*originally published 01/11/2023

Uranium prices, alongside many other commodities, are starting the new year strong. The big question is whether momentum can continue. When we talk about metals, there are other things such as inflation, the Federal Reserve, recession fears etc that we need to worry about. Uranium on the other hand, actually has many strong fundamental reasons for heading higher which we will discuss in this article.

Just yesterday, I took a glance at the agenda of the upcoming Vancouver Resource Investment Conference. Plenty of uranium companies will be there, and I see tons of energy/uranium workshops. Ford Nicholson will be “Dissecting the European Energy Crisis”. The usual “Top Uranium Stocks” and “The Uranium Forecast” workshops are there. Rick Rule and Warren Irwin will be discussing, “How to make a boatload in cash (and keep it) in Uranium stocks”. But one which catches my attention for its straightforward message is Nick Hodge’s talk titled, “Uranium: Either the price goes up, or the lights go out”.

Due to the retail (and institutional!) popularity in uranium, I am certain these workshops and talks will be some of the most popular and most attended at the conference. Judging by the titles, you can get a glimpse of what factors will play in uranium’s rise in 2023.

Uranium rose 41% in 2021. 2022 was a bit muted with uranium starting 2022 off strong, but ending the year up just below 10% higher from its January 1st 2022 start. What were some of the factors for Uranium’s rise? Note these down because many of these themes will continue in 2023:

SUPPLY/DEMAND

Early 2022 saw supply challenges when it came to the conversion and enrichment. Many uranium bulls are betting on net supply/demand factors to be the KEY trigger for higher uranium prices in 2023. A lot of this has to do with who is supplying the uranium.

Recently, Sashi Davies, an internationally acclaimed nuclear power/uranium expert who has been involved with the uranium market and uranium sales for more than 35 years, stated that she believes believes the uranium market is poised for a big breakout which will see uranium prices take out previous highs. Supply and demand were her key reasons.

She compares the current set up to that of the early 2000s:

“Today I think we are where we were at the beginning of the big move like back in the early 2000s (spot uranium prices peaked at $US140/lb in 2007). It has the same feel to it,” Davies said.

“Everyone knows that there is something happening. But because there is some structural change, as well as market movement, it is hard to tell how quickly and when it is going to move.

“Looking at demand, the uncertainty now is how much more demand are we going to have in the near term, as well as how far out it will go.

“On the supply side, it is a case of whether we are actually going to be able to bring production on quickly enough to meet that gap.

“And if you look at inventory, I have never seen so much inventory sucked out of the market as I have seen in the last 3-5 years.

“Over the next 12 months, it is a market where there are several catalysts, and if just one of those changes, I think the price could go above its last high.”

Sprott Asset Management CEO John Ciampaglia stated in November 2022 that nearly 180 million pounds of uranium per year is required to fuel the current global fleet of reactors. The current primary output is over 130 million pounds and is expected to rise to between 140 million and 145 million pounds by next year.

GEOPOLITICS

Geopolitical instability challenged supply chains which affected a host of commodities. Uranium was one of them. The obvious reason is the Ukraine-Russia war, but investors may remember that there was civil unrest in Kazakhstan, the leading uranium producer.

Russia’s invasion then provided a catalyst for uranium prices which saw uranium breach $50. Russia is a big player when it comes to conversion and enrichment of uranium. I recommend readers to read Marin Katusa’s “The Colder War” for in depth knowledge. An older book, but what he said about Russia and nuclear energy was spot on, and we will see his analysis play out in months and years to come.

Russia’s state owned uranium company, ROSATOM, is not under Western sanctions because of the Russian state firm’s importance in the supply chain of the global nuclear power industry. But with the war continuing and relations deteriorating between Russia and the West, perhaps uranium will be the next ‘weapon’.

Citigroup sees a potential western ban on Russian uranium:

Citi’s uranium price bull case assumes the US, the UK, the EU and countries in Asia will introduce bans on Russian uranium supplies starting in 2023, based on publicly available information on ongoing discussions in the US Congress and the European Parliament.

In addition, any Russian-related projects would likely be halted in Eastern Europe, including reactor construction in Hungary, Slovakia and Turkey, Citi suggests.

