Trade ideas and discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

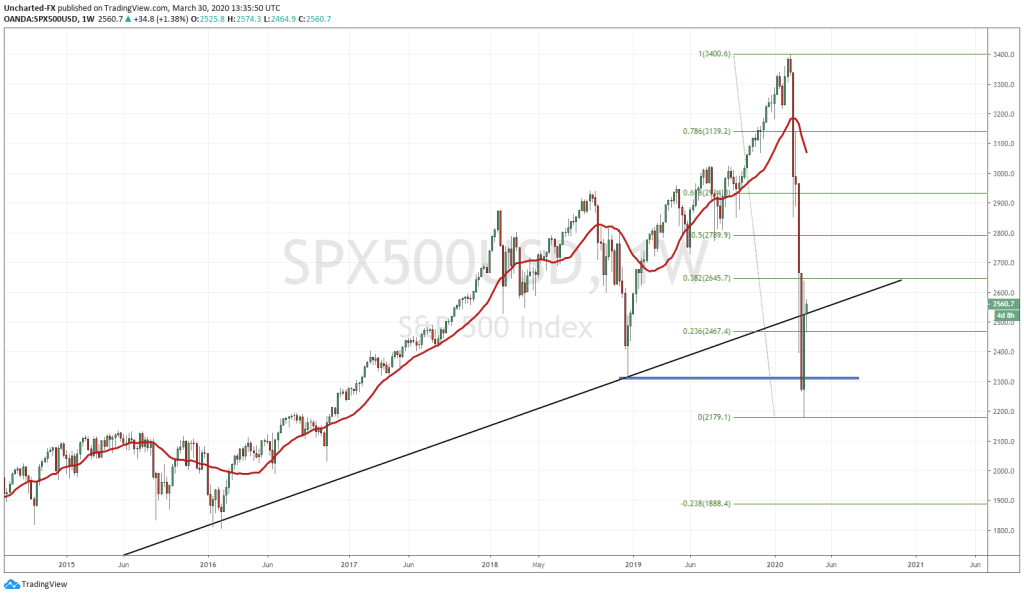

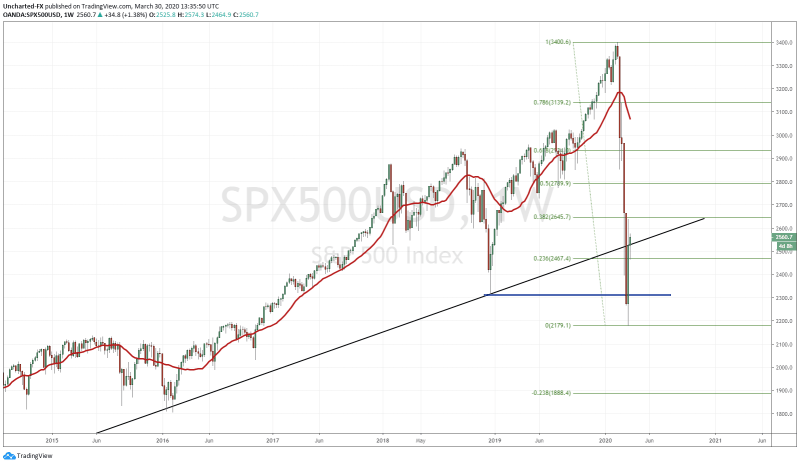

The S&P did test the 38.2 fib zone. A rejection at the 38.2 fib zone is important because it signifies a strong trend. In this case that trend is of course a down trend. Price did begin to sell off near the fib zone BUT I must be clear that this alone does not constitute a lower high swing. In order to confirm a lower high swing, we need a new lower low, or a break and close below 2179.

It is also prudent to point out that we did also close slightly below the trend line going back from the bottoms of 2009. We saw a battle here with the weekly candle attempting to close above.

The way to play swings is very simple:

1) Either enter now front running the eventual break of the lower low. Your risk to reward ratio will be much higher, however the probability of further down side is skewed.

2) Await the weekly candle break and close below 2179 confirming the lower high swing. You have a much better probability of further downside, although your risk vs reward may not be the greatest…but of course this can be managed by how you place your stop.

Sure, we may just range here for the next few weeks. Maybe even test the previous lows and see no break and close. We will wait and see.

On the fundamental side, we have seen the virus relief bill pass the house and signed into law by President Trump. You now have both the monetary side (from the Fed and other central banks) and the fiscal side combination implemented to keep markets propped up. If this fails and we continue lower, we could very well be in the confidence crisis that I have been warning about.

We will have seen a confidence crisis in governments and in central banks. The final one would be a confidence crisis in the fiat money/currency. A lot of people are focused on the equity markets, but I think the bigger moves, and the moves with more ramifications for the world going forward, will be in the currency markets.

Nations and central banks are already killing their currencies as I have said they would. Everyone is trying to weaken their currencies to inflate them. To inflate assets and keep things propped. With more debt being pushed into the system, interest rates will have to be at 0 or lower, and currencies will have to be weak.

On the Discord channel we have also identified a pattern that we could use to trade LONG, to targets to the upside. Join us to find out whether markets still move higher, perhaps to test the other fib zones above. We still are not out of the woods for new lower lows, but we will trade the markets that we have.