Neupath Health (NPTH.V) has expanded its current service offering in Ontario to add fluoroscopic imaging clinics located in Ottawa and the Greater Toronto Area. These services are already available at the Company’s HealthPointe Medical clinic in Edmonton.

“Adding fluoroscopic imaging allows us to offer additional treatment options for patients, particularly patients suffering from back pain. In addition, we have already seen the benefits of adding fluoroscopic imaging from a physician recruitment perspective…Hospitals were overburdened prior to the COVID-19 pandemic, which has made the situation worse. We believe that building non-hospital surgical facilities positions Neupath to be part of the solution and help ease the burden on the health care system,” stated Neupath CEO, Grant Connelly.

Fluoroscopy isn’t some groundbreaking imaging service that will revolutionize the medical market. In fact, digital fluoroscopy has been around as early as the 1960s. However, the fluoroscopy market is expected to grow from US $5.9 billion in 2020 to US $7.5 billion by 2025 according to Markets and Markets. This indicates as CAGR of 4.8% which is reasonable give the size of the market. Furthermore, North America accounted for the largest share of the fluoroscopy equipment market in 2019. Sure, Neupath may be positioned in a healthy market, but how has the Company performed?

Neupath expects its revenues for the first quarter of 2021 to be in the range of $13.8 to $14.3 million, indicating an increase of roughly 20% over the comparable period in 2020. Keep in mind, revenue for Q1 includes the acquisition of HealthPointe for the period from February 8, 2021 to March 31, 2021. Although Neupath expects to see growth in Q1 2021, the Company’s word may not be enough to inspire investors. Overall, Neupath’s presence in the market has been far from recognizable. The Company’s press releases have been sparse and even fewer developments have been announced. As a result, interest in Neupath has been volatile and investor confidence has waned.

Neupath’s word may not be enough, however, the Company plans to provide full details of its financial results upon the release of its Q1 2021 results on Thursday, May 20, 2021. Neupath is certainly a small cap company with plenty of room to grow. With this in mind, achieving its growth target in Q1 2021 may assist the Company in generating investor interest and confidence.

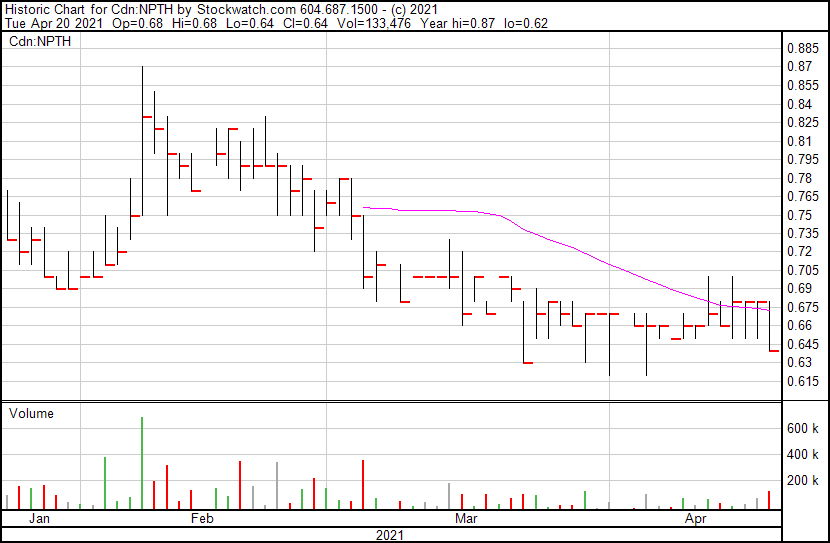

Neupath’s share price opened at $0.68 today and is currently down to $0.64 as of 1:47PM ET.