Under this scenario, uranium production in Kazakhstan with Russian state-owned shares would also likely be banned from Western markets. Such an embargo would create a shortage of enriched products and add even further tightness in the conversion market in the short term, and provide a bid to the U3O8 price.

If this occurs, it would mean that the West would need to invest heavily in domestic supply. This leads us to…

ENERGY SECURITY

America is realizing it must eliminate its reliance on Russian uranium for its next generation nuclear reactors.

In a recent Senate hearing, the Uranium Producers of America noted that:

“almost none of the fuel needed to power America’s nuclear fleet today comes from domestic producers, while U.S. nuclear utilities purchase nearly half of the uranium they consume from state-owned entities (SEO) in Russia, Kazakhstan, and Uzbekistan.”

“We estimate that there is more than $1 billion in annual U.S. dollar purchases of nuclear fuel flowing to ROSATOM,” said Scott Melbye, president of the association and Executive Vice President at Uranium Energy Corp.

Energy security is going to be top priority and be the most important theme driving uranium prices higher in 2023.

The US has big plans for nuclear energy, but these plans cannot work without Russian uranium.

In December 2022, reports suggested that Bill Gates’ company, TerraPower, will face major delays in the development of its advanced reactor demonstration due to its ongoing reliance on Russian uranium. TerraPower expects two years of delays or more on its nuclear development in Wyoming, which was expected to be completed by 2028.

The US is making moves to improve its domestic uranium market. The Inflation Reduction Act introduced some investments in the domestic supply chain for uranium. $700 million was invested to support the development of a domestic supply chain for high-assay low-enriched uranium, commonly referred to as HALEU.

Establishing a U.S. HALEU supply can also play a role in eliminating America’s current dependence on Russia for 20% of the enrichment and conversion services needed for US nuclear fuel supply.

Kicking off 2023, we saw the US Department of Energy (DOE) award ConverDyn $14 million for uranium conversion services under its $75 million program to create a domestic uranium reserve to boost energy security.

Five US uranium producers, enCore Energy, Energy Fuels, Peninsula Energy, Uranium Energy Corp. and Ur-Energy announced in December contracts to supply over 800,000 lb U3O8 to the DOE under the program at prices ranging between $59.50/lb and $70.50/lb.

A secure supply of energy is essential and the US will need to invest in and establish a domestic assured supply of uranium for its new nuclear reactors to ensure there are no delays in nuclear projects. This is bullish uranium stocks as mining more domestic uranium will also be crucial. This means investments in this space.

I believe the prudent uranium bull will be holding some juniors in addition to front runner producers such as Uranium Energy Corp (UEC) and Energy Fuels (UUUU) as a strategy for the upcoming uranium bull market.

GREEN TRANSITION AND IMPROVED ATTITUDE TOWARDS NUCLEAR

Obviously the reason why the US and many other nations have big plans for nuclear energy has to do with it being the only CO2 free energy source that can handle baseload power. Billionaires such as Bill Gates and Elon Musk have said nuclear energy will be crucial for addressing the climate crisis.

Uranium and nuclear energy used to scare many people as it was associated with nuclear disasters such as Chernobyl and Fukushima. To be fair, it still does scare many people today. But people are now being educated about how essential nuclear energy is. What I say is that those nuclear reactor disasters occurred because they were old reactors. Modern nuclear reactors are some of the safest buildings ever designed by humans. Marin Katusa always tells the story that when the Fukushima earthquake occurred and flooding happened, many people actually ran to the new modern nuclear reactor for safety.

Governments worldwide are realizing that nuclear is the way to go, with even some countries reversing the decision to deactivate nuclear reactors. Nuclear restarts are already in the works. More uranium will be required and needed soon.

We even saw a positive attitude towards uranium at the United Nations’ COP27 conference which discussed the importance of nuclear for attaining global emissions-reduction goals.

The US is just one nation with big plans for nuclear energy, and nuclear power will be part of the green energy transition.

