We had a wild day on Wall Street and in the Stock Markets. Started 2021 with a bang. The S&P 500 , the Nasdaq, the Dow Jones all did finish lower, but WELL off the lows. Last week, I mentioned how this week would be big with the Georgia (GA) Senate run off and then the January 6th Electoral Vote Count. The GA Senate run is the big one.

If the Democrat Candidates win both seats today, the Senate will be split 50-50 between the Democrats and the Republicans. But the Vice President gets the determining vote, and since that person is a Democrat, the Democrats technically take the Senate.

This means that they can pass the programs that they want. Many traders are worried about the reversal of President Trump’s tax cuts, and that the markets would act accordingly to a raise on taxes.

The current set up, with a Democratic President and a Republicans controlled Senate is the Goldilocks zone. Balance and checks remain so the Democrats cannot pass large programs.

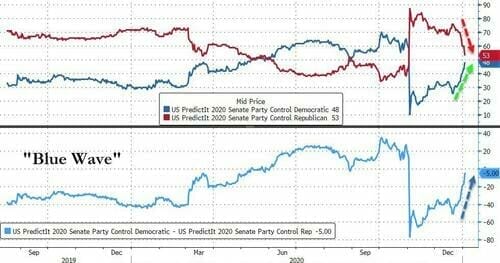

Here are some charts from Zerohedge displaying the run-offs:

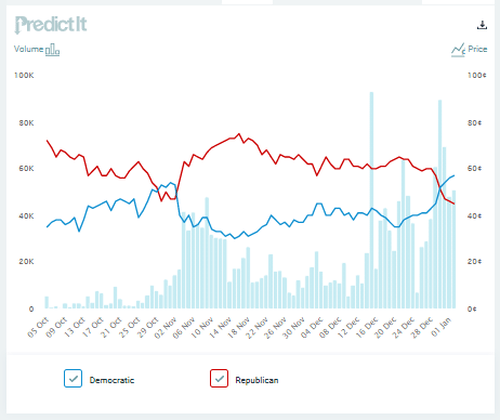

The race between the Democrats’ Raphael Warnock and Republican Kelly Loeffler:

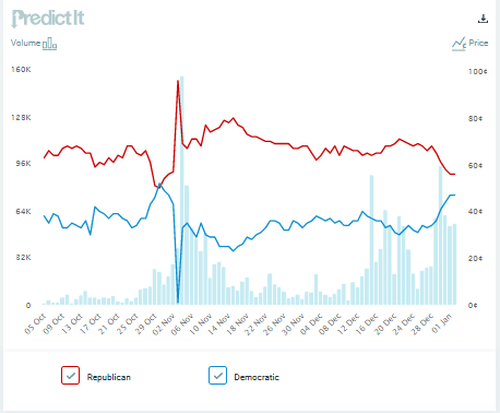

The Democrats’ Jon Ossoff and Republican David Perdue, with the Republican still hanging on to a lead:

Strikingly, while online betting markets priced in a relatively modest 25-30% probability of a blue sweep (i.e., Democrats winning both GA runoffs tomorrow), the Predictit odds for a “blue wave” have soared in the past few days, surging just shy of 50%.

To me, this would meet the definition of a Black Swan Event. Something the market is NOT pricing in. So there is a possibility we drift lower given the outcome today (perhaps the market was pricing this in yesterday). Just want to be clear: this is not telling us the Dems win the Senate today, it is just a possibility that the markets are fearing and reacting to.

If the Republicans maintain the Senate, markets will continue their uptrend as we remain in the Goldilocks zone. If we get the Democratic outcome, we can continue a move lower.

