Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

It’s Fed/FOMC week, and many already know what the Fed will be doing, it is a matter of how much. The Fed Fund Futures is showing no change, with rates to be kept at 0.25%. It is all about how much more easing the Fed will announce. More cheap money and more money printing to keep the system propped and going. I have spoken about the combination of monetary and fiscal policy, and how both have been implemented with the monetary policy tool box quickly running out of tools. All that is left is throwing more money at things… and eventually negative interest rates as a way to handle all the debt. Worldwide debt was at a record 260 Trillion, but with all these policies being implemented worldwide to deal with covid-19, I just wonder how close to 300 Trillion we are now.

The Fed is up on Wednesday. Typically a Fed week can be dull and slow for equities until the day of the announcement. This has been the case for as long as I remember. As already mentioned, this week provides an interesting case because everyone knows what the Fed will be doing, it is just the scope and amount that matters. In my opinion, more easy money that will be announced is going to be stock market positive. Why? Because there is nowhere else to go for yield. The Fed is essentially backstopping the markets, which has given the term the “Powell Put”.

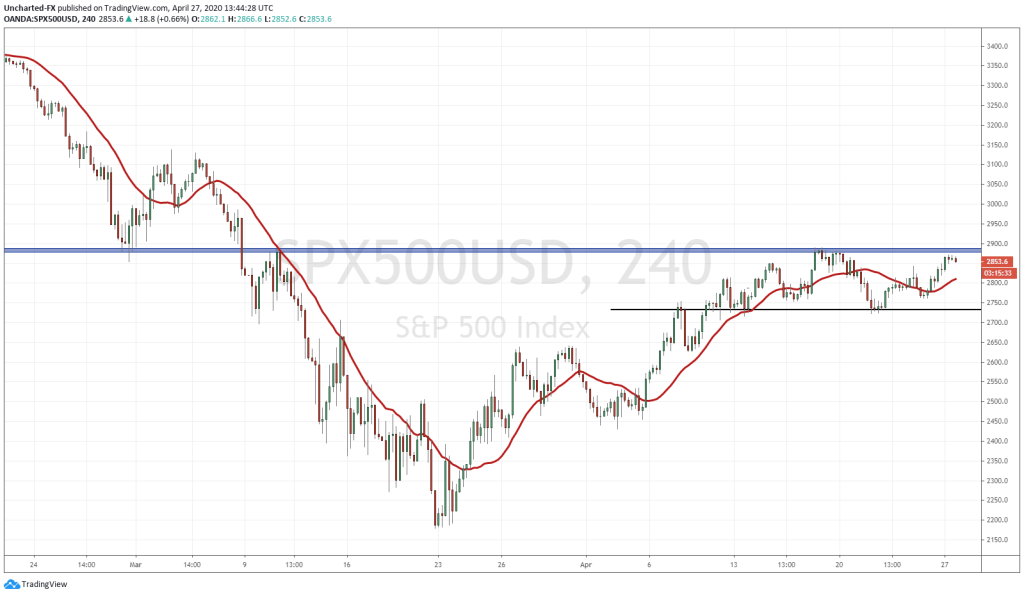

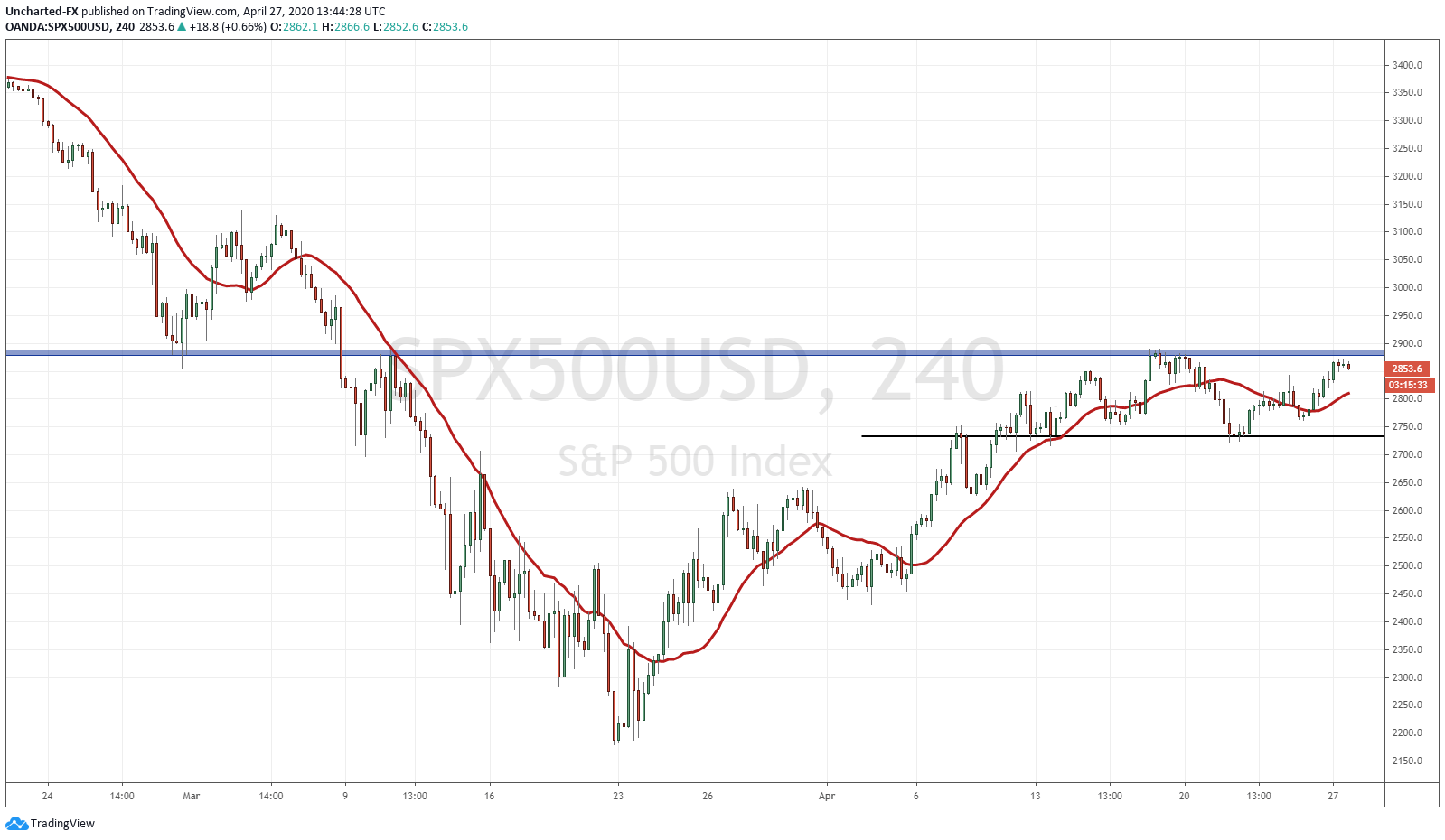

