“There was me, that is Alex, and my three droogs, that is Pete, Georgie, and Dim, and we sat in the Korova Milkbar trying to make up our rassoodocks what to do with the evening. The Korova milkbar sold milk-plus, milk plus vellocet or synthemesc or drencrom, which is what we were drinking. This would sharpen you up and make you ready for a bit of the old ultra-violence.” – A Clockwork Orange

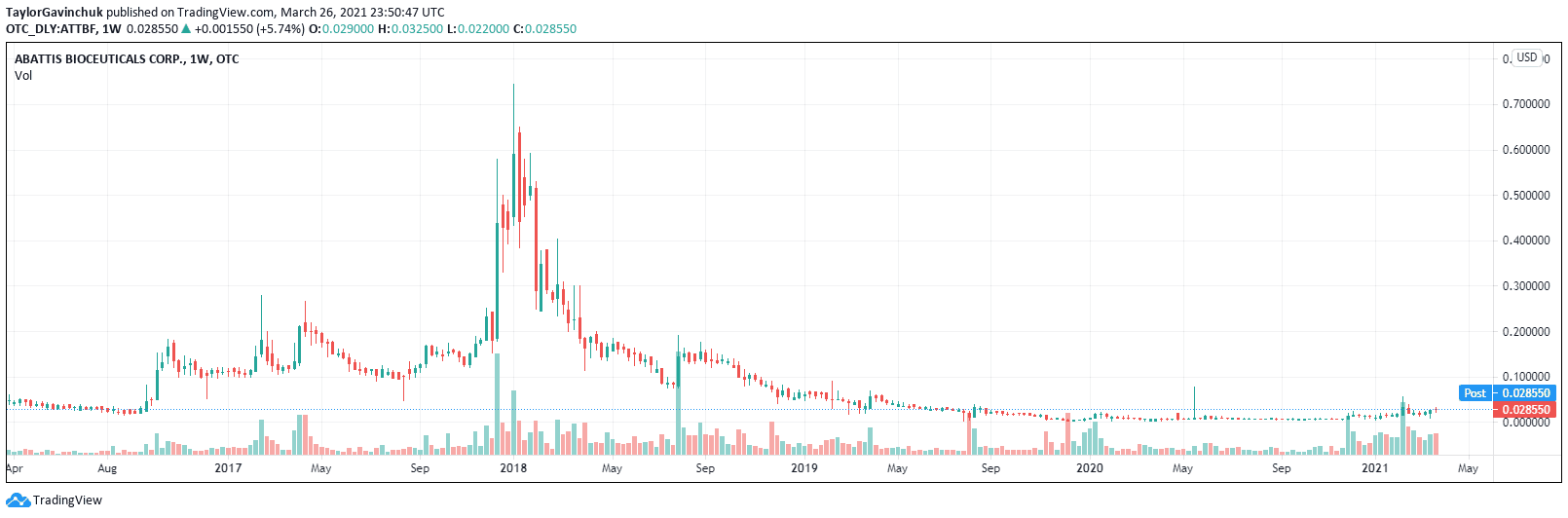

If you were into cannabis stocks around 2017 you may remember the high-flying, fast-crashing company that was Abattis Bioceuticals (ATTBF.OTC) (formerly (ATT.C)). The stock had many scratching their heads because in 2018 despite being worth hundreds of millions of dollars, Abattis generated less revenue than the average Canadian household earns in income per year.

Since its rise in late 2017, Abattis has struggled. The company announced last week that its CEO Robert Abenante is stepping down and that the company hopes to start trading again on the CSE. In February 2019 a cease trading order (CTO) was put on the company by the CSE which caused the stock to be suspended and ultimately delisted, leaving investors stuck holding bags. In the meantime, Abattis and its CEO Robert Abenante have been dealing with regulatory investigations and class-action lawsuits as a result of the company doing business with the Bridgemark Group.

