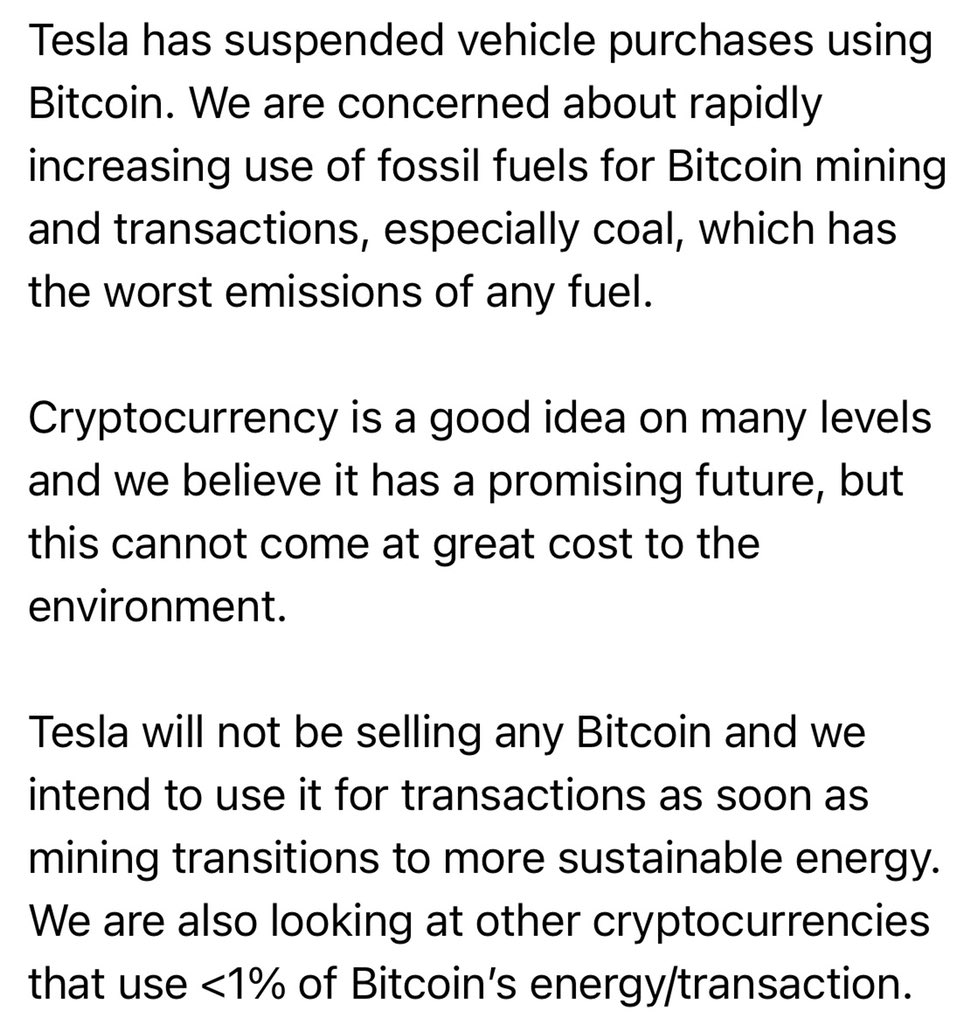

How things have changed for Bitcoin. Elon Musk was the poster boy for cryptocurrencies. Many of the retail/meme crowd were buying crypto’s simply because Elon Musk and Tesla were taking positions. The cult of Elon as some call it. Days after Mr. Musk said that he would literally take Doge to the moon, and put out a Twitter poll asking if Tesla should accept Doge for Tesla Cars, this happened:

Elon Musk tweeted that Tesla will stop accepting Bitcoin for payment for their cars. Bitcoin prices plunged (more on this under Technical Tactics). Leading to many angry retail/meme traders venting their anger and frustration at Elon Musk over on Twitter. It is so rough that some traders are wishing everyone a good morning and a great trading day…but then saying except for Elon Musk.

