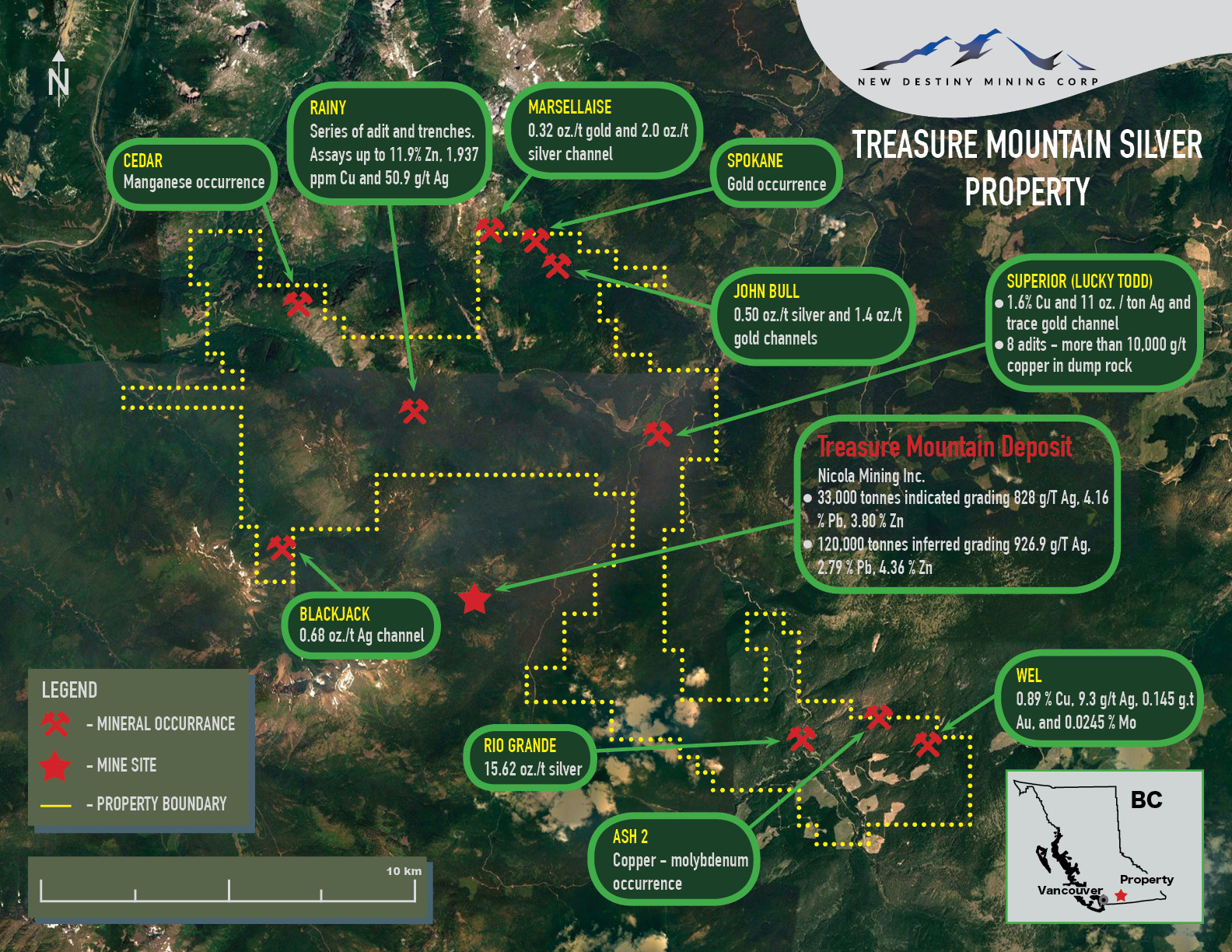

New Destiny Mining (NEM.V) is a junior explorer with an option to acquire a 100% interest in the Treasure Mountain Silver Property comprising approximately 9,500 hectares located in the east of Hope, British Columbia.

The Project is adjacent to Nicola Mining Inc’s Treasure Mountain Property which is the site of the previous operating Treasure Mountain Silver-Lead-Zinc mine. Some highlights of this project include:

- Rainy (Cedarflat) occurrence (north-central region): 2011 grab samples from rock piles near an adit were reported to return 6.5, 7.4 and 11.9% zinc.

- Spokane (northeast region near Jim Kelly creek): A sample reported in 1913 of 4.11 g/t gold over 0.9 meters across the zone.

- John Bull (northeast region near Jim Kelly creek): A channel sample reported in 1937 of 9.6 g/t gold over 0.18 meters across a quartz vein.

- Railroad creek area copper showing ( east region north of Railroad creek): Two 2011 grab samples from rock piles near adits were reported to exceed 1% copper and up to 76.4 g/t silver.

- Rio Grande (southeast region): A 1.5 meter chip sample across a shear zone was reported in 1929 to return 1.2% zinc.

The Project has drill permits in place, however New Destiny have their eyes on the Green Energy market, and positioning themselves to potentially be a significant player in the undersupplied graphite market.