For the equity markets, we are still watching the two levels since last week and longer. We are either going to break above the major daily resistance zone for a break out, or we will drift lower and break below support for a break down. That support level being the same zone we were watching for a potential head and shoulders pattern last week, and used as our neckline. The other scenario is that we just range. Pure and simple. Nothing happens and we just bounce between these two levels. This becomes a more realistic scenario given the fact we have the Fed meeting this week. Perhaps no break out or break down until the day of, or after, the Fed meeting.

In terms of the fundamental news, it is all about economies re-opening. We are seeing this begin to quicken as many municipalities, states, provinces, etc around the world realize the potential of bankruptcy. Things need to re-open as quick as possible because the economic damage from this will deal more damage to others than this virus in the end. As mentioned before, there will be euphoria when things re-open. This news will be positive for markets and you will hear the media touting a V shaped recovery for the markets and economy. We will discuss the play for this, but I have covered it a few times because the chart for that index looks great.

I also want to leave you with another index chart that is testing an important zone like the S&P. The Nasdaq. It is also constrained between two zones, and the same analysis applies. It is a big earning week for big tech with the likes of Microsoft, Facebook, Amazon, Google and Apple announcing earnings in the latter part of the week.

If you are not, definitely join us over at the Discord channel where we will be keeping our eyes on these market levels discussed in today’s blog post.