Let’s talk about Copper! You know, I was going to talk about Oil again, but you can read my technical breakout and price target levels which I posted last week. We wanted a close of $110 on the weekly to see $120. We actually hit $130 yesterday on the open! However, Oil has pulled back now.

Really, I can pick any commodity and write about it. Followers know that I have been bullish on most commodities. Not because of war. I don’t have a crystal ball to predict geopolitical events…although we can make good guesses by watching price action (I’ll save EURCHF and MOEX for another day). I was bullish commodities because of the inflation trade. It is difficult to think about this now given what is happening in Ukraine.

But inflation is still going to be a topic going forward. We do have the Federal Reserve up next week on the 16th, and I am sure you will hear Powell say inflation quite a few times. Remember the whole inflation is transitory? Well that seems to have died off, and now some Fed Presidents have come out saying inflation is a MONETARY phenomenon. This is exactly what all the contrarians were saying… and why we knew inflation was coming once the economy re-opened.

With higher Oil prices and higher Agriculture prices, expect inflation numbers to come out higher. Technically, the Fed will have to hike rates more, but they can now blame this event to save face. Rates are going up, but probably not the 6-7 rate hikes this year that people were expecting. With governments spending more money on defense, more cheap money is better because of the debt they have. Government’s don’t want high rates. With Oil prices rising, people may not spend as much. This could cause a recession even when you add a small 25 basis rate hike. The middle class will be pinched on both sides: rising inflation and rising interest rates.

I promised I would talk about a commodity so I will save the long term chat about the Fed for another time. In essence, Central Banks are stuck, and I believe commodities and hard assets are where you want to be. I prefer Gold, Silver, and even Platinum, but in this Market Moment, let’s talk Copper!

Copper is a very important base metal. There are many who call it the next Oil as it is super important for the electrification of the economy and the movement towards green/clean power and infrastructure.

A quick aside, in health terms, Copper is a beast. We know it kills off bacteria and viruses. In India and other Eastern nations, water is kept in a Copper jug so it doesn’t go bad. People also drink water out of Copper cups and vessels. Yes, even Moscow Mules. Lately, you may have seen Teck Resources’ Copper campaign. Teck is running a campaign to put copper rails in transit and in hospitals since it kills 99% of bacteria to the touch. By the way, many modern hospitals in the East have been doing this: Copper door knobs in the hospital, and Copper bed rails. Not something that first pops in mind when you think why invest in Copper, but it is something which would increase demand relative to supply.

Copper is known as Dr. Copper. Not because it can be used in hospitals, but it is the metal that is used to gauge the health of the world economy. Investors tend to look to China for this. If the economy is growing, more copper is needed for buildings and infrastructure.

Copper has recently made all time record highs, but I don’t think it has to do with economic growth.

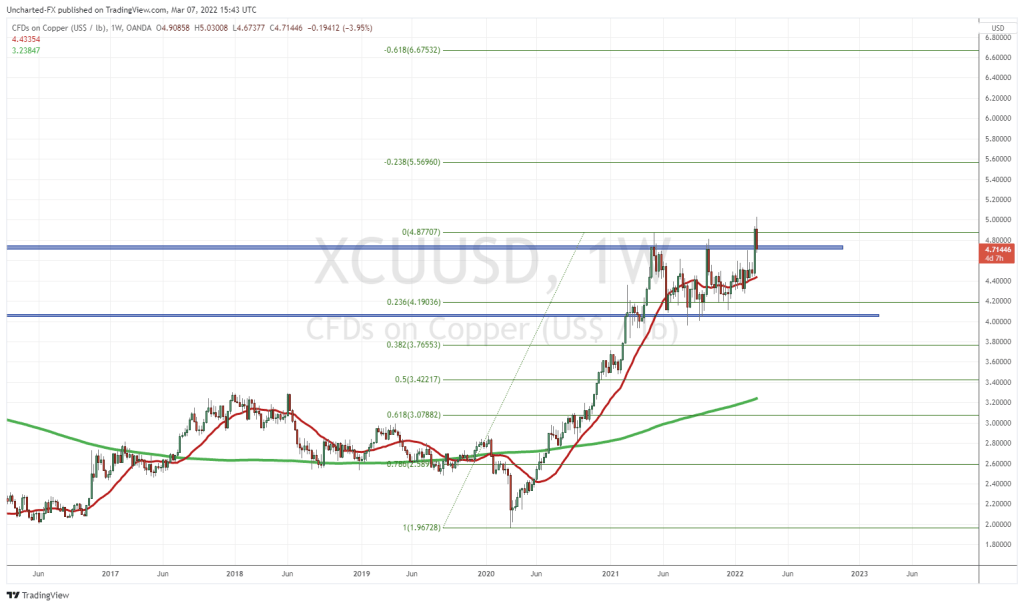

Copper prices have been ranging since April of 2021. We have just patiently waited for a breakout. We got one on Friday, where price closed above the $4.70 zone. Before I get to what next, let’s discuss why this happened.

