A Necessary Change

We need renewable energy. This is a concept I have firmly understood for most of my life after witnessing countless natural disasters spurred on by the effects of climate change. The sheer force of flash floods in Waverly, Tennessee claimed the lives of 22 people while the prolonged devastation of California’s drought has killed an estimated 129 million trees. Climate change is indiscriminate, destroying animals, communities, and the environment itself.

Unfortunately, these natural disasters have had a lingering effect. 2021’s Tennessee flash flooding brought down 17 inches of rain in less than 24 hours, shattering the state’s previous one-day rainfall by more than 3 inches, according to the National Weather Service (NWS). In addition to claiming the lives of 22 people, 2021’s Tennessee flash floods destroyed more than 270 homes, displacing thousands of families.

However, residents of Waverly are now forced to make a crucial decision. Should they stay or should they go? While some have decided to stay, other residents of Waverly have decided to abandon the city, threatened by flooding. The problem doesn’t stop at Tennessee either. Scientific research has determined that extreme weather events will become more frequent as a result of man-made climate change.

In fact, a federal study found that the climate crisis doubles the chances of heavy downpours similar to the one that caused Tennessee’s flash floods. As for California, with nary a storm in sight, the state’s ongoing drought is only expected to get worse in 2022. Despite 33.9 trillion gallons of water falling on California this past winter, most of Southern California’s precipitation was washed out to the Pacific, leaving most reservoirs in the region low.

On November 3, 2021, UN Secretary-General António Guterres issued a global roadmap to achieve a rapid transformation of energy access and transition by 2030, while also contributing to net zero emissions by 2050. In summary, Guterres’ roadmap called for tripling annual investment for global renewable energy by 2030. Additionally, this roadmap aims to phase out coal power plants globally by 2040.

A Rapid Reduction

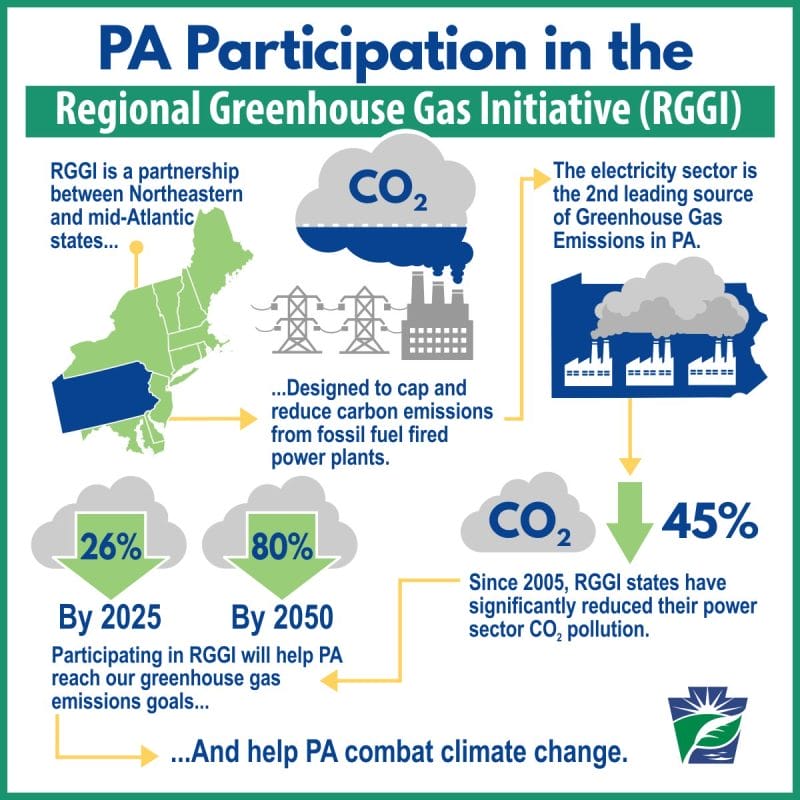

With this in mind, many states and provinces in North America have begun implementing various policies focused on mitigating greenhouse gas (GHG) emissions. Moreover, many states have committed to initiatives such as the Regional Greenhouse Gas Initiative (RGGI) and Transporation and Climate Initiative (TCI), both of which target power and transportation, the two highest GHG emitting sectors in the United States (US).

In Canada, under the Canadian Environmental Protection Act, 1999, Environment and Climate Change Canada requires certain emitters to report GHG emissions annually, similar to the Greenhouse Gas Reporting Program (GHGRP) in the US. In Ontario, the province has committed to reducing its carbon dioxide (CO2) equivalent emissions by 30% below 2005 levels by 2030. As part of this plan, Ontario has established the Emissions Performance Standards (EPS) program.

