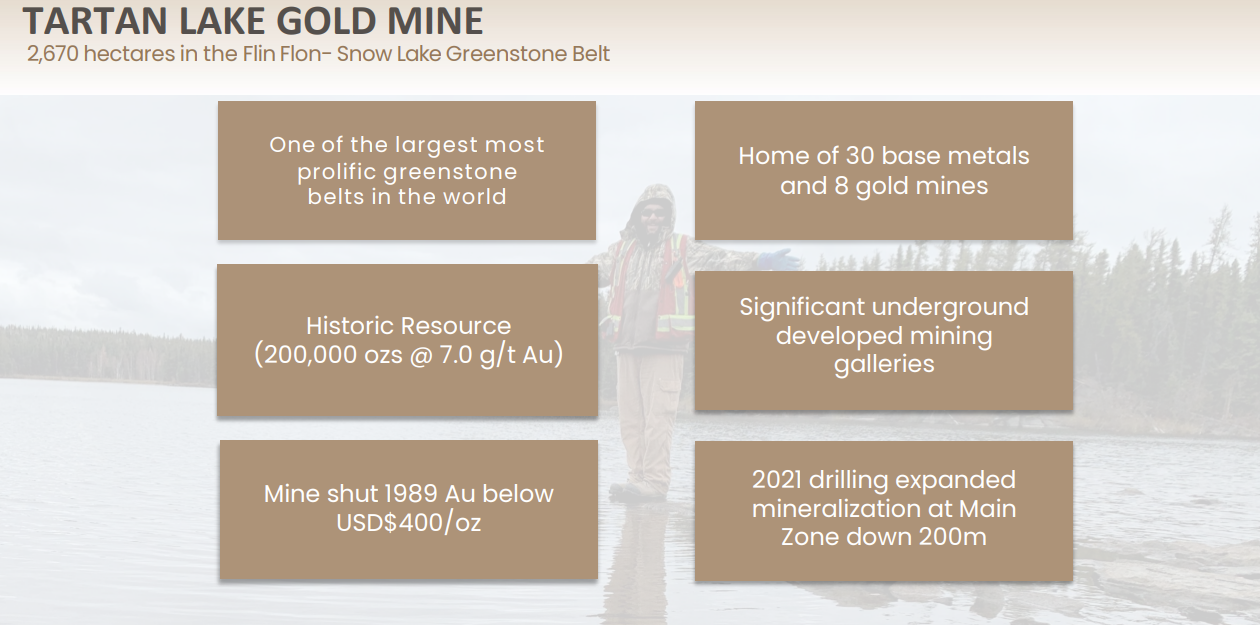

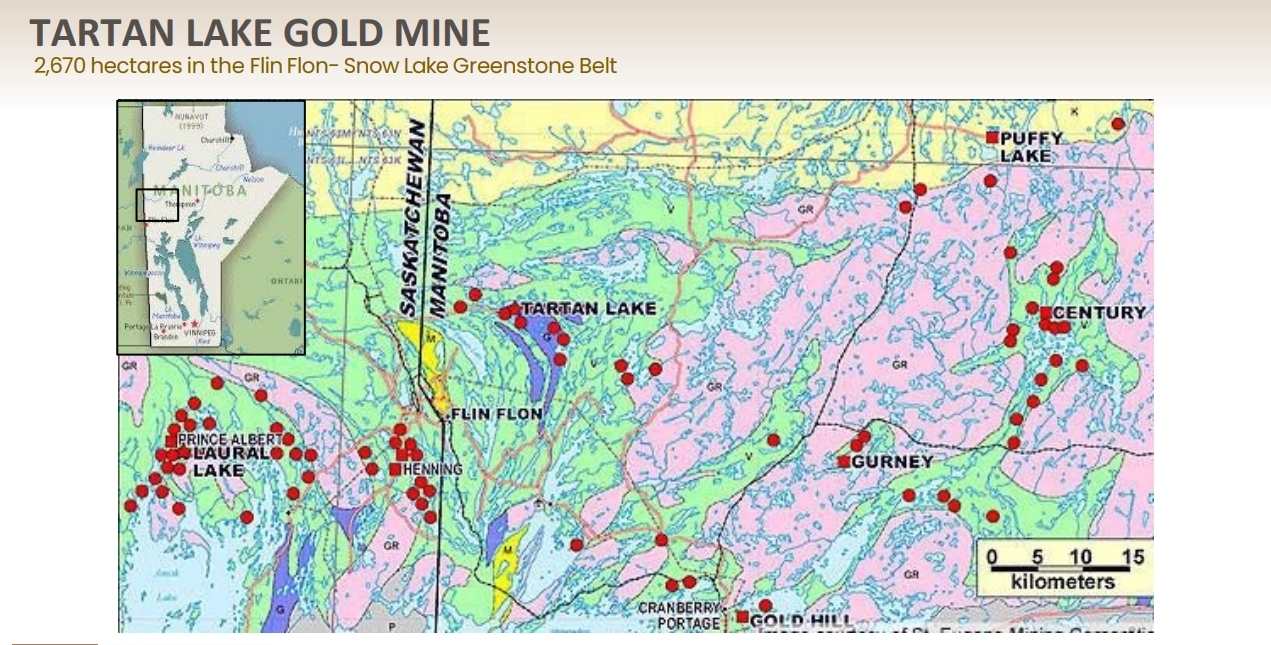

Satori Resources (BUD.V) is up 100% on the day at time of writing. The junior miner’s flagship asset is the past producing Tartan Lake Gold Mine Project, which is located in the Flin Flon Greenstone Belt in Manitoba.

Satori has assembled a team to apply modern geological techniques to better detect the untapped opportunity at the Tartan Lake Gold Mine Project as it shows promising signs of having all the right ingredients to become a significant gold asset once again.

Today, Satori Resources announced that the founder and former Goldcorp Inc. Chairman and CEO, Rob McEwen, will become Satori’s largest shareholder owning 37.6% of the Company.

Satori is proposing to acquire Rob McEwen’s 100% owned private exploration company, Apollo Exploration Inc., that has been acquiring key exploration projects around Canada’s largest gold mines and development projects, including Canadian Malartic Mine (Agnico Eagle), the Hemlo Mine (Barrick Gold) and the Hammond Reef Project (Agnico Eagle). Upon closing, Apollo will also have approx. CDN$1.5 million in cash and no debt.

Upon completion, Satori intends to change its name and assign a new ticker symbol, have approximately $2.2 million CAD in cash and no debt, and execute these catalysts with the cash:

- – Complete the first deep follow-up drill program (approx. 800 metres below surface) that will be used to expand and define the Hanging Wall Zone (“HW”) discovery made in December 2021 that intersected 23.76 gpt gold over 12.60 metres, including 47.56 gpt over 5.8 metres. This was the second-best drill intercept (grade x width) in the history of Tartan Lake. The discovery is open in all directions for further expansion.

- – Incorporate the planned deep exploration and previous drilling since 2017 (approx. 9,500 metres) into an updated NI 43-101 Resource Estimate.

- – Use the updated Resource Estimate to form the basis of a Preliminary Economic Assessment (“PEA”) study. The study will be used to estimate the capital needed to reopen the Tartan Lake Mine and returns associated with the project using and upgrading the existing infrastructure at the mine such as the ramp into the ore body, process facilities, powerlines, and access road.

- – Advance the process of updating the permits from which the Tartan Lake Mine operated under from 1986-1989 and engaging with stakeholders to design the gold mine of the future that has a minimal to no environmental impact and benefits those directly involved with the Company’s growth.

