On November 13, 2018 – The Green Organic Dutchman (TGOD.T) reported Q3, 2018 fiscal and operational results.

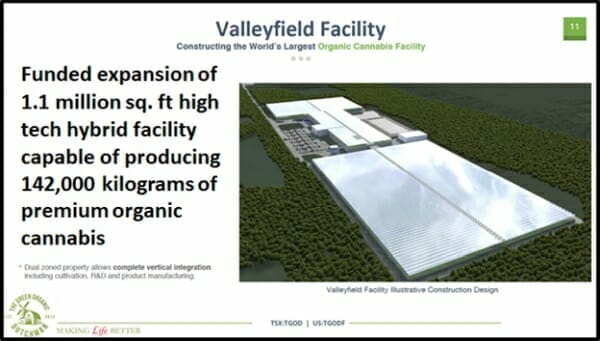

TGOD grows high quality, organic cannabis. It has a funded capacity of 170,000 kg and is building 1.3 million sq. ft. of cultivation facilities in Ontario, Quebec and Jamaica.

Aurora Cannabis (ACB.T) has invested approximately $78 million in TGOD for a 20% off-take agreement on Canadian production.

TGOD Q3, 2018 Highlights:

- Deployed $33 million on construction facilities in Hamilton, Ontario and Valleyfield, Quebec

- Commercial production in both facilities anticipated the first half of 2019.

- In Hamilton, developing five new strains for medical and recreational markets

- The most recent commercial crop harvested will be allocated to TGOD’s select “Grower’s Circle” in January 2019.

- Filed appeal with Hamilton planning department regarding a zoning amendment required to produce cannabis in its new 123,000sq ft hybrid facility.

- Secured approvals from the City’s Agricultural and Rural Affairs Committee, the Planning Committee, the Ontario Federation of Agriculture.

- Hamilton’s 2 existing facilities (total 27,000sq ft), already zoned to produce medical cannabis.

- Invested in Jamaica, through Epican Medicinals. Existing retail sales in its Kingston store. Planned expansion into four more retail stores. Expanding production capacity to 14,000 kgs.

- HemPoland booked sales of CBD oil and other industrial hemp products across Europe

- Anticipates 170,000 kgs of annual cannabis capacity across Canada and Jamaica.

- Has developed both THC and CBD beverage formulations

- JV’d with one of largest pharmaceutical distributors in Mexico.

- Radically expanded operations, https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration and marketing infrastructure.

- Loss for the 3-months ended September 30, 2018 of $11.3 million.

- Loss for 9-months ended September 30, 2018 $27.1 million.

- Both losses are in line with projected budgets.

Should TGOD shareholders fret about investing in a company that is losing $100,000/day?

Short answer: probably not.

Baby elephants suckle from their mother for eight years. That’s how they get to be adult elephants.

Amazon (AMZN.NASDAQ) was founded in 1994, but didn’t turn a profit until 2001. AMZN lost “a staggering amount of money” positioning itself for a dominant market share. It is finally profitable – booking sales of $220 billion in 2017 – about 25% of its market cap.

A weedier comparison: in 2018, MedMen (MMEN.C) reported a net loss of $66.6 million, or $2.77 per share.

TGOD is building its bone structure.

To become mature, strong and self-reliant, it will need loads of cash.

With the exercise of 16.45 million warrants (Avg: $2.91) and completion of the $76.2 million bought deal offering, TGOD currently has $300 million cash on hand to execute its plans.

“TGOD is on track to becoming the largest organic cannabis brand in the world as we continue to aggressively expand our global footprint.” stated Brian Athaide, CEO of TGOD. “Substantial investments in R&D are leading to high quality product with industry leading margins.”

Athaide states that TGOD is “on schedule to scale up our new facilities to bring annual capacity of 170,000 organic kgs online.”

Running a company, and knowing how to tell the company’s story – are two different skill sets.

To a large degree, Equity Guru thrives because publicly traded companies tend to be better at operations than messaging.

So, when we have a client that is skilled at responding to shareholder anxieties – it might be a smart move for us not to highlight that fact.

But we are not that kind of smart.

Credit where credit is due.

Here, Danny Brody, VP of TGOD Investor Relations gives a case-study in how to communicate a story.

Do you enjoy a competitive game of tennis?

Below, is an edited excerpt from a Q&A with Danny Brody, where shareholders hit balls at him, and he lobs them back.

Q: What is causing the recent cannabis market sell-off?

A lack of operational readiness from Licensed Producers, causing supply shortages and distribution issues.

TGOD anticipated this bottleneck. We have focused our efforts on operational readiness and the TGOD brand.

Q: Why did Aurora sell their free trading IPO stock?

A: Sale of shares represents a fraction of their TGOD ownership and they still own approximately 15% of TGOD on a fully diluted basis, remaining our single largest shareholder and an important partner. They currently own 33,333,334 common shares and 19,837,292 warrants totaling 53,170,626 shares and warrants.

