Welcome to this month’s update on our monitoring of the short selling activity going on here in Canada. All of our data comes from shortdata.ca and we use this space to look at the activity in the markets, to help investors identify trends and opportunities.

To begin with let’s see how the trends in February and March have continued into April

Will the last one out of the economy please turn off the lights?

The big money is still betting the craziness down south, inter-provincial squabbles on energy and the crazy levels of debt percolating away in the Canadian houseowner sector is due to give the economy a fairly large slap upside the head.

This is reflected in the ongoing stampede of the big money into old-money stocks.

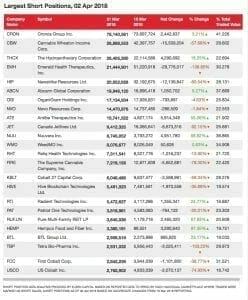

TSX

Banks, energy stocks and other old economy stocks dominate. Of note is the appearance of Couche-Tard here. I’ve covered them before. Since convenience stores do well in a downturn, why is it listed? I think it’s because once the door on cannabis sales is fully shut in their face their stock will take a tumble.

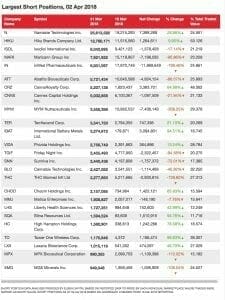

TSXV

CSE

Cannabis and crypto are still nicely represented here, even in the small-cap world we’re seeing a shift away from these areas and a more wide net looking at new tech and other companies creeping in.

This could be a sign the short markets feel they’ve almost wrung as much as they can from these sectors.

Let’s look at the selloffs and see if they match with the trends.

Can we short it? YES WE CAN!

On the TSX, it’s dump railroads and index funds. This is scary for me, as when institutional investors are dumping ETFs and index funds it’s not exactly a vote of confidence in the economy.

TSX

Nothing quite so dramatic in the short activity on the CSE and TSXV, as the shorts market are profit-taking from the ongoing meltdow- er, correction in cannabis stocks. Crypto also continues to be a favourite in the small-cap boards as well.

TSXV

CSE

Ok so that’s what we’re looking at – what does it mean for you?

Well two takeaways. One – the elder gods are worried, so plan accordingly. Two – there’s still money to be made here, but the fat juicy cannabis and crypto companies you want to short are likely running scared and hiding, clutching their stock valuations in their little hands.

Your job is to flush them out and expose their fat market cap to the world – if you like that sort of thing. (No Judgement)

In two weeks we’ll meet back here and see how the situation has changed.