Rob McEwen will be granted the right to appoint two new board members to represent his ownership. Alex McEwen, Rob McEwen’s son, will join the board and is the co-founder and owner of Remote Power Corp., a company focused on electrifying industrial projects in mining, energy, and construction.

The Company will be searching for a new CEO with Satori’s current CEO, Jennifer Boyle, remaining with the Company as a member of the executive team and director.

Rob McEwen said: “High grade gold intercepts have always caught my attention, and here there are many. The new Satori will combine its advanced gold play having significant underground infrastructure situated in a mineral rich district with Apollo’s cash position and strategically located projects next to some of the largest gold mines in Canada.”

Jennifer Boyle, Chief Executive Officer of Satori, said: “This business combination with Rob McEwen ends our search to bring a new dynamic to the Company. Since refinancing Satori over the past 2 years, our small drilling campaigns intercepted grades at Tartan Lake that were not only consistent with historic drilling but resulted in some of the highest grades ever reported at the mine. Having Rob McEwen involved at this juncture is key to unlocking the potential of this project, which has been underexplored and under-funded for decades. His expertise, having realized spectacular growth during his tenure at the helm of Goldcorp Inc., and the portfolio of projects McEwen brings within Apollo, puts Satori in a competitive position for advancing mine development evaluations, and for new discoveries located on Apollo’s projects adjacent to or near to well known producing projects operated by the largest mining companies in Canada.”

Satori has a major fundamental catalyst which has caused a major move in the chart. But what if I said one could predict major catalysts?

This is the power of technical analysis, which has a spooky way of predicting news and catalysts.

My readers know that I have a market structure method. All markets move in three ways: uptrend, range and a downtrend. These just repeat.

Satori had a long downtrend, and recently began to range between September 2022- January 2023. A bottoming was forming, and this occurred at a major support zone for the stock going back years.

The trigger for the reversal was today’s breakout, but if you put all the things I have said above together, the PROBABILITIES of a reversal were quite high. I capitalize probabilities because really this is what investing and trading is all about. It is a business of probabilities.

Support now comes in at $0.045 and resistance at $0.10.