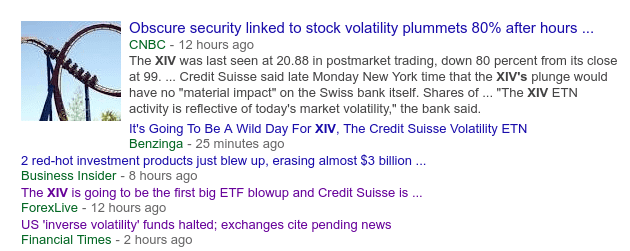

XIV, a NASDAQ traded inverse volatility ETN, cratered in after-hours trading Monday and now appears worthless. This has financial pundits pondering the contagion effects to Credit Suisse, the issuer, and the market in general.

It quickly became one of the big news stories following the Dow Jones record-breaking 1175 point plunge.

What a difference a month makes in the markets! Remember, remember the 5th of September February!

Suddenly, shit just got real, and things are starting to look a little spookier.

Maybe “this is it” – time to dig out your copy of Margin Call

RIP XIV – Looks to be worthless

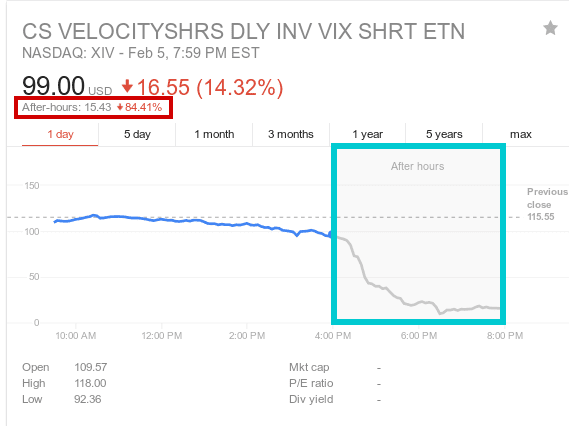

While it emerged from the Dow’s 1000+ point annihilation at the end of regular trading hours (RTH) somewhat intact, it wasn’t so lucky in after-hours (AH) trading, getting smashed 84%.

Chart breaking bad, right there! We’ve highlighted the AH action (boxed in blue) and the 84% drop, in red.

That number is important, as a decline in excess of 80% may constitute a Termination Event.

Doesn’t sound good.

Firstly, unraveling the Google-speak:

CS VELOCITYSHRS DLY INV VIX SHRT ETN

| CS | Credit Suisse the Issuer (hence counterparty) |

| VELOCITYSHRS | VelocityShares the enabler. |

| DLY INV VIX | Daily Inverse VIX meaning it moves in the opposite direction of the CBOE VIX futures and is rebalanced daily. |

| SHRT | As in short term. Not designed as a long-term trading vehicle. |

| ETN | Exchange Traded Note. The Note refers to the instrument being a debt security which has similar properties to a bond. |

Whenever you decide to trade these beasts it’s a really good idea to read the prospectus.

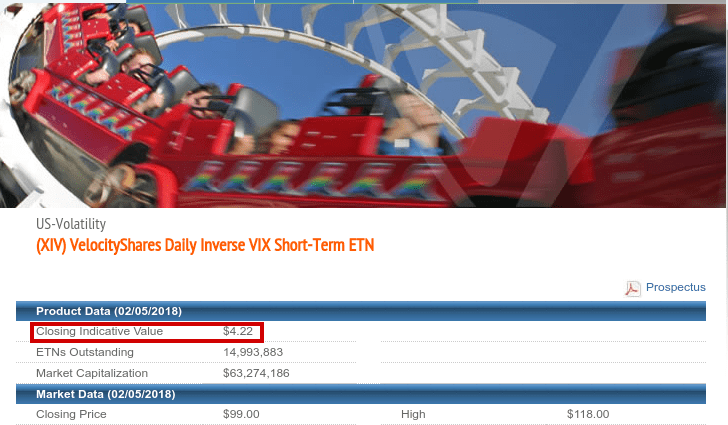

So what was all the brouhaha which caused XIV to come crashing down? Seems someone spotted the fact it was only worth $4.22. Then everyone saw it, causing them to collectively hit the sell button.

Here’s a screen grab from the VelocityShares website with the XIV product data for February 5th, 2018.

See the all-important number? Closing Indicative Value of USD $4.22.

Doesn’t take a genius to know what happens if you tell people something which last traded for 99 bucks is only worth 4 and change.