The EPS is used to determine an emissions limit that industrial facilities must meet each year, with standards becoming increasingly strict each year. Via the EPS, industrial facilities must either reduce their emissions or pay for exceeding the limits. As you probably could have guessed, most companies would rather cut their GHG emissions than paying the price. Are you starting to see why renewable energy is inevitable?

Why Renewable?

There is a multitude of environmental and economic benefits associated with using renewable energy, including the generation of energy that produces no GHG emissions. Renewable energy also allows for the diversification of our energy supply, therefore, reducing our dependency on imported fuels. With this in mind, renewable energy sources present appealing options for emitters looking to cut their GHG emissions.

With this in mind, there are a variety of options for using renewable energy, including generating renewable energy on-site using a system or device at the location where power is used. For example, Apple uses approximately 635,000,000 kWh on an annual basis, however, the company has acquired several solar farms which directly provide energy to its data centers. Aside from generating renewable energy on-site, emitters can choose to purchase renewable energy.

To be more specific, emitters can purchase renewable energy certificates (RECs), also referred to as green tags, green energy certificates, or tradable renewable certificates. RECs are a market-based instrument certifying that the holder owns one megawatt-hour (MWh) of electricity generated from renewable energy resources. The whole gimmick surrounding RECs is that they can be sold to other entities to offset their emissions.

For example, Oatly Group AB (OTLY.Q), a Swedish food company that produces alternatives to dairy products using oats, has sourced RECs from a local biodigester partner. This biodigester then utilizes Oatly’s oat fiber residue to produce renewable natural gas, which is then supplied to the local electricity grid. Now that you understand the importance of renewable energy, let’s talk about some companies with skin in the game.

Ozop Energy Solutions Inc.

- $121.661M Market Capitalization

Ozop Energy Solutions Inc. (OZSC.OTC) invents, designs, develops, manufactures, and distributes ultra-high power products, including chargers, inverters, and power supplies. The Company’s products can be used for numerous applications ranging from industrial to military. With this in mind, Ozop is committed to capturing a significant share of the renewable energy market as a provider of assets and infrastructure needed to store energy.

Some of Ozop’s products include the Company’s high current submarine battery chargers, micro-grid solutions, and EV Energy Storage. With this in mind, Ozop Energy Solutions, the Company’s wholly-owned subsidiary, is responsible for manufacturing and distributing Ozop’s products. Overall, Ozop’s energy storage solutions and battery chargers could see massive popularity as companies continue to transition towards renewable energy.

Recently, on April 26, 2022, Ozop announced the launch of its new division, Ozop Engineering and Design Inc. (OED), a wholly-owned subsidiary of the Company. OED will design and engineer energy-efficient, easy-to-install, smart digital lighting control systems for commercial buildings, and campuses, as well as sports, medical, and military complexes throughout North America, and eventually globally.

Ozop’s share price opened at $0.024 on May 3, 2022, compared to a previous close of $0.024. The Company’s shares were up 12.27% and were trading at $0.027 as of 3:59 PM EST.

Greenlane Renewables Inc.

- $136.768M Market Capitalization

Greenlane Renewables Inc. (GRN.T) is a leading global provider of biogas upgrading systems that are helping decarbonize natural gas. With this in mind, Greenlane is cleaning up two of the largest and most challenging sectors to decarbonize, including the natural gas grid and transportation sector. Greenlane’s solutions create clean, low-carbon renewable gas (RNG), suitable for injection into the natural gas grid and for direct use as vehicle fuel.

More specifically, Greenlane’s biogas upgrading plants marketed and sold under the Greenlane Biogas™ brand, remove impurities and separate carbon dioxide from biomethane in the raw gas created from organic waste at landfills, wastewater treatment plants, farms, and food waste facilities. In total, Greenlane has over 125 systems throughout 19 countries and more than 30 years of experience under its belt. Keep in mind, Greenlane is the only biogas upgrading company to offer multiple core technologies.

Recently, on April 28, 2022, Greenlane announced that its wholly-owned subsidiary, Greenlane Biogas North America, has been awarded a USD$8.9 million contract with a single customer for its pressure swing adsorption (PSA) biogas upgrading system for new RNG projects across three US states. While the customer’s name has not been disclosed, order fulfillment is expected to commence immediately. If you’d like to know more about Greenlane, please check out this article. I put my soul into it!

