Common vs preferred shares

A company can go bust for a number of reasons. It happens all the time. In those dire circumstances, the retail investors will be the last ones to recoup their losses, if they do at all.

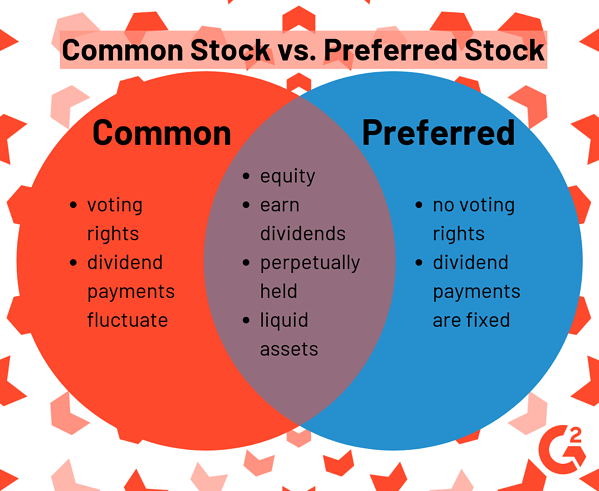

It’s important to know the difference between preferred shares and common shares. Investors who purchase common shares try to sell the share at a higher price than when they bought it in order to turn a profit. Sometimes, common shares will come with dividends that are paid out.

Although preferred shares still include some features of common shares, they also share some features with a bond. As a refresher, the bond issuer borrows capital from the bondholder and makes fixed payments to them at a fixed interest rate for a specific period. Like bonds, preferred shares receive a fixed amount of income through a recurring dividend.

Companies can usually receive more funding through issuing preferred shares because those investors want reliable dividends and stronger bankruptcy protections than common shares offer. Some companies like to issue preferred shares because they keep the debt-to-equity ratio lower than issuing bonds would. This also makes them attractive for M&A targets as debt/equity is one of the most popular methods in assessing the stability and longevity of a company. The lower that ratio is, the more attractive the company looks to both investors and potential buyers.

Shareholder rights

Banks, funds, and those with preferred shares have the best chance of getting anything back from a company if it goes belly up. One of the benefits of preferred shares is a much better chance of receiving a payout. Owners of common shares will only be paid after those with preferred shares are. It’s just reason #5,000 as to how the scale is tipped toward the rich when it comes to investing.

But retail investors who own common shares in a company do still have some rights.These include:

Voting power on major issues. Voting power includes electing directors and proposals for fundamental changes affecting the company such as mergers or liquidation.

Ownership in a portion of the company. . Common shareholders have a claim on a portion of the assets owned by the company. As these assets generate profits and as the profits are reinvested in additional assets, shareholders see a return as the value of their shares increases as stock prices rise.

The right to transfer ownership. The right to transfer ownership means shareholders are allowed to trade their stock on an exchange.

Entitlement to dividends. Investors do not have a say as to what percentage of profits should be paid out—the board of directors decides this. However, whenever dividends are declared, common shareholders are entitled to receive their share.

Opportunity to inspect corporate books and records. Shareholders have the right to examine basic documents such as company bylaws and minutes of board meetings. In addition, the Securities and Exchange Act of 1934 requires public companies to periodically disclose financials.

The right to sue for wrongful acts. Suing a company typically takes the form of a shareholder class-action lawsuit.

Class-action lawsuits

Every year, around 200 class-action lawsuits are filed against public listed companies in the United States alone. A class-action lawsuit allows a large number of people with a common interest in a matter to sue the same defendant as a group. This method of justice is typically used when an individual claim would be too small or expensive to pursue, so class-action lawsuits will typically have at least three investors involved. Class-action lawsuits happen in many areas of businesses and life, but, for the sake of brevity and staying on theme with the site, I will use a few examples of class-action lawsuits involving publicly traded companies.

Earlier this month I wrote about the class-action lawsuit against the Bridge Mark group, a conglomerate of lawyers and penny stock pumpers who engaged in highly controversial capital raises and service agreements that saw them lining their pockets in more than one way while those company investors took the loss.

A few of those investors got together and started a class-action lawsuit against the group, the case is still ongoing and isn’t anticipated to end any time soon with further court dates scheduled for November 2022.

Class action lawsuits can involve huge companies. In August 2016, Tesla (TSLA.Q) announced that the Board of Directors agreed to acquire SolarCity Corporation in an all-stock deal that valued SolarCity at roughly $2.6 billion USD.

The complaint from Tesla’s investors said that ‘the Board breached their fiduciary duty to the company’s stockholders by agreeing to acquire SolarCity Corporation for an exorbitant price, and issuing a misleading Preliminary Joint Proxy Statement/Prospectus that omits necessary and material information on whether to vote in favor of the Proposed Acquisition.’

Ultimately Tesla and its shareholders agreed to a Partial $60 Million USD settlement in the SolarCity class-action lawsuit.

Earlier this month Twitter (TWTR.N) said it would pay $809.5 Million USD to settle a shareholder class-action lawsuit accusing the social media company of deceiving investors about how often users were actually using Twitter. Shareholders sued Twitter in September 2016, alleging it artificially inflated its stock price by misleading investors about user engagement. According to the complaint, Twitter discontinued reporting “timeline views” in late 2014, and concealed stagnating or declining user engagement by reporting vague descriptions of user metrics

The sudden rise in SPACs has also lead to an increase in class-action lawsuits in a newer type of investment vehicle. Federal suits against SPACS have continued to rise since 2019, according to an analysis by Cornerstone Research and Stanford Law School’s Securities Class Action. SPACs sell shares to raise money and search for acquisition targets. They can give private companies a way of going public without the process of a traditional initial public offering.

Like shell companies, SPACs are highly unregulated, and many of its investors don’t fully understand what they are getting into. SPACs are the sexy new thing coming out of the Silicon Valley scene with guys like Chamath Palihapitiya talking about them constantly, and even running a few himself. They seem to be fertile ground for a potential class-action lawsuit.