Things changed Friday. A couple of charts indicated a shift. Fundamentally, the blowout US non-farm payrolls employment took analysts by surprise.

Last week, Jerome Powell did say the Fed would continue to raise interest rates and keep them high for a long time until the Fed tames inflation. His press conference was quite dovish, and market reports gloated about how many times they counted Powell saying the word ‘disinflation’.

Inflation is falling, and the markets see this as a sign that the Fed will pause soon. Many think the Fed will pivot and cut rates in the second half of 2023 due to an economic recession. Friday’s labor data changed things.

Even Treasury Secretary Janet Yellen came out today stating, “You don’t have a recession when you have 500,000 jobs and the lowest unemployment rate in more than 50 years,”. Yellen is firmly on the ‘soft landing’ side, “What I see is a path in which inflation is declining significantly and the economy is remaining strong.”

I have said in the past that Powell was saying one thing and the markets another. Powell kept saying rates will be heading higher, but traders have been calling his bluff due to the action in the bond markets. And now we could be in for a volatile repricing.

This is a chart worth your attention. Follow it going forward. The 2 year yield tracks short term interest rates. The interest rates that the Federal Reserve and other central banks can control.

There was a reversal pattern known as the head and shoulders forming back in December 2022. It indicated that yields would start heading lower… again, this happened at a time when Powell was saying rates will head higher.

Instead, we bounced for a bit before breaking down below the neckline or support in January 2023, triggering a breakdown. No momentum though, and the two year yield just ranged from mid January 2023 to February 2023.

On Friday post NFP data, the two year yield climbed back above its resistance neckline zone triggering a false breakdown. Today’s price action is strong showing a pop which would see us break a trendline IF we can confirm a close like this by the end of the trading day. Very bullish.

Yields look like they are going to continue to climb which will put pressure on stock markets. Watch to see how we will react at the 4.75% level.

The 10 year yield may also confirm an interim breakout with a close above 3.55%. The major resistance though was 3.90%.

The second market to follow is the US Dollar (DXY). The dollar has been getting beat up and in a long downtrend since November 2022. Many traders have been watching for a reversal around the 100 zone. A major psychological zone.

Instead, the dollar confirmed a false breakdown with a strong green candle on February 2nd 2023, and has continued to rally strong. A reversal breakout in my opinion with a close over 102.60.

Are we now in the process of a hawkish re-pricing of the US Dollar?

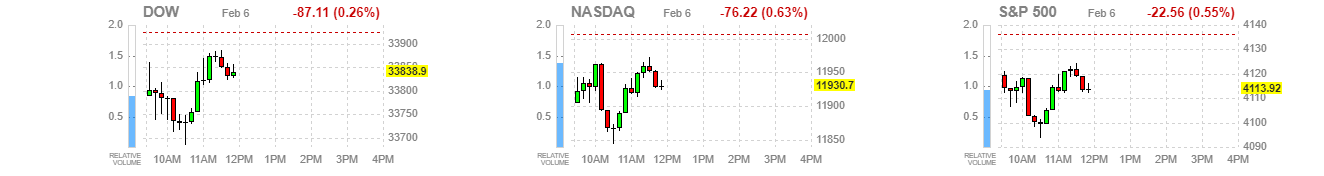

Markets are slightly down on Monday following a drop on Friday post NFP.

What I will be watching this week is how markets will react on their retests of their breakout zones. The S&P 500 is doing this currently. I would watch this zone and the 4,000 level which is the current higher low.

The Nasdaq has further room to the downside before it confirms a retest. While the Dow Jones did not join in with the S&P 500 and Nasdaq rallies.