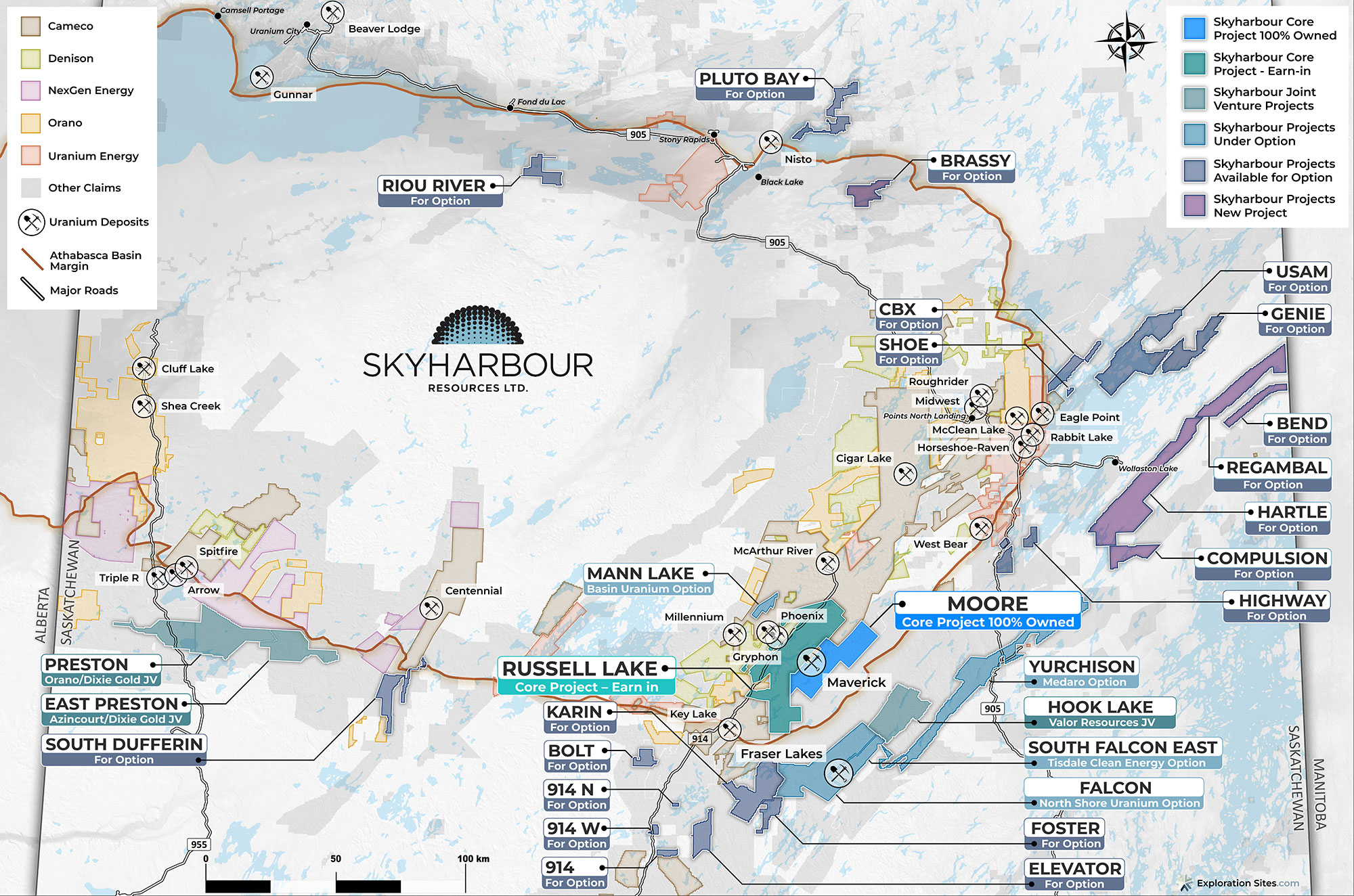

Skyharbour Resources (TSX-V: SYH), a uranium exploration company with prime assets in the Athabasca Basin, is poised to capitalize on the anticipated resurgence in the uranium market. The company’s extensive portfolio of uranium exploration projects and strategic joint ventures with industry leaders make it a wise investment for those seeking to benefit from the rising demand for nuclear power. With twenty-five projects covering over 587,000 hectares of mineral claims, Skyharbour is well-positioned to become a major player in the uranium mining industry.