It’s trading at around $15 after hours and a notice on the EFTs website said the net-asset value is just $4.22. If that’s all correct, it’s basically worthless. It’s a similar story in SVXY, which is a similar ETF from ProShares. – Source: ForexLive

[Editors Note: Many articles are incorrectly referring to XIV as an ETF. Wrong! – It’s an ETN. See below]

So is it worthless?

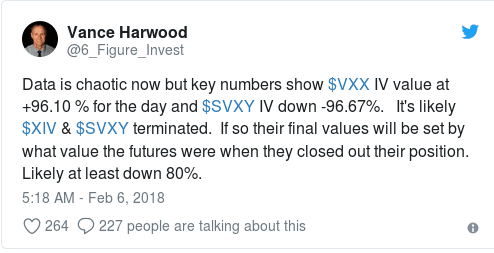

Pretty much, based on our deciphering of the overnight information. We defer to Vance Harwood of Six Figure Investing for more.

Six Figure Investing have an excellent in-depth article on how XIV works, not that anyone will need this going forward.

Understanding Volatility and the VIX

Volatility in finance is not that different to volatility in chemistry – a way to determine the chance of something exploding in your face or vaporizing your portfolio.

Low volatility = boring and unlikely to make you much cash. High volatility = monster moves every other day, direction unknown.

And the VIX?

Short for Volatility Index, the VIX takes its cue from the Implied Volatility (IV) of 30-day S&P 500 options and gives traders a gauge for how fearful market participants are of the current conditions. This is why it’s known as the fear gauge and since its introduction by the CBOE in 1993 its been a widely accepted barometer of market sentiment.

When complacency is commonplace the VIX is low, usually below 12. When panic spreads the VIX rises. Anything above 15 is considered ‘high’. The market spends its time either climbing the wall of worry or sliding down the slope of hope.

When complacency is commonplace the VIX is low, usually below 12. When panic spreads the VIX rises. Anything above 15 is considered ‘high’. The market spends its time either climbing the wall of worry or sliding down the slope of hope.

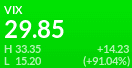

Current reading: 29.85 (futures)

VIX futures were introduced in 2004 to allow participants more of a pure play on future volatility. Think volatility is too high? Sell VIX futures. Too low? Buy ’em.

These, in turn, spawned a series of other derivatives – VIX options, VIX ETFs VIX ETNs and the like.

Plenty of ways to take a punt of volatility if that’s your thing. Caveat Emptor my friend.

How does an ETN differ from an ETF?

In two words – credit risk. More from Wikipeda, as per usual:

ETNs are designed to provide investors access to the returns of various market benchmarks. The returns of ETNs are usually linked to the performance of a market benchmark or strategy, less investor fees. When an investor buys an ETN, the underwriting bank promises to pay the amount reflected in the index, minus fees upon maturity. Thus ETN has an additional risk compared to an ETF; if the credit of the underwriting bank becomes suspect, the investment might lose value, the same way a senior debt would. (Emphasis ours)

That’s why we’ve seen the fireworks in AH action on XIV. There’s now some doubt as to Credit Suisse’s ability to pay up and questions about the accuracy of the Closing Indicative Value. (as mentioned above)

Back to the prospectus.

“Your ETNs may be accelerated at any time on or after the inception date or if an Acceleration Event has occurred…”

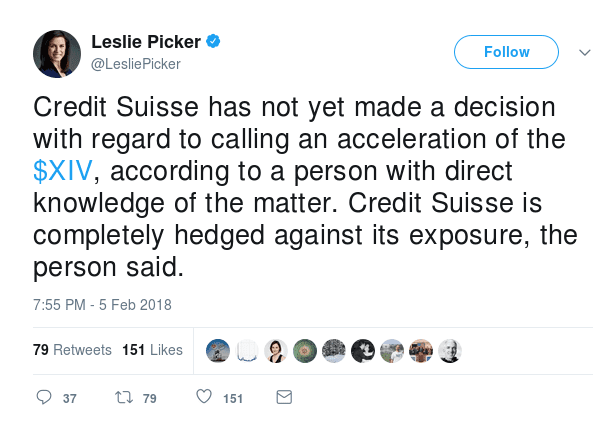

Meaning they can wind the notes up and pay you out. Forget about holding the position for sunnier days, amigo. It’s highly likely this Acceleration Event will occur but as yet CS are holding their cards close to their chest.

UPDATE: [6/2/18 08:30 PST] As expected, CS announces Accelertion Event: XIV is consigned to the scrapheap

The good news for anyone unlucky enough to still be holding these is they can’t go below zero. But still, the thing was worth 100 bucks yesterday and today? Likely nothing.

