Why some stocks are undervalued

A lot of things go into determining a company’s share price, but in a young emerging industry like psychedelics, many of the traditional measurements and ratios like EPS, P/E etc. go out the window. It’s also hard to judge and compare companies so early in the game, but a quick look at revenues, profit margins, market cap, and cash on hand can still give a pretty outcome on determining which stocks could be undervalued.

One starting point is to look for companies who:

- could potentially uplist

- could potentially get bought out

- are asleep at the wheel with their marketing and promo

An uplist will often expose the company to new investors, likely increasing trading volume and their ability to raise money. A merger or buyout is a good opportunity if you can get in long before the event. Companies that look like sexy acquisition targets are often bought out at a premium. If psychedelics ever get legalized recreationally in Canada watch out for the lifestyle brands, there could be some crazy valuations.

And lastly, a lackluster promo strategy can be a quicker fix than say an issue with clinical trials, drug candidates, or shady management. One of the big reasons a company stays undervalued is just obscurity, even in psychedelics there are so many new companies popping up, it’s tough to keep track of them even as someone covering them.

These stocks still have risk even if they are undervalued. Less access to capital probably means less ability to scale, less reputable exchange means tougher time raising money, and apathy towards promo means breakthroughs might not really pop.

I think Novamind is a candidate for at least two of the three, a future buyout target, and a lack of promo – so let’s dive in.

Novamind vs. Field Trip

On paper, Novamind (NM.C) is severely undervalued compared to others in the psychedelics space.

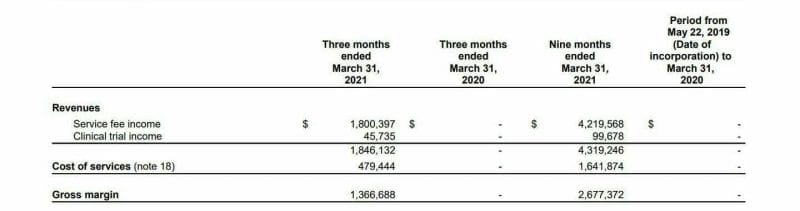

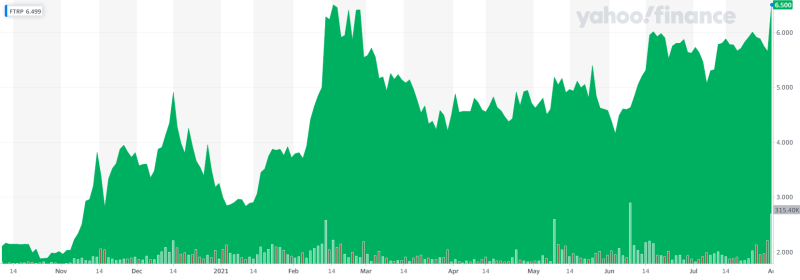

The company put up an impressive $1.86 million CAD in revenue last quarter, and the gross profit on that revenue was $1.37 million CAD. Revenue is difficult to come by in this highly regulated sector, so these are impressive numbers.