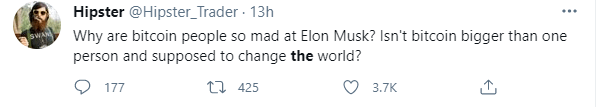

Others on the sidelines retorted:

Some people pointed out the irony that more Coal power is used to build Tesla’s Electric Vehicles, particularly the factories over in China. Others pointed out that mining for the metals and materials used for Tesla vehicles also damage the environment. They do have a point.

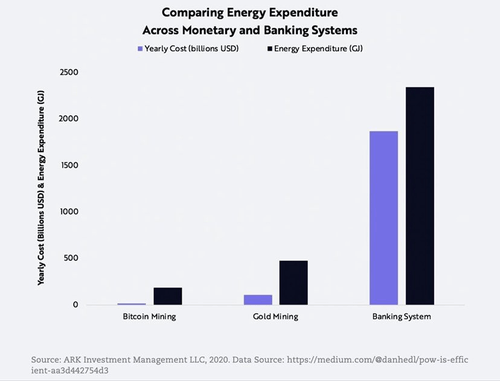

But how much energy does Bitcoin use? More energy than entire countries such as Sweden and Malaysia according to the Cambridge Bitcoin Electricity Consumption Index. Does Bitcoin harm the environment? Sure, the mining done in China does use a lot of coal, but there are places in Scandinavia that use Thermal energy. As more millennials get into investing, environmental, social, and corporate governance (ESG) investing is becoming more popular. Younger people want to invest and feel good about it. Environmental impact is a very sensitive but crucial topic right now, and some (likely those NOT holding Bitcoin) will applaud Musk’s stance.

But in terms of energy consumption, nothing beats the traditional banking system:

Oddly enough, Zerohedge wrote about JP Morgan being bullish on Ethereum and environmental impact was one of the bullish points. Even though Ethereum’s gas light fees are ridiculous (one guy on Twitter paid a $350 gas light fee for selling his Ethereum at a $200 loss) this and energy consumption are to be addressed in Ethereum 2.0…whenever (or if) that comes out.

As JPM recently pointed out in a note to clients, ESG factors are one reason ethereum’s explosive move higher, which has made it a standout crypto performer in recent weeks, will likely continue. The greater focus by investors on ESG has shifted attention away from the energy intensive bitcoin blockchain to the ethereum blockchain, which in anticipation of Ethereum 2.0 is expected to become a lot more energy efficient by the end of 2022. Ethereum 2.0 involves a shift from an energy intensive Proof-of-Work validation mechanism to a much less intensive Proof-of-Stake validation mechanism. As a result, less computational power and energy consumption would be needed to maintain the ethereum network.

In other words, this is one area where ethereum can out-compete bitcoin in the long run.

Note the mention of ESG investing. Crypto’s have now entered the realm of ESG.

