It’s been a long ten months for CannPal Animal Therapeutics (CP1.ASX) shareholders having watched their investment hover around the $0.20 IPO issue price.

While other ASX cannabis names have posted healthy gains in that time, CP1 has remained in the doghouse.

Many must be wondering when the company will attract the attention of the investing public and finally break free of the tight trading range which has contained the share price since its listing.

Sometimes a company is clearly over or undervalued, and the reasons why tend to be self-evident.

Other times, such as this, it’s difficult to correctly price a company based on the data it has released to the market.

Company overview

CannPal is an animal health company which listed on the ASX in October 2017. They are targetting companion animals, specifically cats and dogs.

Their lead drug candidate, CPAT-01, is targetting pain symptoms in dogs using a proprietary oral cannabinoid formulation containing both THC and CBD.

The company announced the successful completion of Phase 1A of their pharmacokinetic and safety study in June 2018 and recently received Ethics Approvals for Phase 1B of the study.

Here’s founder and Managing Director Layton Mills with more:

Trading history

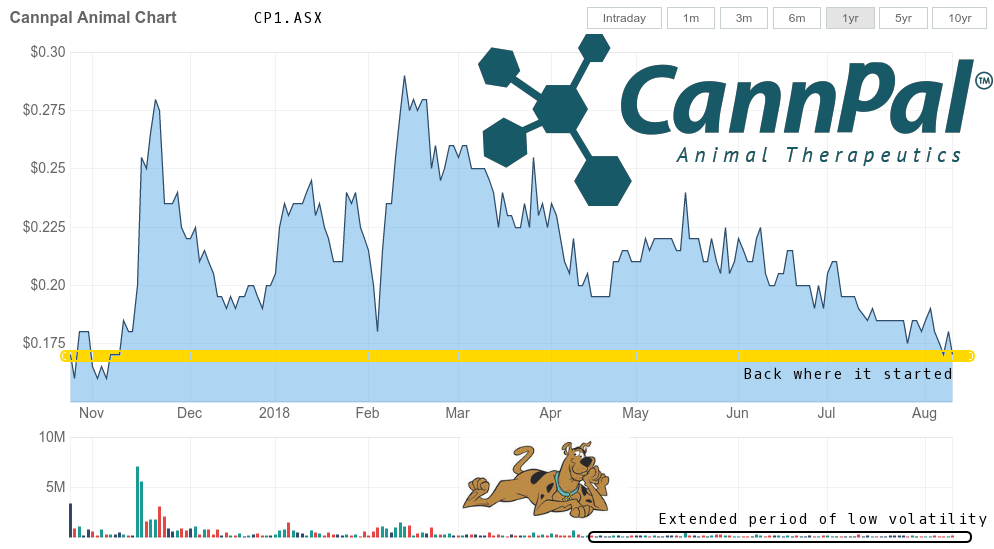

The company listed on the ASX back in October 2017, issuing 30 million shares @ $0.20 a piece which put AUD 6 million in the company coffers.

Although the IPO was ‘heavily over-subscribed’, stags were left despondent as the 20c shares hit the boards at a discount, closing out the first day of trade at 17c.

That’s one cent lower than where the shares finished up yesterday August 14th, 2018.

This is a stock that requires a great deal of patience. A classic biotech play which would likely double from such a low base on big news such as a licensing deal or positive trial outcomes (and also collapse on the negative news which is often part and parcel of bringing new drugs to market).

The chart

Traders dream, investors nightmare

So far in its brief life as a publically listed company, the CP1 share price has meandered between the 20c issue price and a high of $0.29 achieved on 13th February 2018.

Great for traders, who have been able to step in near the now well-defined support level and buy with confidence while waiting for a spike to materialize into with they can offload their stock to the hopium fueled investors.

MD Mills seems to be taking a Buffet-esque approach – He’s decided to get busy building the company up and ensuring they hit their milestones rather than worrying about the day-to-day fluctuations in the company’s share price.