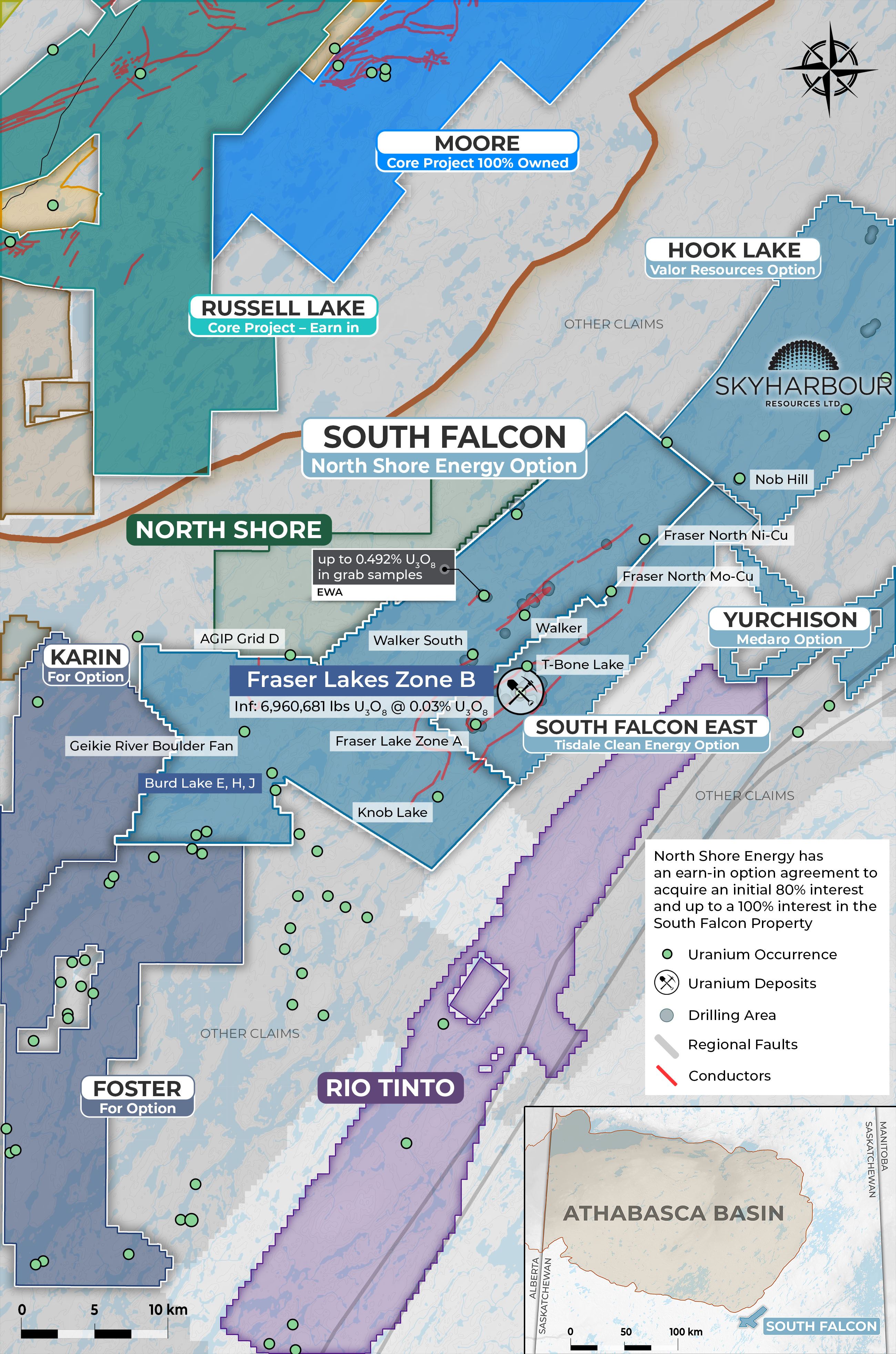

Today, Skyharbour Resources announced that its partner Company, North Shore Uranium, has commenced its drill program at the Falcon Property located at the eastern margin of the Athabasca Basin in northern Saskatchewan.

North Shore is planning to drill three targets associated with electromagnetic (“EM”) conductors. Information pertaining to the drill program and a summary of the Property were provided by the Company on February 28, 2024.

The drill program is being managed by TerraLogic Exploration Inc. The final three targets selected for drilling, which lie along a strong, dominantly northeast-trending EM conductor system.

The Falcon Property, which constitutes part of North Shore’s Falcon Property, contains eleven mineral claims comprising approximately 42,908 hectares approximately 50 km east of the Key Lake mine. Nine of the claims are from Skyharbour’s original South Falcon Uranium Project and the remaining two claims are from Skyharbour’s Foster River Project. Historical uranium mineralization discovered at Falcon is shallow and is hosted in several geological settings including classic Athabasca-style basement mineralization associated with well-developed EM conductors.

North Shore may acquire an initial 80% interest in the Property by issuing common shares of the Resulting Issuer (“Shares”) having an aggregate value of CAD $1,225,000; making aggregate cash payments of CAD $525,000; and incurring an aggregate of CAD $3,550,000 in exploration expenditures on the Property over a three-year period. Once North Shore has earned an initial 80% interest in the Property, North Shore may acquire the remaining 20% interest in the Property within 90 business days by issuing Shares having a value of CAD $5,000,000, and making a cash payment of CAD $5,000,000 to Skyharbour. If North Shore does not elect to acquire the remaining 20% interest, a joint venture will be formed with Skyharbour holding a 20% participating interest.

The stock continues to battle at a major support level. There was a breakdown below it on February 23rd 2024, but the following trading day saw buyers jump back in and nullify the breakdown. Since then, the stock has attempted to regain the major psychological $0.50 zone.

The stock is now in a range between $0.42 and $0.49. A breakout or breakdown will give further direction.