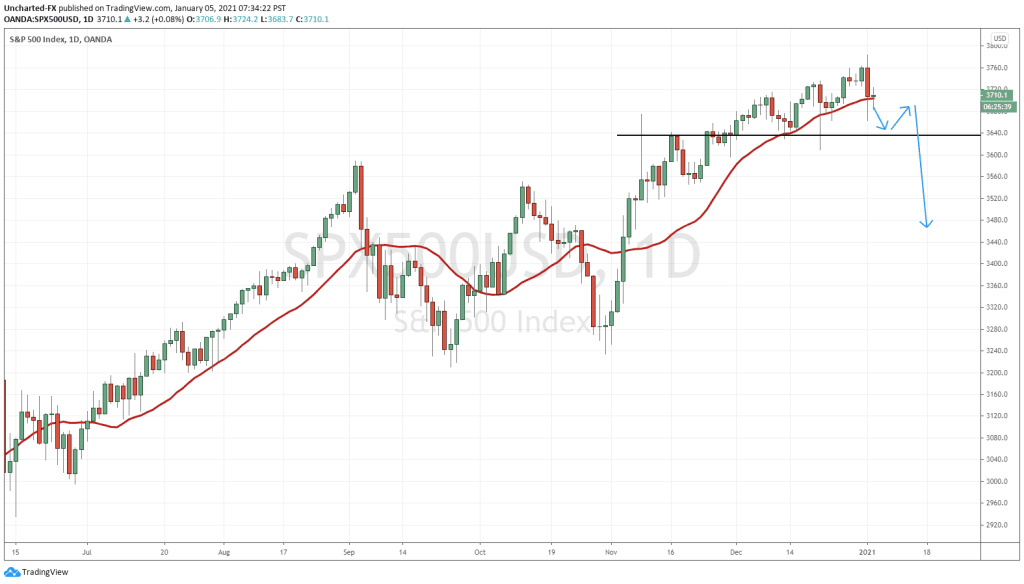

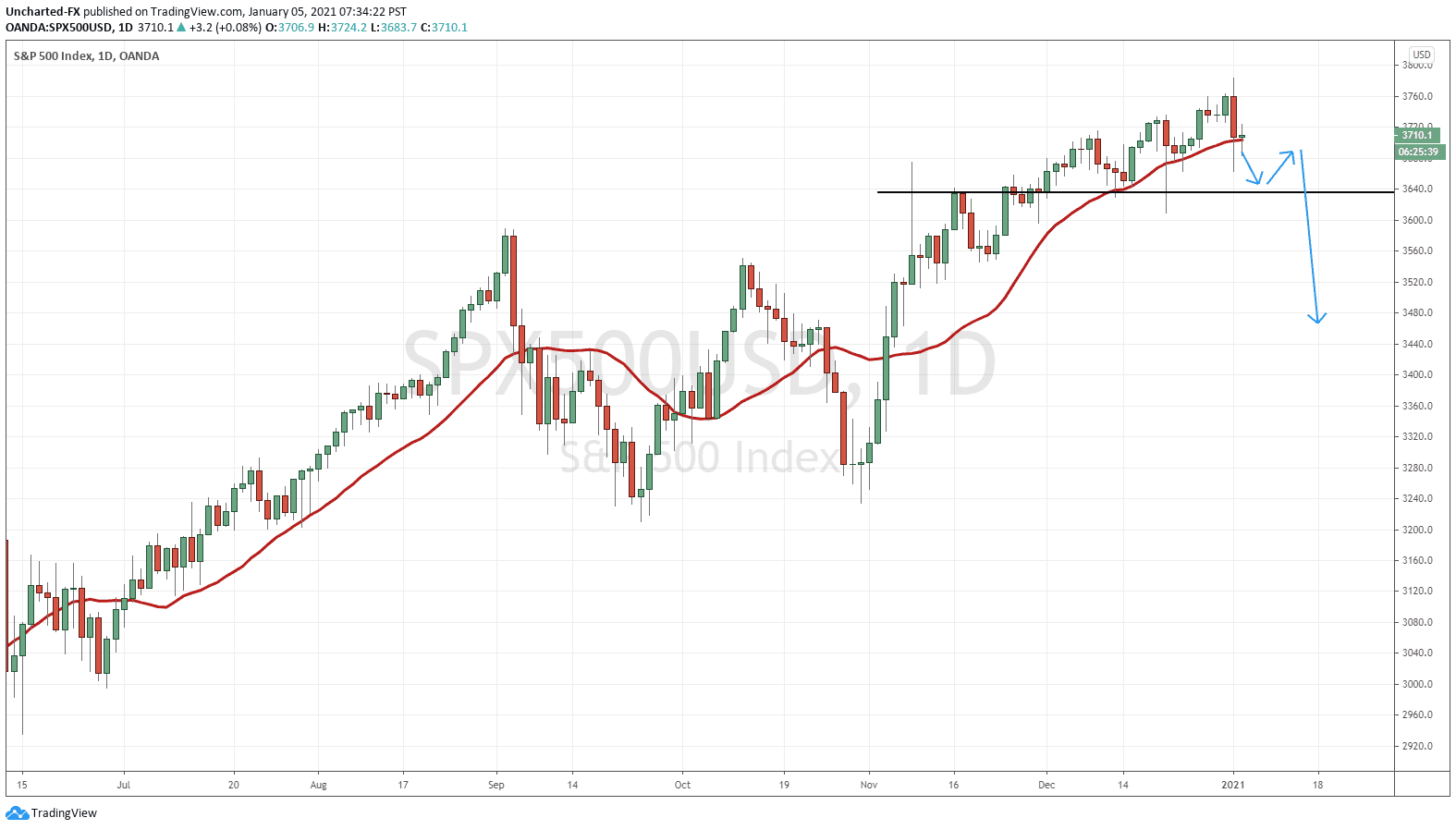

The zones I would look at would be on the Daily chart . For the S&P 500 , there is a possibility we are forming a head and shoulders reversal pattern. The 3640 is a major support zone that I am watching if price drops lower. Some would even take this down to the wick at 3600. One could even make a case there is a flip zone at 3700, and the daily close indeed closed back above.

IF we fall and do hit 3640, expect a bounce and then our right shoulder eventually breaking below 3640. That would be my short trigger. I would target 3530, and then 3400 below that.

BUT you all know my outlook on the monetary and fiscal side. Cheap and easy money is here to stay. It cannot stop and it will not stop. So yes, there is a chance the S&P 500 and other US Stock Markets drop on the “Blue Wave”, but I do think the dip eventually gets bid up when reality of the macro environment sets in.

The Federal Reserve is not stopping its asset purchasing program anytime soon. Interest Rates will be suppressed, and stock markets will continue to be the only place to go for yield.

A Blue Wave means even MORE money will be spent. Democrats are generally big spenders. Stock markets continue to be the only place to go for real yield. You all know my thoughts on Gold , Silver and Cryptocurrency. This is where you want to be to preserve purchasing power!

Expect a highly volatile week. At the end of the week, I would not be surprised to see the tone change. What started as a red week on wall street, turns to be a positive week for wall street. I welcome this relief rally, and further pressure if it plays out. Profits must be taken and the markets need to give back some!