Smart move.

Is CannPal misunderstood by investors?

Yes, we believe so.

We were in that camp too when we first mentioned them.

Now that we’re looking deeper into the backstory and the size of the market they’re targetting, we have a different appreciation of the stock’s potential.

Here are two reasons why we feel the stock is being overlooked by the majority:

1. Investors fail to realize CannPal is focusing on the US market.

According to a recent company presentation, the companion animals market for dogs and cats is

estimated to be approximately US$12bn, with the US and Europe accounting for ~77% of the global market.

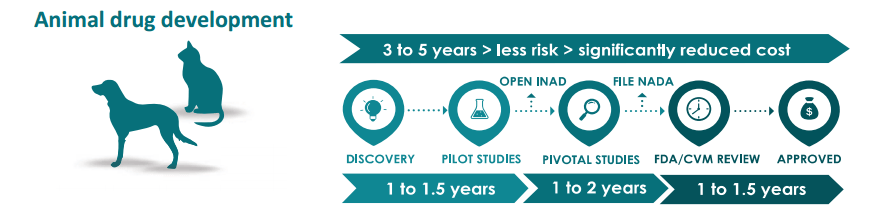

The company is currently focusing on bringing its lead drug candidate CPAT-01 to market in the US, which requires FDA approval.

This is a 3 to 5 year process.

A Brief Summary of the Drug Approval Process [source: FDA]

The drug sponsor collects information about the safety and effectiveness of a new animal drug. The sponsor may need to conduct studies to get this information. For any studies that are performed, the sponsor analyzes the results.

Based on the collected information, including any study results, the sponsor decides if there is enough proof that the drug is safe and effective to meet the requirements for approval.

The sponsor submits a New Animal Drug Application (NADA) to CVM. The NADA includes all the information about the drug and the proposed label.

A team of CVM personnel, including veterinarians, animal scientists, biostatisticians, chemists, microbiologists, pharmacologists, and toxicologists, reviews the NADA. If the center’s team agrees with the sponsor’s conclusion that the drug is safe and effective if it is used according to the proposed label, CVM approves the NADA and the drug sponsor can legally sell the drug.

CVM – Center for Veterinary Medicine

ONADE – Office of New Animal Drug Evaluation

INAD – Investigational New Animal Drug

ADUFA – Animal Drug User Fee Act

NADA – New Animal Drug Application

2. Investors are focusing too much on the end-game.

Slow news flow is the nature of the business in the biotech world. The pipeline to get a product to market is a long and winding road.

One thing we really like about CannPal is they have a laser-like focus in what they are setting out to achieve. They are targetting one market segment with tremendous upside.

No cannabis doggie biscuits or beers.

There’s another way CP1 investors are exposed to significant upside in the stock price from these levels – a licensing deal with an industry ‘big-hitter’.

Final thoughts

Billy Beane would be all over this one – it’s starting to smell like a straight up Moneyball pick.

This stock is just playing dead at the moment. The slow burn.

Things are happening behind the scenes – the company continues to make progress towards its goal of bringing their lead drug candidate CPAT-01 to market.

The latest 4C quarterly cashflow report looks good. These guys are not splashing the cash. They have 5 million in the bank and operating cash outflows for the quarter totaled AUD $357,000.

A steady hand on the leash, right there!

CannPal is fully funded to progress the clinical development of CPAT-01 into pilot studies

If the company can control cash-burn over the coming quarters and keep investors appraised of pipeline developments then we see a high likelihood of the shares trading closer to the 40c mark as opposed to the 18c they are sitting at now.

In fact, 40c is a fairly conservative estimate based on the market cap of some of its peers and the potential upside if all goes to plan at CannPal.

Your ASX commentator,

–// Craig Amos

(feature image by Savs on Unsplash)

FULL DISCLOSURE: CannPal is not an Equity Guru marketing client.