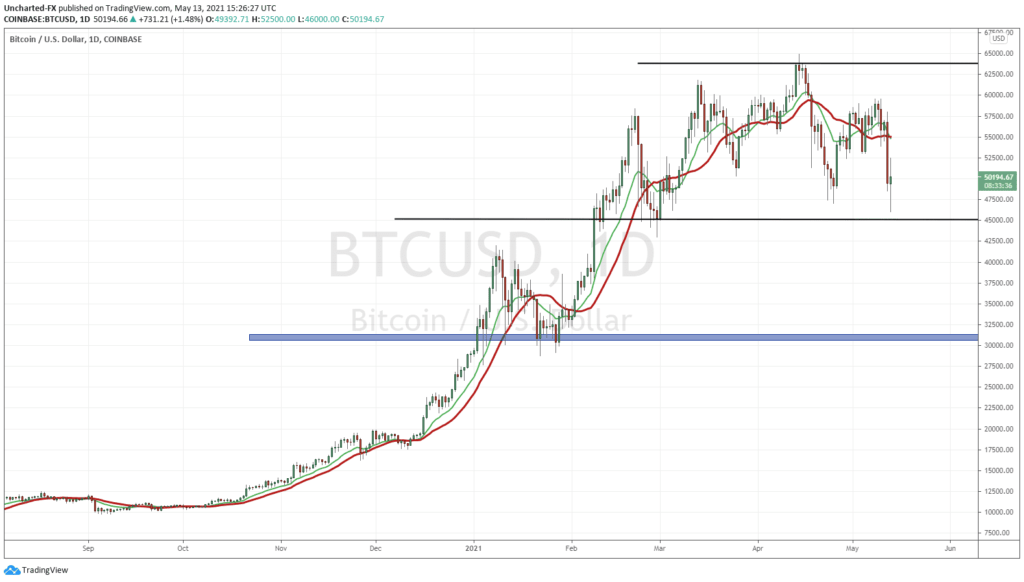

Technical Tactics

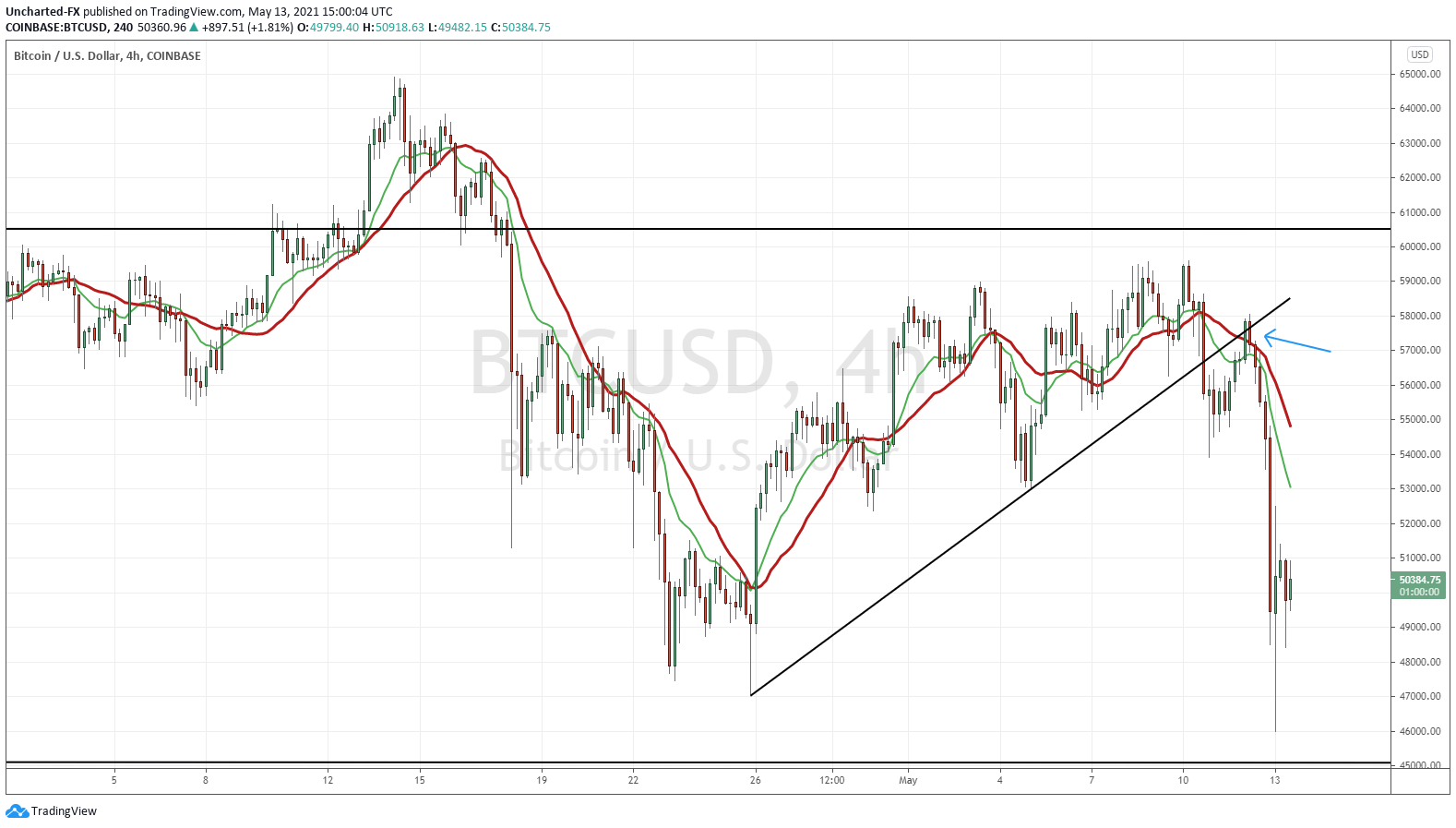

I want to start with the 4 hour chart of Bitcoin before zooming out to the daily. Those who are members of Equity Guru’s Free Discord Trading Room were notified about this 4 hour uptrend break. As per usual, a breakdown or breakout tends to see a retest before continuing lower. Note the blue arrow where this retest occurred.

This is why I believe technicals need to be a part of your arsenal. I did not know Elon Musk would come out with this statement, but technicals can reveal something coming because it displays human emotions and money flows. Especially on the Forex markets, where you can predict data prints a day before just by looking at candles. I believe we do live in a world with imperfect information, and those in the know, tend to make their moves before hand. Candlesticks can give you an edge in predicting these type of moves and events.

I call this system market structure and rely on higher lows and lower highs because all markets move in three ways: uptrend, range, and a downtrend. Even on Bitcoin and cryptocurrencies. Our job is to note when these shifts happen. As you continue reading my Market Moment articles, I hope you begin to see what I look for. Most of my charts look the same because I look for the same structure. Then I trade, take profits, and move onto the next trade. Rinse repeat.