The prospectus highlights the risks, investors can’t say they weren’t warned:

- “Uncertain repayment of initial investment”

- “Credit Risk of the Issuer” – So if CS goes down the shitter they’re taking you along for the ride.

- “Long holding period risk” – The prospectus is kind enough to point out The long-term expected value of your ETN is zero” At least they have the decency to both highlight and underline this important feature of the investment.

- “A trading market may not continue over the term of the ETNs” – while you can buy and sell ’em now that may not always be the case.

Is Credit Suisse in the firing line?

ForexLive went to press early with concerns over Credit Suisse’s financial position.

In the case of XIV, who has the losses? Here is a clue. Numbers published Sept 30 showed Credit Suisse holding nearly 5 million of the shares itself. Those would have been worth $550 million at the open and about $20 million now — a net loss of $530 million for the Swiss bank.

.. because if Credit Suisse is on the hook, it would mean two quarters of profits have just been wiped out: recall that CS reported roughly $250MM and $300 million in profits in the last two quarters, which would mean that the XIV loss was roughly equivalent to half a year’s worth of profits

Bloomberg says not.

Nicole Sharp, a spokeswoman for the note’s sponsor, Credit Suisse AG’s VelocityShares, said in an emailed statement that “The XIV ETN activity is reflective of today’s market volatility. There is no material impact to Credit Suisse.” She didn’t elaborate on the fate of the product.

Talking head for CNBC Leslie Picker agrees with Bloomie.

That didn’t stop traders from dumping CS ADRs (American Depository Receipts) in Asian trading Tuesday, according to perennial bear blog Zerohedge.

Additionally, talk has already begun suggesting the CS bonus pool will take a direct hit because of the blow-up.

Guess we won’t know until the dust settles on this one.

As shown above, FT is reporting US ‘inverse volatility’ funds halted; exchanges cite pending news. As they’re hiding behind a paywall we can’t tell you any more at this stage.

S&P futures were down 70+ points in overnight trade but have staged a remarkable comeback. Maybe the Commander In Chief has had to activate the Plunge Protection Team (PPT).

As we go to press they’re down 12 after having been up 33 points at one time – that’s a 100 point move off the lows.

Un. Fucking. Believable.

These market moves are a little reminiscent of 2008 – Whatever you do, be careful out there folks. When the swords are slashing it’s not the time to stick your neck out.

–// Craig Amos

FULL DISCLOSURE: The author does not hold any VIX-related securities at this time.

Great explanation. This buying and selling “reverse vol” is doing my head in.

Still have some questions:

IF CS holds its own ETN’s, is this a problem or does it mean someone else has sold short ETN’s and wants to be paid?

Otherwise it’s like losing money to yourself.

Could this long XIV position be a hedge against a long VIX position elsewhere?

How does one hedge a VIX (or XIV) position anyway – other than taking the opposite position in a similar contract (XIV, VIX ETF or futures) elsewhere?

It’s not like you can hedge with some kind of position in underlying physical.

Is it like reinsurance where someone is always left holding the bag?

Reminds me so much of the CDS trading leading up to 2008.

Thanks for reading Turtle. Wow, some great questions and I wouldn’t do them justice with a reply here. Let me gather my thoughts and throw up a post in the next few days covering the vol issues.

As for CS holding its own ETNs – I agree it doesn’t make a lot of sense, but without context (their entire book) it’s impossible to know. I saw one reddit thread which suggested they may be custody holdings, which makes a lot more sense (see below)

Here’s the url: https://www.reddit.com/r/investing/comments/7vnmas/xiv_is_finished/

Turtle – Wanted to get back to you on hedging.

As you point out, there being no physical underlying (tradeable) with VIX, options are the main vehicle wrt hedging a long/short VIX futures position. Calls for a short VIX futures position and puts for a long position. The cost of implementing the hedge could be minimized by using a collar, whereby the trader also sells another option to somewhat offset the cost of the bought option.

An example:

Assuming a VIX of 20 and outlook is for VIX to normalize into the 12-15 range a trader could sell VIX futures, purchase a 25 call to protect against a further rise and sell the 15 put to offset the cost of the call.

The call protects the futures position against losses above 25 while the put caps profit at the 15 level (in other words the option seller is agreeing to buy VIX futures at 15, but having sold them higher will receive a profit.)

With VIX derivatives such as the ETFs and ETNs it gets murkier. Some of them have options available, but not all, which would allow a similar strategy to be employed.

One of the problems facing XIV holders was they had no right being in the trade in the first place, and no easy way to hedge their positions.

Here are two papers I found useful on the subject – warning – it is rocket science!