We recently shared hot pot with a group of Chinese nationals in Chengdu, China. After being serenaded by a Mongolian musician, the topic of the simmering “trade war” with the U.S came up.

In their eyes, the instigator of the trade war (Trump) has already blinked.

The subtext of a tariff is: “Someone else makes this better than us.”

The next day the trade war heated up.

The U.S announced additional tariffs on China imports worth around $50 billion. China retaliated with tariffs on $50 billion worth of US goods – fulfilling its promise to counter-punch with “measures of the same strength and the same scope”.

A China Daily Op-ed entitled, China Justified in Hitting Back to Protect Interests stated that, “Beijing is ready to stand toe-to-toe with Washington.”

The article scoffed at The Section 301 investigation calling it “a stick that Washington often wields to intimidate its trade partners into conceding to its demands”.

With the latest tariffs, the U.S. is targeting machinery, information technology and communication products. Beijing hit back at imports of aircraft and soybeans.

The Chinese media believe Trump is “playing to his base” while “Beijing continues to keep the bigger picture in mind”. The U.S. trade deficit, with China – they claim – is the caused primarily by the “low saving ratio” of working Americans.

Then on Tuesday, Xi gave a keynote speech at the Boao Forum for Asia promising to open China’s doors “wider and wider” to foreign imports.

Xi pledged to deregulate foreign ownership limits for banks and car makers, lower tariffs on imported cars, and increase penalties for intellectual property (IP) theft.

Trump bought it.

But if Trump payed attention – or had competent advisors – he would have realised that Xi’s speech was just a re-hash of his profile address at the World Economic Forum’s 2017 annual meeting in Davos, Switzerland.

The U.S. wanted substantive concrete policy change.

They didn’t get it.

Why does this gargantuan communist nation refuse to cower when the World’s Biggest Economy threatens to sanction them?

There are a few reasons.

Firstly, the Chinese know that the demographics favor them. Broadly (and bluntly) speaking, U.S citizens are old and tired. To power a national economy, you need armies of young people with fire in their eyes.

That 17-year-old building I-phones in Shenzhen? He’s making 500% more than his father does, growing rice. How many 17-year-olds do you know making 5X more than their fathers?

China’s economy is driven by swarms of ambitious young people. The tariffs will make the U.S. less competitive – hurting the people it is supposed to help.

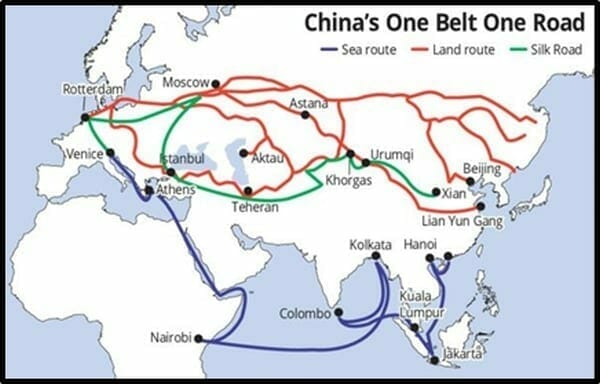

Secondly, the Chinese have other irons in the fire. While Trump dismissed the continent of Africa as a collection of “shit hole” countries, the Chinese have initiated a $6 trillion “One Belt, One Road” infrastructure initiative, linking China to Europe, India and Africa.

The Belt and Road initiative opens up 7 corridors.

- New Eurasian Land Bridge – Western China to Western Russia

- China–Mongolia–Russia Corridor -Northern China to Eastern Russia

- China–Central Asia – Western China to Turkey

- China–Indochina Peninsula – Southern China to Singapore

- China-Bangladesh–India Corridor – Southern China to Myanmar

- China–Pakistan Corridor – South-Western China to Pakistan

- Maritime Silk Road – Chinese Coast to Mediterranean

It is the largest mega-project in history, covering more than 68 countries that contain 65% of the world’s population and drive 40% of the global GDP.

China is looking outward for new trade partners.

Thirdly, the U.S. owes China a lot of money. In 2017, China purchased an additional $126 billion worth of U.S. treasuries, bringing the total to $1.18 trillion. China is now the largest non-U.S. holder of U.S. debt.

This debt relationship is symbiotic. In 2017, China ran a trade surplus of about $430 billion. Most of those earnings came in US dollars. So, China has to park that cash somewhere.

Earlier this year, Bloomberg published a report stating that Beijing was looking to radically scale back its purchases of US debt. There was an immediate sell-off of US Treasuries, pushing the yields on 10-year bonds to a yearly high.

Financial pundits are fond of saying China will never call in its US debt because it would trigger a mutually destructive financial tsunami. They are probably right. But China views the U.S. as a decadent cousin who knocks on the front door intermittently for pay-day loans.

When that same cousin threatens you, it does not strike fear into the heart.

Who’s going to win the trade war between China and the U.S?

Probably Vietnam – a country that is already sucking factory jobs out of China due to lower wage costs – and is likely to suck a lot more if this trade war heats up.

The Asian Development Bank predicts that Vietnam’s economy will expand by 7.1% in 2018 – the highest rate in a decade.

”Vietnam’s economic growth will be driven by manufacturing and export expansion, rising domestic consumption, strong investment fueled by foreign investors,” stated Eric Sidgwick, Development Outlook Director.

Vietnam’s annual trade is now 185% of GDP, making it the 2nd most trade dependent economy in Southeast Asia, behind Singapore.

“Vietnam has been able to mobilize an abundant supply of young, well educated workers to attract foreign investment into labor-intensive manufacturing over the last decade,” stated Sidgwick.

The Vietnam ETF (NYSE: VNM) provides exposure to Vietnamese equities. Foreign investors made net 2017 purchases of about $995 million. It is up 45% from its 52-week low.

The collective response of the Chengdu diners to the U.S.-China trade conflict was a wry smile.

If there was any fear, the Chinese have got a helluva poker face.