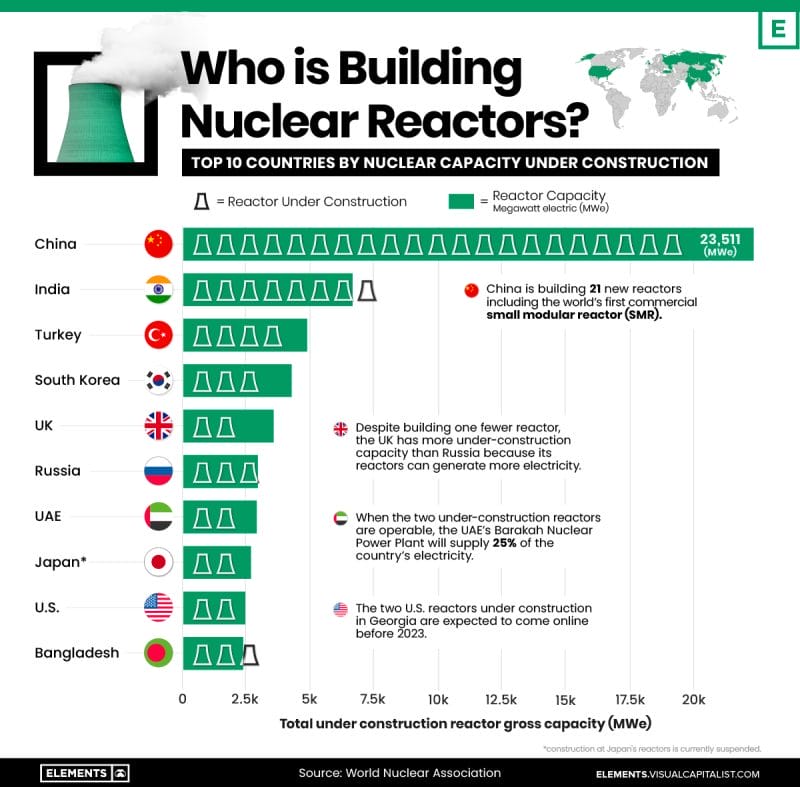

Currently, there are 437 nuclear reactors providing 10% of the world’s electrical needs. Another 104 reactors are in the planning phase. Another 338 have been proposed.

In summary (and words uranium bulls will love to hear): If renewable energy and the green transition is the end goal for most countries, then uranium’s spot in the clean energy revolution cannot be ignored.

URANIUM TECHNICALS

Let’s end off with the chart of uranium. Keep in mind that uranium does not trade on an open market like other commodities. Buyers and sellers negotiate contracts privately.

If you follow my work, in my uranium sector roundups, I have been saying that uranium is likely to test the lower limits of its 2022 range. Uranium did breakdown below its interim support at $48.60 but there was no follow through momentum.

Instead, we began to range at this support level. 2023 kicked off with uranium prices rising, and some can argue we broke out with a close above $49.30.

Technically, uranium still remains in a major range between $46.65 to the downside, and $53.65 to the upside. The latter zone almost saw a breakout in October 2022, but instead, was rejected and caused the drop in the last few months of 2022.

Going forward in 2023, bulls will really want to see a breakout above $53.65. This is what really starts a major technical breakout move which would see uranium test 2022 highs around $65.

The spot price is sitting at $49.80, and I am curious to see how uranium reacts at the major psychological $50 zone. We could reject it if we see the dollar begin to rise and affect other commodities. A move which could see us test the lower limits of the range at $46.65. Alternatively, we could breakout and set up the initial momentum move to breakout above $53.65.

Overall, 2023 will be a huge year for uranium. The technicals are indicating a potential bottom which means it is a great time to accumulate uranium stocks. The fundamental side of things are super bullish uranium, and should provide a lot of interest for long term investors in both the retail and institutional space.

The world has come to the realization that nuclear power is the only practical means of producing electricity without burning gas oil or coal. Wind and solar are too intermittent and diffuse to be of any real practical value and vast areas of land will be required to replace fossil fuel generation. The only real option is nuclear power. Many Governments have already turned a 180 even California has kept its Diablo Canyon nuclear plant open…this in the land of Jane Fonda. An expansion of nuclear power is inevitable and is already occurring in developing nations. The icing on the Uranium cake is that no reactors currently under construction or planned can use anything else but Uranium. It is price inelastic. Utilities either pay the price or shutdown their reactors – very simple. Uranium is fast approaching a perfect storm of no new mines, a shortfall in production and dwindling above ground supplies. There is only one way this gets resolved and that is higher Uranium prices. Expect the price to top $200US/lb before this is over,