BCSC’S Bridgemark case has many moving pieces but isn’t too hard to understand in theory. Bridgemark was a group of consultants who would raise money for companies only to take a ridiculous amount back as kickback. This is common practice, and legally ambiguous as company consultants are sometimes there to serve as paperwork for cutting a cheque. The issue with Bridgemark is they took upwards of 80% of the cash back on some of their deals.

https://equity.guru/2019/08/08/abattis-bioceuticals-att-c-grift-building-several-years-regulators-couldnt-ignore-anymore/

The companies weren’t exactly innocent either. They could tell excite their investor base with a ‘hey we just raised $50M CAD’ press release, when in reality, it means they maybe only raised $10M CAD toward the company. It was likely that none of the investment banks wanted to go near them, so they looked for other options, that’s where Bridgemark came in to offer a helping hand to companies like Abattis.

Abattis not only faced an investigation from the BCSC and CSE, but they were also slapped with a class-action lawsuit from their own investors. People were pissed, Abattis became a monumental disaster as a result of poor managerial decisions, and those who invested are now stuck with the bill – a pile of $0.03 stock they legally can’t trade.

Abenante was previously the CEO of the African gold company Blox Inc. (BLXX.OTC), and similar to Abattis, Abenante talked of turning Blox Inc. into a household name, telling investors Blox would be a $10 billion dollar market cap company someday. That didn’t quite happen, the company’s market cap sits at $1.43M CAD currently. In 2017, Abenante was sued by Blox Inc. for making unsubstantiated payments to himself including paying off his personal credit card with company money. Blox stated in their 2012 8K,

Our officers lack experience in operating a public company. Our success is substantially dependent on the performance of our executive officers. In particular, our success depends substantially on the continued efforts of Robert Abenante.

Our future success is particularly dependent on the vision, skills, experience and effort of Robert Abenante, our Chief Executive Officer, President and director.