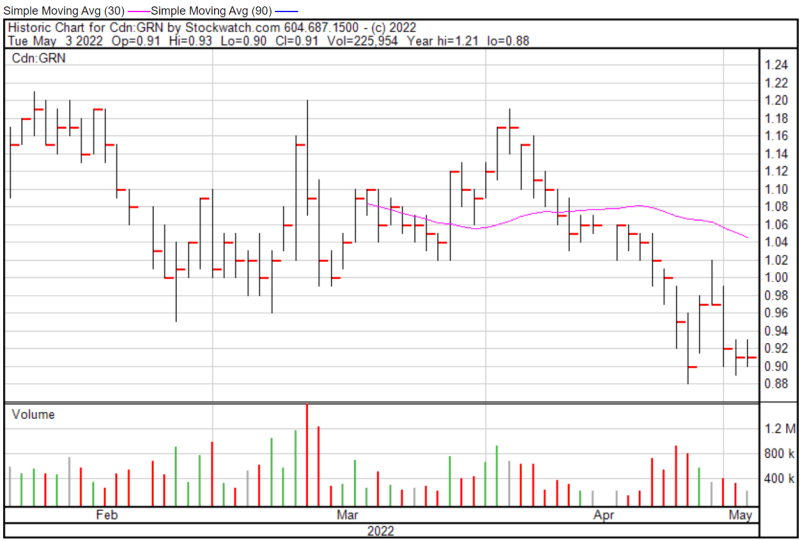

Greenlane’s share price opened at $0.91 on May 3, 2022, compared to a previous close of $0.91. The Company’s shares were trading at $0.91 as of 3:59 PM EST.

Clearway Energy Inc.

- $6.1B Market Capitalization

Clearway Energy Inc. (CWEN.NYSE) represents one of the largest renewable energy owners in the US, with over 5,000 MW of installed wind and solar generation projects. With this in mind, Clearway may be out of reach for some investors, myself included. However, the Company serves as a good example of what to look for in smaller renewable energy companies, like Greenlane and Ozop.

In addition to over 5,000 MW of installed wind and solar generation projects, Clearway also possesses over 7,500 MW of assets, including roughly 2,500 net MW of environmentally sound, highly efficient natural gas generation facilities. Needless to say, the Company’s assets are both diverse and promising. If that wasn’t enough, Clearway’s shares are quite attractive, offering dividends with an annual yield of 4.72%.

Keep in mind that the average dividend yield on S&P index companies offering dividends typically fluctuates between 2% and 5%. So, what is the Company doing to offer dividends at such a high yield? According to Clearway’s Full Year 2021 Financial Results, the Company saw its generation in the renewables segment grow 56% in Q4 2021, compared to Q4 2020.

Clearway’s generation was significantly bolstered by the Company’s acquisition of 35% interest in Agua Caliente, a 290 MW utility-scale solar project located in Dateland, Arizona. Recently, on May 2, 2022, Clearway announced that through its subsidiary, Clearway Energy Operating, the Company has closed the sale of its Thermal Business to KKR, a leading global investment firm, for total consideration of $1.9 billion.

Clearway first announced that it had entered into a binding agreement to sell its Thermal Business to KRR on October 25, 2021. Clearway’s Thermal Business consists of thermal infrastructure assets that provide steam, hot water, chilled water, and in some instances, electricity, to commercial businesses, universities, hospitals, and governmental customers across the US. This represents a significant milestone for the Company, further strengthening its cash position.

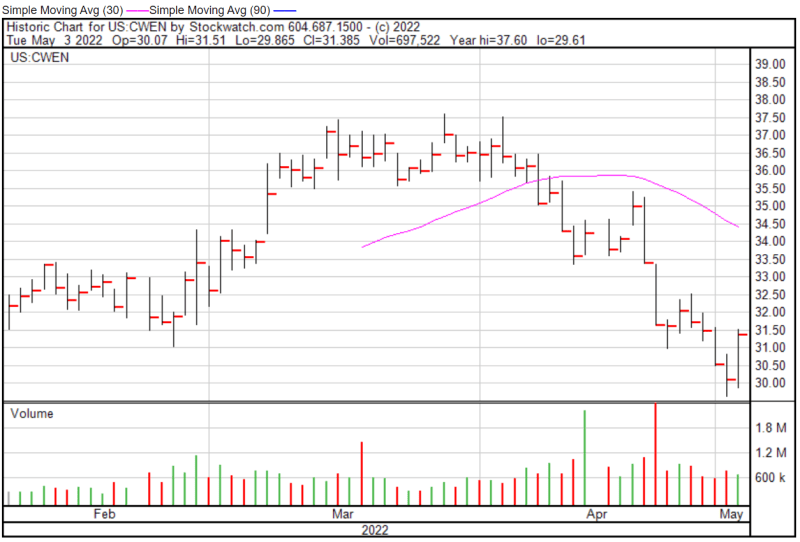

Clearway’s share price opened at$30.00 on May 3, 2022, down from a previous close of $30.10. The Company’s shares were up 4.25% and were trading at $31.38 as of 4:00 PM EST.