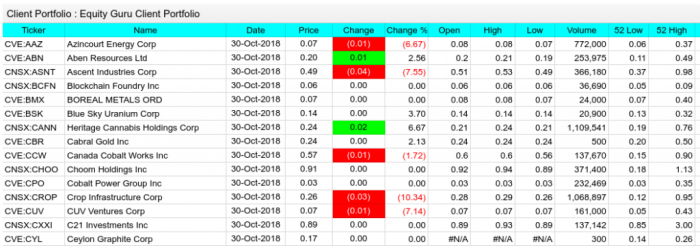

This week we released a Client Portfolio feature, which provides a snapshot of our listed clients stock prices.

You can find it here.

Powered by Google Sheets, as far as we know this is still a street legal way to show stock prices.

Enjoy it while it lasts.

We say this because access to free market data has been a slippery slope over the past few years, with both Google and Yahoo deprecating their API’s to the frustration of many.

Additionally, when Google Finance was overhauled in 2017, the portfolio feature disappeared.

As part of the overhaul to Finance, Google is eliminating several features. Portfolios, the ability to download them and the historical tables are among those to go, the blog post said. The company informed Finance users of the change to portfolios in September and gave them until “mid-November” to download portfolio data.

There are a number of online stock portfolio offerings and we’ll leave you to search for them if that’s your thing. While many have a free plan, they will typically limit the number of stocks you can track to say, ten or so. Some offer feature-rich reports and dashboards – if you’re a heavy-hitter these could easily pay for themselves come tax time.

What’s an API?

An acronym for Application Programming Interface, in layman’s terms an API allows one piece of software to interact with another piece of software.

The building blocks for building, well, cool stuff.

Like Expedia pulling flight info from Amadeus into its website.

So why were the Google Finance and Yahoo APIs switched off?

The problem was, people were building cool stuff using these APIs and then selling it without giving Yahoo or Google their cut. Big boys no likey, to the extent they have even built defense mechanisms to stop ‘screen-scraping’, a technique which some propeller heads have used to pull information off web pages automatically.

Hey, I’m sure you’ve had to negotiate one of those I’m not a robot absurdities where you are clicking street signs, cars or shopfronts for what seems like an eternity, right?

When you rely on a 3rd party for a core part of your business or income stream it can go tits up literally overnight, and there’s nothing you can do about it.

It’s a business model that works until it doesn’t.

Case in point: All those 20-somethings who were raking in the bucks playing on Pokerstars, Full-Tilt Poker and Absolute Poker while living it up in Puerto Rico, Costa Rica or anywhere else with cheap rum and spectacular beaches.

Many enjoyed six-figure incomes fleecing the sheep until the FBI turned off the fun tap, forcing them to head back to the States and apply for jobs at their nearest McDonalds.

This LA Weekly article profiled the fortunes of a few who were caught up in this mess including Walter Wright, Maxwell Fritz and Michael LaTour.

But now he was stuck in North Carolina, out of a job, living with his in-laws, with no way to provide for a family of four. [Wright]

Then Black Friday hit. Suddenly, Fritz had not only lost his income but also $65,000 seized from his Full Tilt account.

Two years after pulling himself off unemployment by his wits, he’s back to searching for a job. [LaTour]

So why isn’t market data free?

Market data has value. Real-time data more so.

Generally speaking, you can only get delayed quotes if you ain’t paying up.

Why?

In a nutshell – It’s a kick-ass income stream for stock and commodity exchanges and they ain’t about to let it go anytime soon 😆

After vendors package the exchange data and release it into the wild, they also need to make a profit.

If you’ve ever spent any time in or around trading floors you’ll know a Bloomberg Terminal is the Rolls Royce of market data.

But it ain’t cheap. Those two screens and a fancy keyboard will set you back a cool 2K per month

Your scribe has lusted after one for many years, but the economics could never justify it.

He’s still looking for a rich benefactor to help fill the void, though.

Where does that leave the rest of us?

- Browser-based sites like Google Finance, Yahoo Finance, TMXmoney, Bloomberg.com, eSignal

- Alpha Vantage offers free APIs in JSON and CSV formats for realtime and historical stock and forex data, digital/crypto currency data.

- IEX Trading – founded by Brad Katsuyama of Flash Boys fame, IEX offer free market data via their API for US Stocks only.

- Quandl has financial, economic and alternative data delivered in modern formats including Python, Excel, Matlab, R. Free plan is great for system building and testing but for trading purposes, I’d look elsewhere.

- Aussie traders – The ASX has a comprehensive listing of market data vendors which should point you in the right direction.

–// Craig Amos

(feature image and Steve Harvey gif both courtesy of giphy.com)