Synthemesc & drencrom

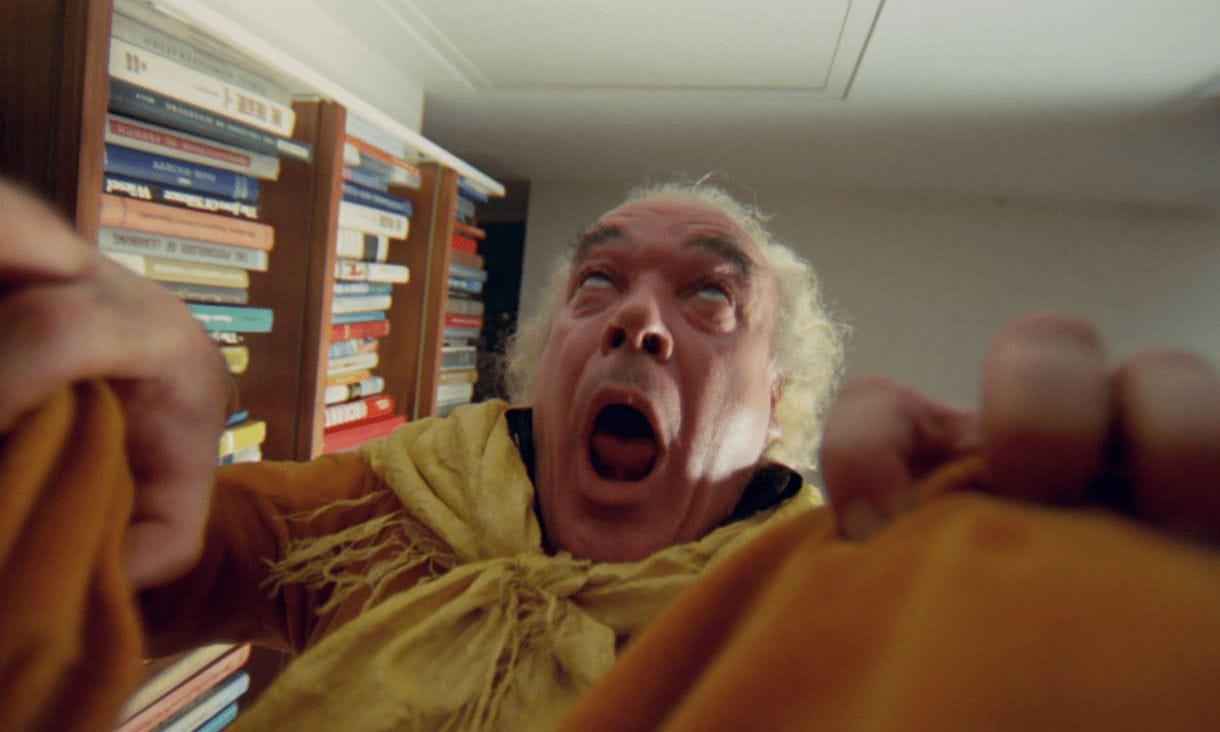

Much like the lofty expectations of Blox, Abattis sold its investors on the idea of creating a diverse catalog of cannabis products like CBD beer, CBD sunscreen, and vapes. They also had a JV running Northern Vine labs where they could make all of these products, and they were even going to purchase an LP. They could control the entire supply chain from seed to sale, sounds exciting; and the company projected to be cash positive by 2019. Abenante is good at selling, he wears a big collar and knows how to talk.

Here is Abenante’s bullish interview with the CSE just 6 months before they delisted his company, it’s rather awkward in retrospect. In it, Abenante tells us about his plan of building a world-class cannabis company, one that’s vertically integrated, creating the next generation of cool and popular cannabis products.

In April 2019, Abattis purchased the Dutch supplement company Pro Natura with aims of distributing their previously mentioned cannabis products stating, ‘capitalizing on the growth in the market, especially CBD, the acquisition aims to leverage Pro Natura’s distribution network for CBD sales in Europe, which will be further bolstered by new CBD products introduced by the company.’ But then the banks and regulators showed up, and in November 2019 Abattis made the decision to dispose of all of its cannabis-related businesses.

The company needed to lay low for a while.

Abattis Announces Breakthrough CBD-Based Sunscreen Formulation –

Read More>>> https://t.co/AlVtvJifui pic.twitter.com/4UriCpgKny— Abattis Bioceuticals (@Abattis) August 28, 2017

Abattis posted $459K USD in revenue for 2020. Their website is currently just a shell with no information, and because they have been delisted from the CSE, the company is not in the SEDAR system anymore aside from one recent press release. The only info I could find was a share purchase (oof) of Pro Natura BV, a Vitamin & supplements store in Oisterwijk, Netherlands. By taking a look at Pro Natura BV’s product selection I assume Abattis is making money selling cranberry and Vitamin B supplements, a far cry from cool and innovative cannabis products.

Singin’ in the rain

The last few years have been rough on the company and its shareholders. Now in 2021, Abattis is looking forward to brighter days ahead. According to the most recent update from the company, Abenante is stepping down as CEO, while still proclaiming his innocence. The company also has hopes of someday returning to the CSE.

I made a promise to the Company, its shareholders and its stakeholders that I would not leave this Company until I had completed the BCSC review, received a clean bill of health of the financial statements and proven that the Company and I should not have been named in the Class Action Lawsuit. Now that these significant milestones have been achieved, I can turn over the reins to a new leader that can take this Company back to the heights it once enjoyed. Therefore, I am tendering my resignation as President, CEO and Director of Abattis, effective immediately. – Robert Abenante

I have followed Abattis pretty closely over the years.

Why?

I have had no choice really, no matter how many times I unsubscribe from their list I still get their emails. After 2 years of ‘we are just about to figure this shit out soon and it’s gonna be cool trust me‘, I have finally begun to enjoy them.

But while Abattis is interesting to follow, not everyone is having fun.

And worst of all, all the CBD beer is gone.