It is a supply and demand issue. Mining.com sums it up nicely:

Concerns about supply disruption, historically low global stockpiles and rocketing energy costs have lit a fire under base metals, trumping concerns over the longer term impact of the Ukraine invasion on global growth, rising interest rates in the developed world and a slowing economy in China.

Copper for delivery in May rose on the Comex market in New York, touching a high $4.9490 per pound ($10,910 per tonne), more than 3% compared to Thursday’s closing. The bellwether metal is up 10% since the Russian invasion of Ukraine little over a week ago.

LME registered warehouses indicate falling inventories. Copper stocks, at 69,825 tonnes, are the lowest since 2005.

Russia nor Ukraine are major Copper producers, but commodities are popping due to war fueled supply chain issues.

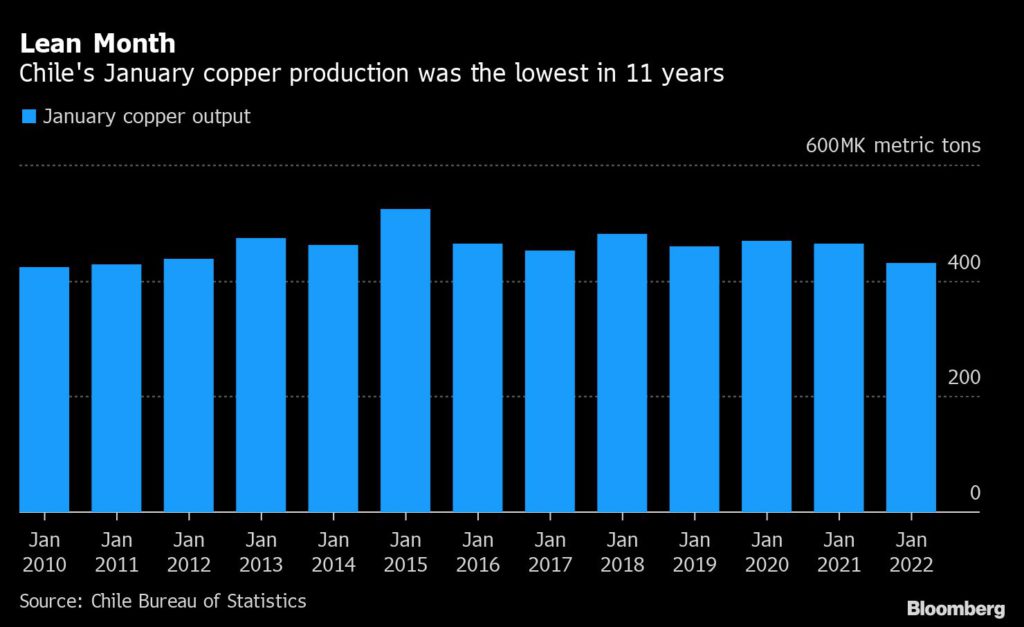

It should also be noted that Chile, the largest producer of Copper, recorded its lowest output since January 2011.

Going back to the breakout on the chart, what comes next?

Currently, we are pulling back to retest the breakout zone at $4.70. This is good. A retreat after a breakout is normal, and it provides an opportunity for buyers to jump in again for the next leg higher. Today’s close is important. If we close above $4.70, then we can say that buyers are jumping in here and are holding the breakout. If we close below, we then have a fake or a false breakout. A very strong US Dollar could be the culprit for this.

So since we are not at all time record highs, what comes next? When we are in uncharted territory, I use the fibonacci tool. But before that, it is important to remember the psychological zones. I think $5.00 is a good candidate, and then $6.00 and $7.00 and so on. Notice how we actually retreated when we broke out and hit $5.00. Definitely an important level going forward and a daily candle close above $5.00 will go a long way.

For longer term targets, I have my fibonacci applied to the weekly chart above. I crunched the chart so you can see the extended price targets.

My first fibonacci target comes in at $5.569 (nice). And my second extension takes us to $6.675. Whether this happens on this wave and breakout, price action and time will tell. I do think Copper can make these levels based on the green and electrification of the economy.