Q: How does Aurora’s Milestone Option expiry affect TGOD?

A: We recently raised $76 million at $6.85 per share, which de-risked the capital side of Aurora’s investment. Had Aurora exercised their option to acquire an additional 8% of TGOD, the acquisition price would have been ~$4.75, adding significantly more dilution for the same amount of capital.

Any large-scale alcohol or beverage company looking to partner with us would have to do so knowing a third-party competitor LP had an option to acquire over 50% of our Company. Now that all four Milestone Options have expired, we are no longer tied to a single LP.

This puts us in a stronger position moving forward.

Q: Do any research analysts cover your company?

A: Canaccord has just released a 40-page research report reviewing our entire business. You can obtain a copy of this report from your broker. Canaccord has rated TGOD a speculative buy.

Q: Isn’t it true that you aren’t producing?

A: False! We have been breeding and cultivating on a small scale since 2016 at our Ancaster site for R&D purposes, while fine tuning our grow methodologies and novel product development in anticipation of the launch of our medical and recreational brand.

In Valleyfield we have begun cultivating in our breeding facility, and plan to scale production and sales throughout 2019 and 2020.

Internationally, we are already producing cannabis in Jamaica and industrial hemp in Poland, including CBD oil and other products derived from industrial hemp.

Q: And what about sales? You still have zero revenue and haven’t sold a gram?

A: False! We are selling in Europe with our HemPoland and CannabiGold brands which will be reflected in our Q4 financial statements. Additionally, we are selling in Jamaican dispensaries through our partnership with Epican Medicinals. With our recent Mexican JV, we have established over ~7,600 potential points of sale across Latin America which we intend to start selling during the first half of 2019.

TGOD is excited by the Supreme Court of Mexico’s ruling, on October 31st, 2018, that an absolute ban on the use of recreational cannabis was unconstitutional.

Q: What about supply agreements?

A: In the long term, it will be the consumers who dictate the products and the brands that survive based on demand. This is why we have spent time focusing on our brand and product, to ensure we are prepared, instead of rushing to the market on October 17th.

43% of consumers prefer organic cannabis.

Q: So, you haven’t missed the ‘demand window’ with recreational cannabis?

A: Absolutely not. This industry is still in its infancy.

Remember, we are on schedule to reach 170,000 kgs of production during 2020, with national sales across medical and recreational markets.

Q: Can you comment on your share price? You’ve moved from $9 down to $3.41

A: The whole industry has trended down in that time frame, and TGOD’s Nov 2nd, 2018 free trade date placed further downward pressure on our stock.

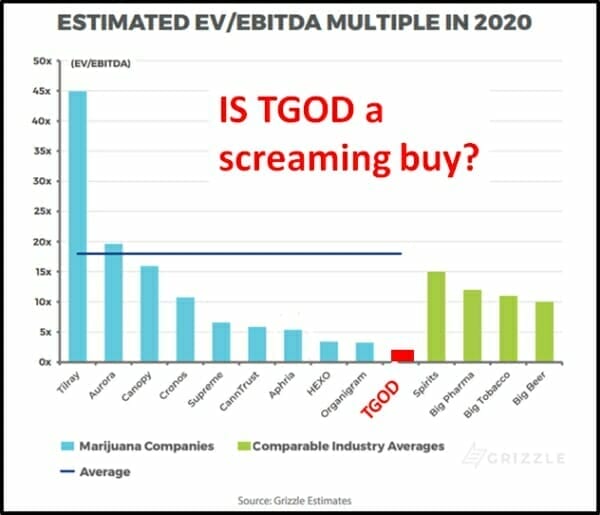

Our share price has moved so much that we believe we are now the cheapest large-scale LP on a 2020 EV/EBITDA multiple.

See chart below detailing TGOD at a discounted 2020 EV/EBITDA multiple (based on analyst estimates of EBITDA) versus an industry average of 15x.

Q: What’s next for TGOD?

A: We will continue to communicate to the markets and ensure you understand our value proposition.

The fundamentals of our business have not changed.

- We are fully funded for our domestic and international strategies

- TGOD has no plans to return to the market for additional capital

- We have de-risked the capital side of our business and plan to execute expansion plans on schedule and on budget

- TGOD is launching its first Canadian product in January 2019, and we will continue to ramp-up our production throughout the year, reaching 170,000 kgs of annual production during 2020

- Canada is home to only 37 million people. We are not waiting until our maximum production is online to aggressively pursue additional distribution and sales networks throughout Europe and Latin America.

“Our focus is now on delivering medical and recreational sales in Canada and internationally,” stated Sean Bovingdon, TGOD CFO, “We expect to drive significant value for shareholders in 2019 and beyond.”

Full Disclosure: TGOD is an Equity Guru marketing client, and we own stock.