that the bad earnings have been priced in. When Delta announced their dismal earnings, the stock did not break into new lower lows. Why? This move down has already priced in all the bad data… for now. In summary, Delta chart could still give us that double bottom pattern in the near future.

Warren Buffett selling his Delta position did not ease fears. In fact he may have caused fear in the short term, as Jim Cramer put it: “Buffett’s overview on airlines really does make me very concerned about the near term.” The markets reacted, dropping down over 200 points on the futures, and continuing the sell off this morning. However, at time of writing, markets are getting a bid with the Nasdaq leading the way into positive territory.

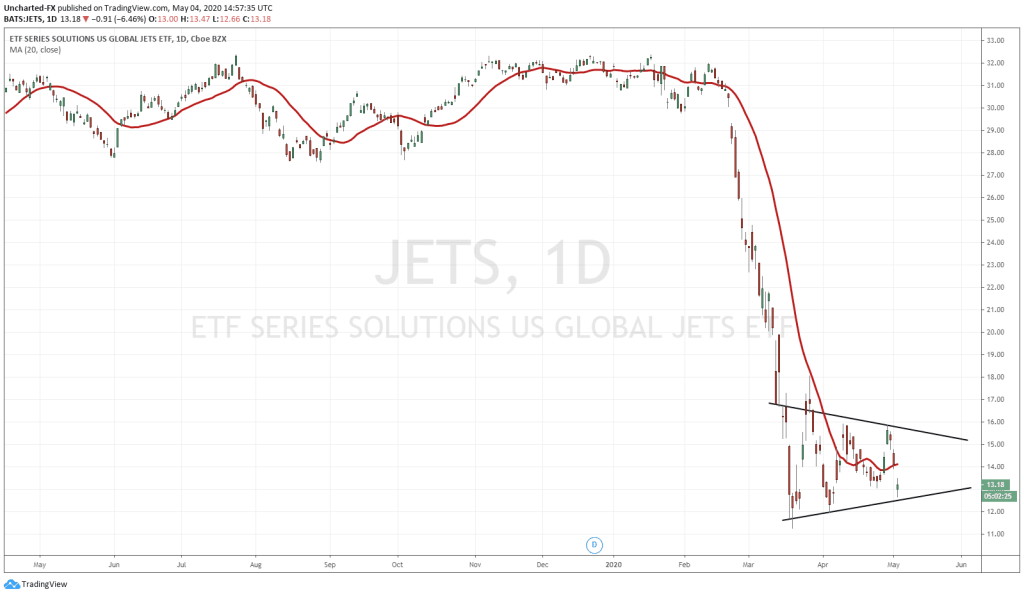

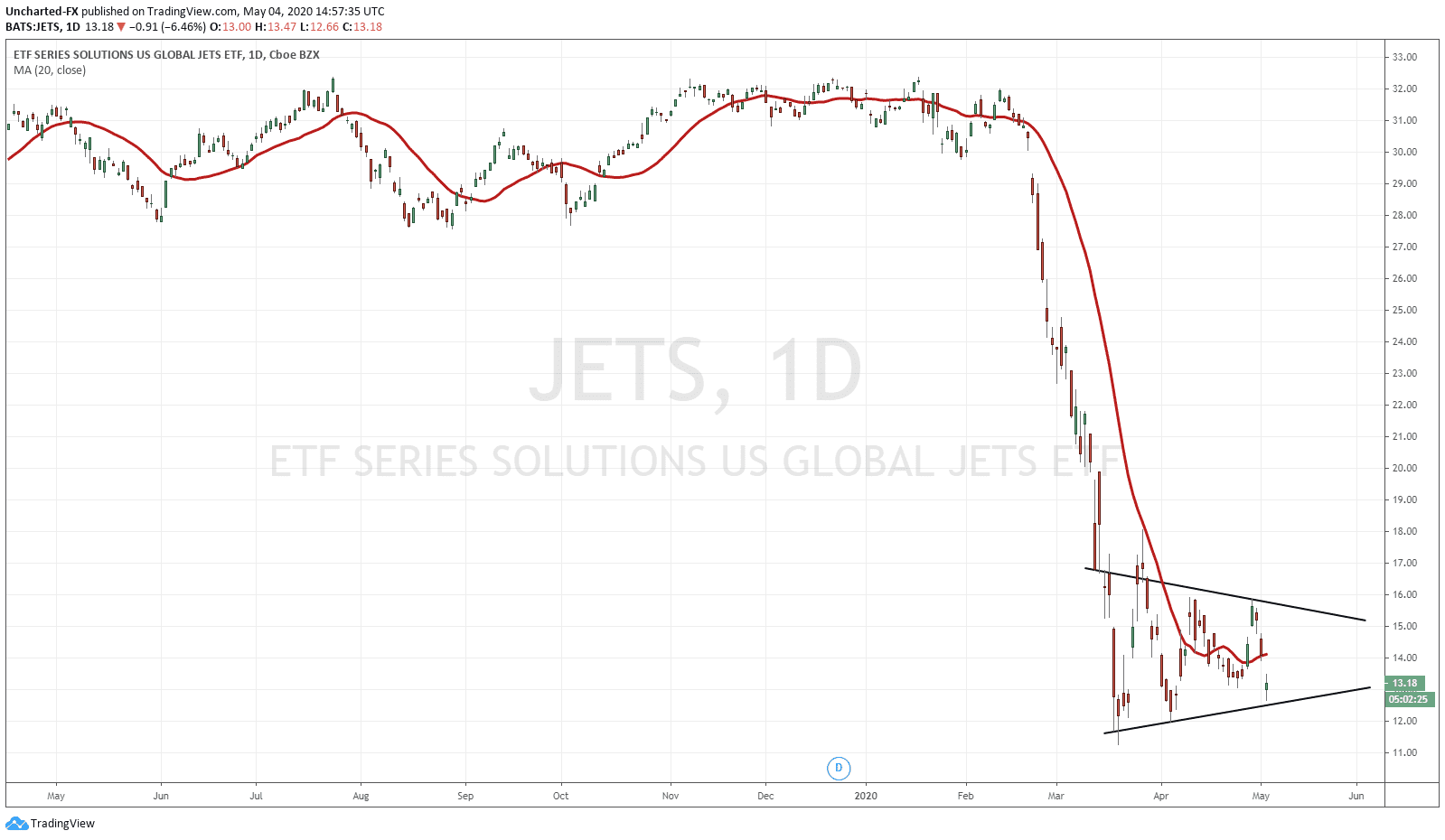

Obviously with Warren Buffett selling off his Delta position, naturally everyone will be talking about airlines this week. Let us take a look at the JETS ETF featured in this post. This ETF is another chart we have been following with the potential of a reversal. We liked the large down trend move with multiple lower highs and lower lows, and then liked the bottoming pattern here. We were originally looking for a double bottom pattern, but this did not occur. It seems we are now forming a wedge pattern, with a break above or below either side to give us our next direction. This pattern shows us the coiling of a move before the break determines which way the energy is released. Once again, these companies have received billions and are being propped up. Another market fall is what would cause these to tumble lower.