Aurora Cannabis (ACB.T) announced on Tuesday that it will be shutting down its Aurora Polaris facility in Edmonton, Alberta. Furthermore, the Company has stated that approximately 12% of its global workforce has been laid off as a result.

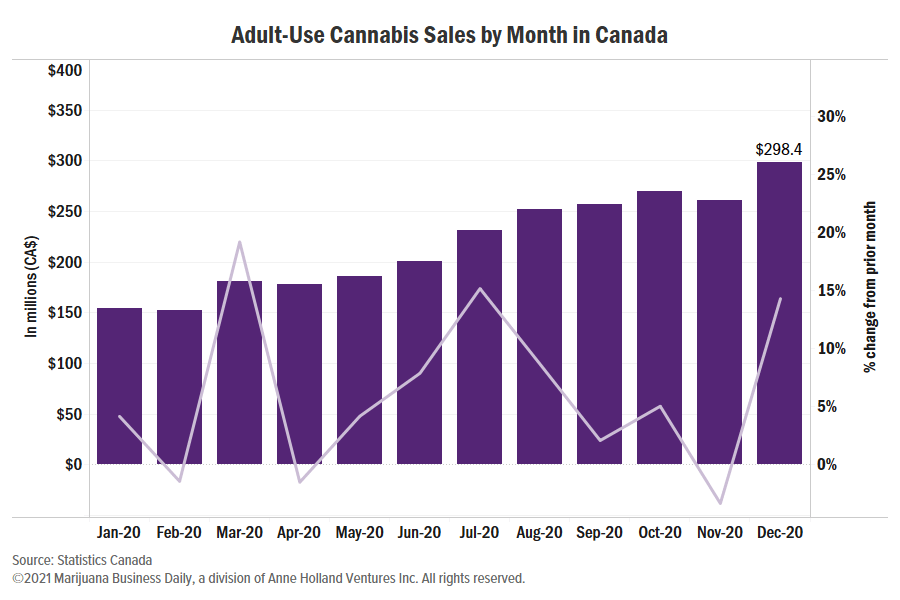

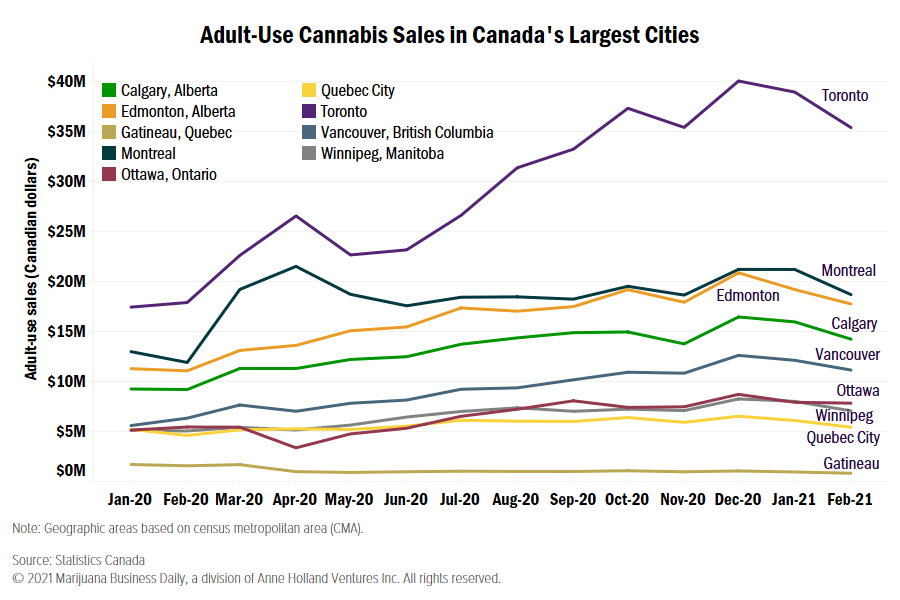

Cannabis has never been my cup of tea. In fact, I could count the number of times I have consumed cannabis on one hand, maybe two. However, I am in the minority when it comes to recreational cannabis consumption in Canada. In 2020, Canadian sales of legal recreation cannabis totaled CAD$2.6 billion. This demonstrates a 120% improvement in Canadian cannabis sales, up from CAD$1.2 billion in 2019. In December alone, licensed marijuana retailers across the country sold an impressive CAD$298.4 million worth of cannabis, indicating a 14.3% increase from November. In particular, Canada’s four largest cannabis markets, including Ontario, Alberta, Quebec, and British Columbia, accounted for more than 84% of legal recreational cannabis sales in December. Those were the glory days, back when cannabis was at its peak and Canadians were stoned out of their minds, however, things have taken quite a turn since then.