Today, New Destiny Metals announced it has secured a 100% interest in the Indigo Graphite Property from private company Lumin Graphite Corp. The Indigo Claims provide the Company with the opportunity to expeditiously replicate the exploration and development success that has allowed Nouveau Monde (TSXV: NOU) to bring its Matawinie graphite deposit to near-production. The two deposits are less than 60 km apart.

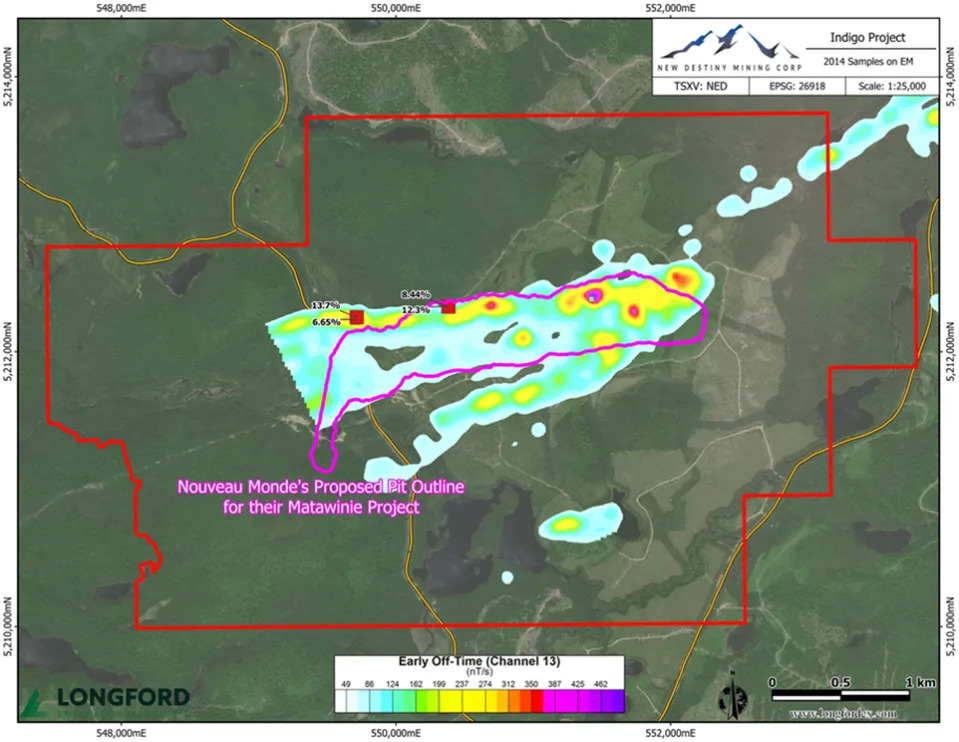

Nouveau Monde’s 2015 “Technical Report of the 2014 Prospecting and Trenching Campaigns on the Matawinie Property, Quebec” dated April 28th, 2015, authored by A.Cloutier. shows surface sample graphite grades at Indigo comparable to those at the Matawinie deposit. The April 2015 report describes several geographically separate claims blocks, VTEM survey results, and rock and trench sampling results. The block designated as Block “I” in Nouveau Monde’s 2015 technical report has (with modified geographic boundaries caused by the recent staking) been designated by the staker as the Indigo Graphite Property.

The similarities in geophysics and assay results described in Nouveau Monde’s April 2015 Technical Report suggest a graphite deposit on the Indigo Property would reflect the same geological structure as that of the proposed Matawinie open pit mine location.

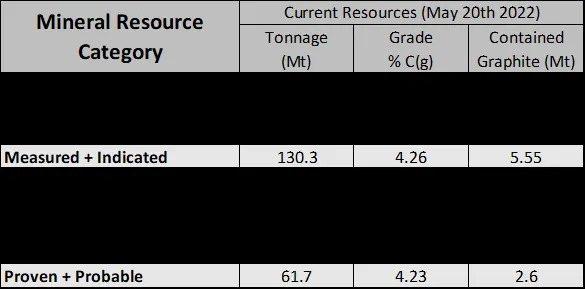

If ‘close-ology’ proves to be true, then New Destiny could be sitting on a project with MASSIVE POTENTIAL. To put things in perspective, Nouveau Monde Graphite has a market cap of over $400 million. The soon to be producing Matawinie Graphite Deposit has an NI 43-101 resource of:

New Destiny Mining has a current market cap of under $3 million.

“The Indigo project is at the same stage that Nouveau Monde’s Matawinie graphite project Block “H” was only 7 years ago,” stated Glenn Griesbach, staker and owner of the Indigo Claims. “The road to developing the Indigo graphite deposit (trenched by Nouveau Monde but not reported to be drilled) has been clearly blazed by Nouveau Monde’s success in developing their historic Block “H” into the current Matawinie graphite deposit and soon-to-be mine. Nouveau Monde has provided an exploration and development template that New Destiny can emulate, and perhaps improve upon, to achieve production quickly, to create excellent returns for long term New Destiny stakeholders.”

The stock is up 69% at time of writing, and was at one point up over 80%. Above average volume as well with over 500,000 shares traded.

The stock is set to break above a range which it has held since August 2020. A daily close today confirmed over $0.095 would trigger a significant breakout. Some interim resistance comes in at the $0.175 zone which bulls should be aware of. The major resistance comes in higher at the $0.25 zone.