Trillium Therapeutics (TRIL.V) announced today that the Company has entered into a definitive agreement under which Pfizer Inc. will acquire Trillium.

“We’re delighted to announce Pfizer’s proposed acquisition of Trillium. Today’s announcement reflects Trillium’s potentially best in class SIRPα–CD47 status and contribution to immuno-oncology,” said Dr. Jan Skvarka, Chief Executive Officer of Trillium.

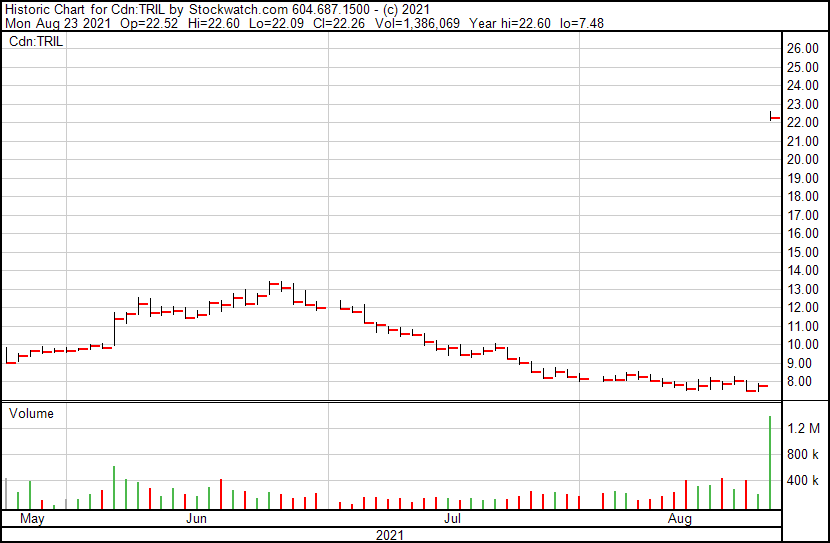

Trillium’s share price previously closed at $6.09, however, following the Company’s latest news its shares climbed 200%. With this in mind, it looks like Christmas came early for shareholders of Trillium Therapeutics, an immuno-oncology company developing innovative therapies for the treatment of cancer. The Company is targeting CD47, a molecule that tumors frequently use to evade the immune system. More specifically, CD47 is a “don’t eat me” signal that prevents macrophages from destroying tumor cells. That being said, TTI-621 and TTI-622 are Trillium’s two lead molecules intended to block CD47. Currently, both TTI-621 and TTI-622 are undergoing Phase 1b/2 development across several indications, with a focus on hematological malignancies.

For context, hematological malignancies are cancers that affect the blood, bone marrow, and lymph nodes. This classification includes various types of leukemia, multiple myeloma, and lymphoma. More than 1 million people worldwide were diagnosed with a blood cancer in 2020, representing almost 6% of all cancer diagnoses globally. To put things into perspective, more than 700,000 people worldwide died from a form of blood cancer in 2020. However, in clinical studies to-date, TTI-621 and TTI-622 have demonstrated activity as monotherapy in relapsed or refractory lymphoid malignancies. Moreover, TTI-622 and TTI-621 are currently the only known CD47-targeted molecules that have shown meaningful activity in multiple hematological malignancies.

“Trillium has the only known SIRPα–CD47 targeting molecules with clinically meaningful monotherapy responses as well as a strong basis for combination therapies, which is supported by preclinical evidence with a diverse set of therapeutic agents. With Pfizer’s global reach and deep capabilities, we believe our programs will advance more quickly to the patients we’ve always aspired to serve. We believe this is a good outcome for patients and our shareholders,” said Dr. Jan Skvarka, Chief Executive Officer of Trillium.

Keep in mind, Pfizer has had its eye on Trillium for quite some time. In September 2020, as part of the Pfizer Breakthrough Growth Initiative (PBGI), the company invested $25 million in Trillium. Furthermore, Jeff Settleman, Senior Vice President and Chief Scientific Officer of Pfizer’s Oncology Research & Development Group, was named to Trillium’s Scientific Advisory Board. Having now entered into a definitive agreement to acquire Trillium, Pfizer clearly recognizes the Company’s potential. Under the terms of the agreement, Pfizer will acquire all outstanding shares of Trillium not already owned by Pfizer for an implied equity value of $2.26 billion, or $18.50 per share, in cash.

Overall, Pfizer is picking up Trillium at a good time. According to the Company’s Q2 2021 Financial Results, Trillium was able to cut costs in multiple areas including general and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses. On the contrary, R&D expenses increased in relation to the Company’s ongoing clinical operations. As a result of operating expenses, Trillium’s cash position decreased to $264.5 million, compared to $291.2 million on December 31, 2021. However, Trillium’s net loss for the six months ended June 30, 2021 was $29.3 million, representing a decrease from $39.5 million year-over-year.

Trillium’s share price opened at $17.72, up from a previous close of $6.09. The Company’s shares are up 187% and are currently trading at $17.51 as of 10:41AM ET.