The only hope for Abattis bagholders at this point is having the company get out from under their cease trade order (CTO). If the order is lifted, holders might be able to breathe a sigh of relief, maybe they can unload their shares, but who is buying?

Or should we forget about weed, CBD sunscreen, biocueticals, nutraceuticals all together?

Abenante is moving on, should we as well? Most good jump-shooter in the NBA joke about having a short memory span, the quicker you forget your misses, the faster you can start hitting again, it’s all mental. And that’s just what Abenante is doing. Now that he has Abattis and Blox Inc. off his back, he is preparing for a comeback, rejoining a familiar sector, mining.

Marifil Mines

I feel dizzy. my drink has been spiked with scopolamine, so let’s have a look at his new deal Marafil Mines (MFM.C).

Abenante is currently the CEO of Marafil Mines, an Argentina-based gold company with properties in the Rio Negro province, with a market cap of $7M CAD. Marifil’s intent is to become a hybrid royalty company whereby they will have a mix of royalties, working interests, and carried interests in their projects.

The company is actively working to sell off its non-gold assets to focus solely on gold. The company also has exploration rights to 2,166 hectares in the El Indio Gold Belt, a mineral-rich region of the Andes Mountains spanning the border between Chile and Argentina.

Abenante has a contract with Marafil which allows him to earn 1,000,000 bonus shares over a period of two years should he reach certain performance milestones, 550,000 bonus shares have already been earned and are ready for release. Marifil’s performance bonuses aren’t nearly as handsome as what Abattis was offering. On February 27, 2018, Abenante received Abattis shares worth $1.7M CAD, and 12 days later he received additional Abattis shares worth $810K CAD.

Abenante has also collected $151k CAD in management fees so far from Marifil and has simultaneously earned some extra cash by leasing one of his properties for $2k CAD per month to the company, according to the company’s most recent MD&A posted below.

https://e4njohordzs.exactdn.com/wp-content/uploads/2021/03/m-mines.pdf

Defenders of Abenante will say this is all one big coincidence, and that he has never been given a real opportunity to build a company. His big dreams have consistently been sidetracked by annoying lawsuits and nosy regulators. But Abenante isn’t totally against the system, as last year Marifil Mines received a $40k CAD COVID relief business loan from the Canadian government, the company stating Argentina’s lockdown measures being rather harsh, making business activities difficult.

So, what does the future hold?

Those betting on Abenante can invest in Marifil’s $2M CAD raise. Exactly what the cash is going to be used for beyond ‘general capital’ isn’t laid out in the press release, and Marifil Mines doesn’t have a website as of today, we are going to have to take Abenante at his word.

Thank you for the update on this slime ball.

Your articles rock!!

I lost like 8000$ and had to move back home cause of my dumb mistake to invest in Abbatis, thanks Robert, could’ve made something out of this company but no you had to get greedy.

Robert Abenante supposedly resigned from Cryptobloc… which is now called Extreme Vehicle Battery Tech (AC/DC) and Bryson Goodwin wished him all the best in his future endeavours….

https://m.marketscreener.com/quote/stock/EXTREME-VEHICLE-BATTERY-T-54548035/news/Cryptobloc-Technologies-ANNOUNCES-MANAGEMENT-CHANGE-AND-INTENT-TO-CHANGE-COMPANY-NAME-29938514/?fbclid=IwAR3tuDwfMupBHK2dvNR2Xz-p-sYiCJL_vW6QixiYiNbRMtfHCQVUfjVfRjk

But if you haven’t noticed Robert Abenante is still working with these guys at EV Battery Tech (AC/DC). Something fishy is going on here and this guy is still lingering around. The question is why?????.

Something fishy is definitely going on and Abenante has found a new partner to sucker into it….It’s still very quiet, but it’s there is you look. He’s decided to go farther afield (not in Canada this time). Look into EV Battery Tech and /Cryptoblox and see who all is involved……