Go Metals Corp (GOCO.CN) was at one point today up 323% at its highs. At time of writing the stock is still up over 300%. What caused this massive pop?

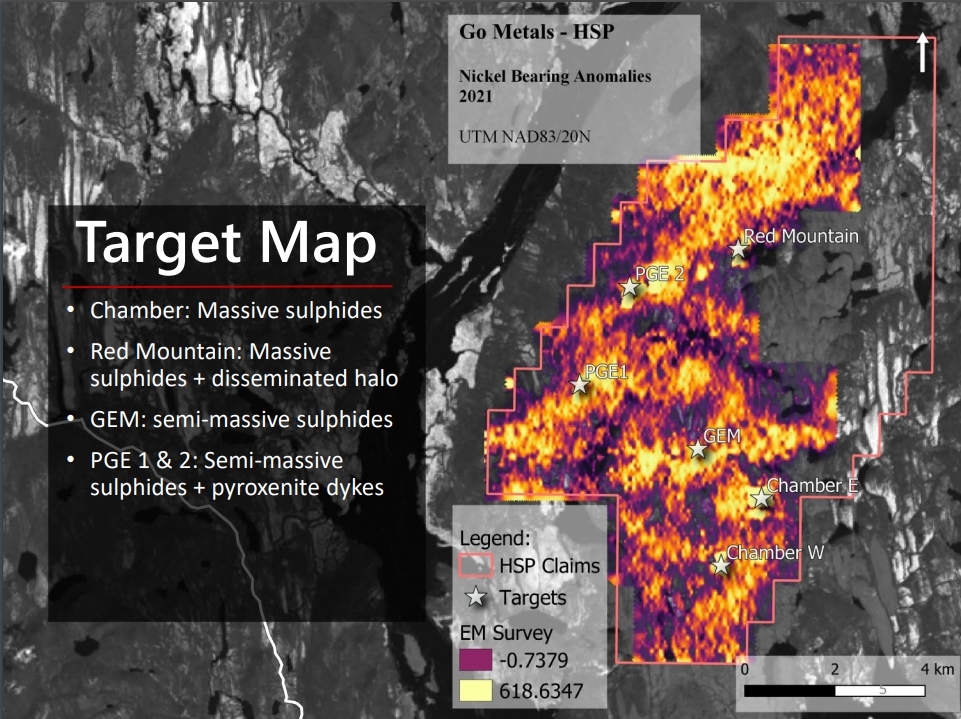

A press release announced that Go Metals has visually identified nickel and copper sulphides at all five zones from the first ever drilling at its 100% owned HSP nickel-copper PGE project in Quebec, Canada. Here are the initial highlights:

- 5 targets with confirmed visual nickel-copper mineralization all beginning near surface

- Drilling intersected wide intervals of mineralization in 5 zones and all remain open to depth

- Massive and semi-massive mineralization total of 21 metres in HSP-DDH-22-02

- Disseminated mineralization intercept of 175 metres in HSP-DDH-22-04

- Established consistent preliminary structural orientation of mineralized zones

1,250 metres of drilling to date and samples have been sent for analysis to be assayed for nickel, copper, platinum and palladium content.

Geophysical consultant Steve Balch had this to say:

“The AirTEM survey is responding to the more massive sulphide intersections within the extensive intervals of disseminated sulphide. The results from this maiden drill program are very encouraging and really open up the property as the targets were very widely spaced. The assay results within the disseminated sections will be particularly important as that is where the size of the project will ultimately be determined.”

Go Metals is a junior explorer that is targeting Canadian battery metal projects to help power a sustainable future. The flagship is the nickel-copper sulphide HSP project in Quebec. The asset is close to infrastructure (near road and power) and has 6 large electromagnetic targets all associated with massive and semi-massive sulphides.

Monster rally on the news with over 2 million shares traded for the day. Massive for a stock which sees average volume of 17,376 per day. In fact, this is the most volume traded in a long time. If you look back on the chart and see that massive three day rally in February 2022, that occurred with less than 600,000 shares traded. So this volume is significant and investors are getting excited.

What comes next? Well the assay results will be a catalyst for the stock. From a technical perspective, we do have resistance around $0.40. The stock did sell off at this zone back in February 2022. I would expect to see some reaction there. If the stock manages to close above $0.40, then we can expect another momentum rally higher.

A word of caution: with a 300% plus move in a single day, I would expect to see holders take some profits. This means a pullback or a red day following this move is very possible. In terms of support, I would watch the psychologically important $0.25 zone, and then the support at $0.125.