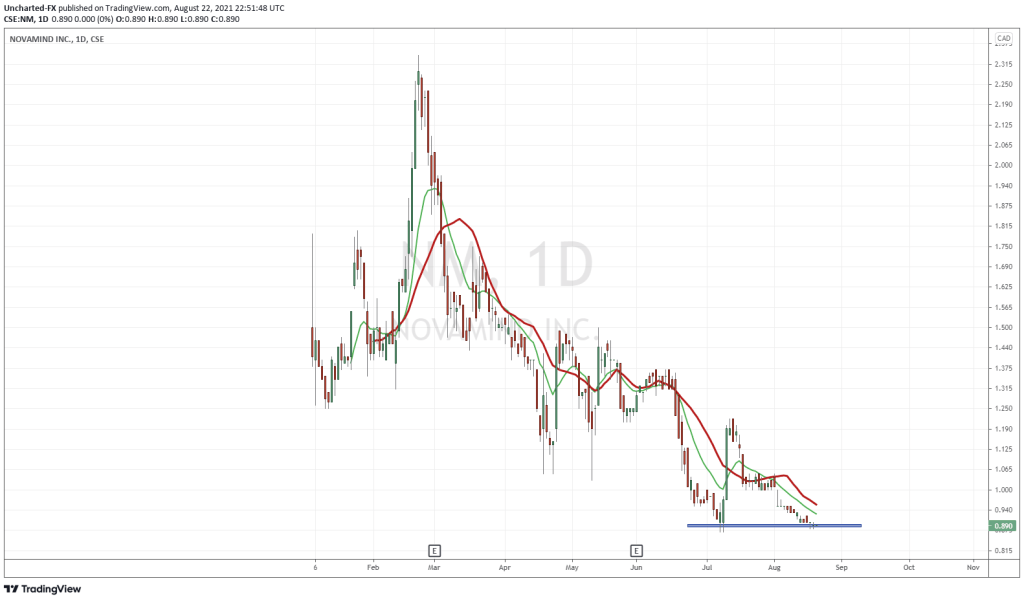

But the company is only trading at $1.01 CAD. With roughly 40 million shares out, Novamind has a current market cap of $40.6 million CAD.

This hasn’t translated to a good run for Novamind, their stock has really been taking a beating.

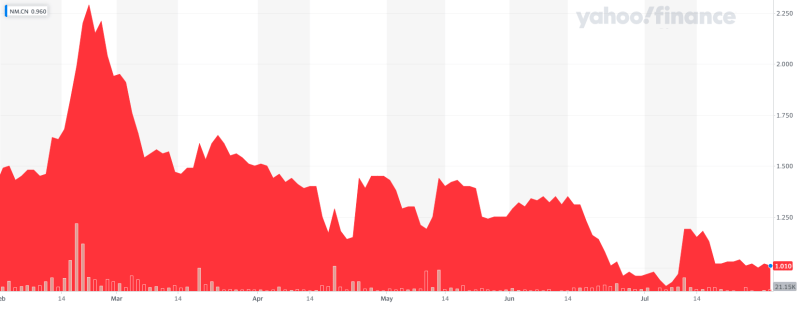

To compare, Field Trip (FTRP.Q) who has a similar business plan centered around ketamine clinics, is currently trading at $7.29 CAD and has a market cap of $443 million CAD – more than 10 times that of Novamind. And in the same period of time Novamind churned out $1.86M in revenue, Field Trip put up only $960,000 CAD – 48% less than Novamind. Their gross profit on that was $580,000 CAD.

Field Trip is clearly a more established company with more resources and access to capital, which is important when determining a company’s value. Field Trip is the safer bet, and many of the bigger fish have taken that bet with multiple sizable equity raises. That said, with 57 million shares out Field Trip isn’t exactly suffering from dilution, so investors have to be feeling good about that.

Novamind had $7.6 million CAD cash on hand with total assets of $18.5M CAD as of March 2021. On the same date, Field Trip had $38.4M CAD in cash with $116.1 million CAD in assets.

Look at Field Trip’s run! It’s been almost the complete inverse of Novamind. It’s tempting to want to jump onto Field Trip, but, there’s no reason why Novamind can’t do something similar. They have almost the same business plan, better revenue, and have well-connected insiders like Chuck Rifici who raised about 500 trillion dollars for Auxly (XLY.T).

Obscurity

Novamind is interesting because the efficiency at which they’re generating revenue isn’t represented in their share price. This could be down to a lack of promo, or a poor job of communicating the company’s story/message. If they can successfully scale their business their financials will be off the charts.

According to the company, Novamind’s investment in the expansion of its clinic network follows a significant increase in demand from clients for mental health services to address existing unmet needs and the effects of the Covid-19 pandemic. All Cedar Psychiatry clinics currently have a 2-week wait time for booking new appointments. Novamind plans of having the scale to meet with 65,000 clients per year by the end of 2021.

Maybe for Novamind, it’s been more of a lack of communication around the company and its value. It maybe doesn’t have the boldest business plan when compared to the likes of competitor Field Trip. Novamind currently operates 8 clinics, doubling up from 4 back in May. Field Trip is aiming for 20 by next year.

I can’t believe he raised $500 trillion for Auxly! They’ve really blown through the cash!

They really have, those Bahamas hedge funds have dried up though unfortunately.