Shortly after reaching its peak, Canada’s recreations cannabis sales declined to CAD$282.8 million in January, marking a 5.6% decrease from December, according to Statistics Canada. In total, this represents a decrease of almost CAD$17 million. Although sales fell in every province, Ontario and Alberta took the biggest hits. While Ontario netted a total of CAD$90 million in January, Alberta was only able to achieve CAD$58.4 million in recreational cannabis sales, down CAD$5.4 million from December. So, where does Aurora Cannabis fit into this equation? As one of Canada’s largest cannabis companies, Aurora has proven that no one is safe during what I will now call The Great Cannabis Depression of 2021.

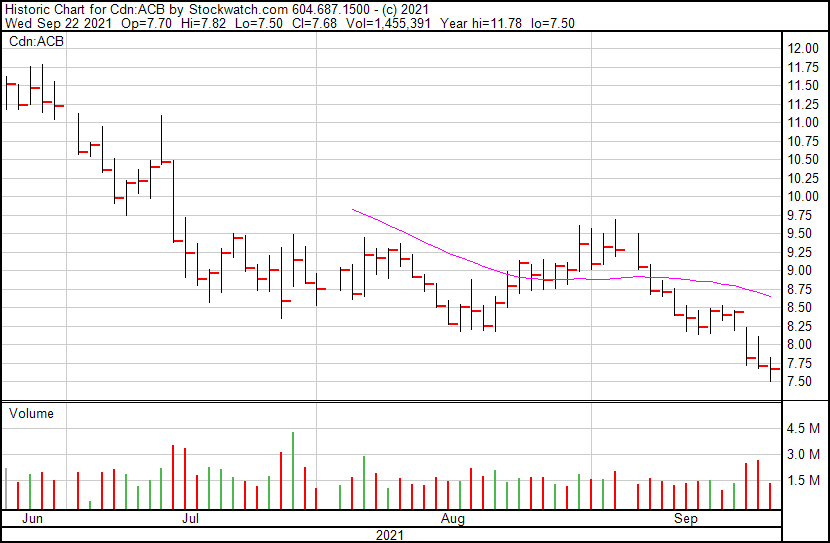

Following Aurora’s announcement that it would be closing its Polaris facility, investors began doomsday prepping. Fueling the flames, the Company announced that it would be delaying its Q4 2021 results, which had originally been scheduled for release after closing on Tuesday. However, Aurora now intends to report its Q4 2021 and full 2021 fiscal year results after markets close next Monday. According to analysts polled by Bloomberg, it is expected that Aurora will report $56.4 million in sales, and an adjusted EBITDA loss of $16.6 million. Keep in mind, compared to its high of $24.10 in February, Aurora’s shares have fallen more than 67%.

Looking forward, the Company plans to shift the distribution of medical cannabis from its Polaris facility to its nearby Aurora Sky facility. Moreover, manufacturing will be moved to the Company’s Aurora River in Bradford, Ontario. Things may seem rough for the Canadian recreation cannabis sector now, but Brightfield Group expects this market to peak at around $9 billion in 2026. It is important to note that Aurora isn’t the only cannabis company taking a hit, no pun intended. Even Tilray Inc., another leading Canadian cannabis company, announced that it would be closing its flagship facility in Nanaimo, British Columbia. Personally, I think it may be a while before we see any more explosive growth in Canada’s recreational cannabis sector.

Aurora’s share price opened at $7.70, down from a previous close of $7.72. The Company’s shares are down -0.13% and were trading at $7.71 as of 1:42 PM ET.