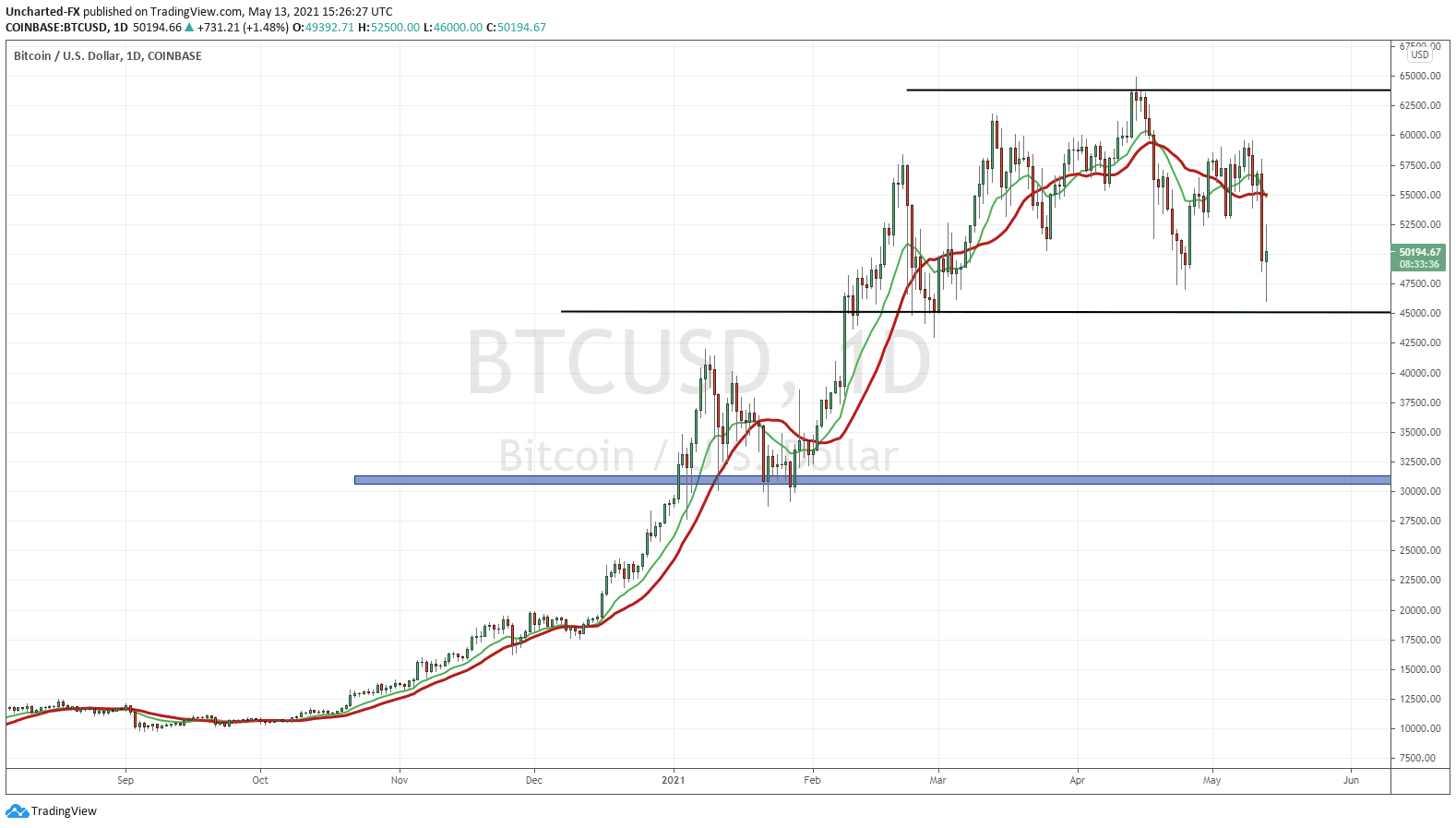

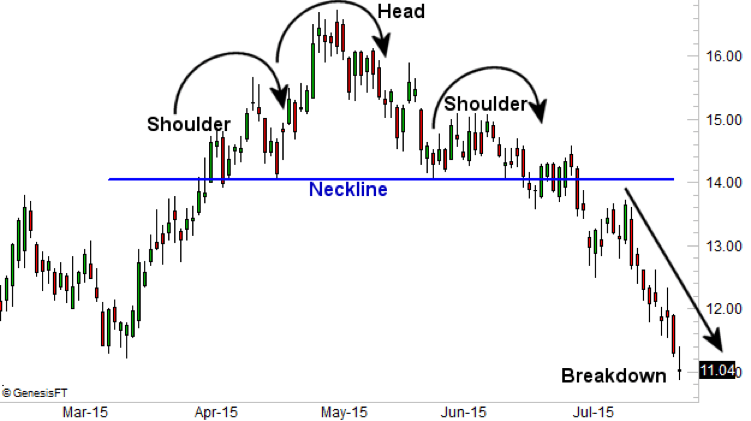

Bitcoin on the daily looks somewhat worrying. Trained technical eyes might see one of the most popular reversal patterns: the head and shoulders pattern. It might not be perfect. but the structure is there.

$50,000 is an important psychological support zone that Bitcoin is currently holding, but I think we can drag this support down to the $45,000 zone. We get a close below this, and the reversal pattern triggers, denoting a top for Bitcoin in this uptrend. The break is key. Remember, if we don’t break, the uptrend continues and we are likely to make more record highs.

To the downside I would look at $40,000 and then $30,000 if the selling continues. For prices to hit $30,000 it might entail a stronger US Dollar and/or a stock market sell off.

For now I remain on the sidelines waiting for the breakdown, or some sort of base building here for a long trade.

So would I still be a buyer of Bitcoin even though Elon Musk may have cucked it? Absolutely. My base case for Bitcoin and other cryptocurrencies remain the same: they are a way out of fiat currency. Knowing what central banks are going to be doing to inflate their currencies as more and more debt will be required, I would rather hold crypto’s and commodities.

I am also one of those that see Crypto’s now as a safe haven. A way to preserve value. Why spend it as money when it moves up?

Can governments put a dent into this? Yes. But I think if crypto’s remain a safe haven rather than being used for money, things will remain the same. Once crypto’s begin to make a move for being used as money that’s when they begin to compete against the central banks. These guys have kept the monopoly on printing money for centuries. They will not allow crypto’s to challenge them. It will lead to trouble. We will be using their centralized digital currency, and it is already starting with the Digital Yuan.

As long as crypto’s remain a safe haven or are even classified as a different asset class in preserving purchasing power, the retail and the institutional crowd makes money. Everyone remains happy.