Citron Research is the subject of “Friday’s Big Fail”.

Citron is a 14-year-old company that “has amassed a track record identifying fraud and terminal business models.”

Citron’s CEO is a private investigator and veteran trader, Andrew Left.

“Since 2001, more than 50 companies covered by Mr Left have become targets of regulatory interventions.”

Citron attacks companies it thinks are fraudulent – and shorts the hell out of them.

Right now, Citron is trying to take down a company called Roku (ROKU.NASDAQ).

Roku builds streaming players that connect to your TV.

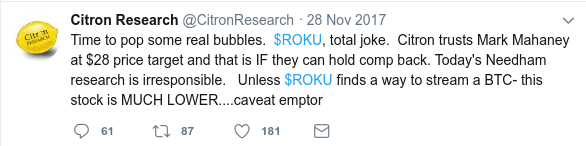

On November 28, 2017, Citron tweeted: “Time to pop some real bubbles. $ROKU, total joke…unless $ROKU finds a way to stream a BTC- this stock is MUCH LOWER….caveat emptor”

In the last month, Roku stock has gained $700 million in market cap.

It is now valued at $5.2 billion.

Since it IPO’d 3-months ago, the Roku chart looks like this:

To explain what’s going here, we have to go back to 2005, when “cord-cutting” (cancelling of traditional Pay-TV) was something only tech-savvy youngsters did.

The trend is moving mainstream.

According to a December 19, 2017 Chicago Tribune article, “Cord-cutting is not just for millennials anymore. Fed up with high prices and bloated packages, millions of Americans cut the cord on cable TV in 2017, finding refuge with a growing number of streaming services, which deliver lower prices and a competitive channel lineup over the internet.”

“Internet television bypasses cable and delivers video directly to viewers through a broadband connection. Major players include Netflix (NLFX.NASDAQ), Amazon Video and Hulu as well as livestreaming services such as Sling TV and DirecTV Now, which air dozens of cable channels in real time.”

Roku is a rising player in this space, offering a more convenient and cost-effective way to watch TV.

To be fair to Citron, there are a lot investors betting again Roku.

About 7.7 million shares of Roku are sold short. That’s only 7% of the 97.8 million shares outstanding. But the majority of those outstanding shares are held by insiders.

Roku’s short interest is about 43% of the total public float.

Roku’s upward stock price movement is caused in part by a short squeeze (short sellers covering their positions). The predictable result is increased buying volume that drives the stock price up.

Roku post a loss of $7.9 million for Q3 2017, better than the $12.7 million posted in the same quarter a year ago.

Revenue was $124.8 million, up from the $89 million a year ago. Advertising and licensing business generated in $57.5 – a 137% improvement year-over-year.

Hardware sales earned Roku $67.3 million in Q3.

Roku stock jumped 24% on the Q3 earnings.

Roku’s streaming business is similar to Apple TV (AAPL.NASDAQ), Chromecast, from Alphabet (GOOG.NASDAQ) and Amazon’s (AMZN.NASDAQ) Fire stick.

But Roku has a couple of important differentiators.

First, television manufacturers have been building Roku into some of their new televisions using the Roku platform as a selling feature. This generates licensing revenue.

Second, Roku is making mega-bucks selling ad space on its main-menu screen. Ad revenues are accelerating even faster than device revenue.

Traditional Pay-TV companies lost 1.7 million subscribers in 2016, and the 2017 losses are expected to top 3 million.

Despite the negative growth, there are still 94 million traditional Pay-TV subscribers in the U.S, and only 3.6 million subscribers for virtual streaming services.

So, there is room for Roku to grow.

But there are a few clouds in the sky. For Roku to succeed, the streaming services need to deliver customer value.

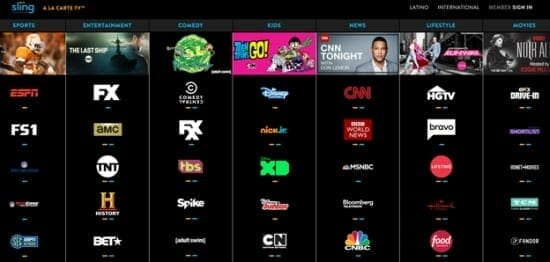

Last week, we purchased a free 7-day trial for Sling TV, in order to watch streams of English Premiere League Football.

On the website, it all looked so delicious.

“Al La Carte TV”.

Yum.

I’ll have broiled ESPN, with steamed FX and side of Spike TV.

Unfortunately, we could not the make the Sling TV technology work.

After 20 fruitless minutes, we gave up, cancelled the subscription and now watch English footie on the computer through reddit football highlights.

Currently, streaming TV has a clunky interface – but it’s going to win the war.

Why?

Because it’s cheaper.

Streaming devices such as Apple TV, Google’s Chromecast and Roku make streaming services feel very much like cable, easing the transition for cord cutters. But for many, the biggest reason for taking the plunge into streaming is price. The average cost to subscribe to traditional pay TV is more than $100 per month, while the average bill for a streaming TV service runs $35 to $40, on top of the cost of an internet connection.

Roku is here to stay.

A survey of Citron’s website did not reveal a deeper analysis of its bearish call on Roku.

That’s why Citron Research is “Friday’s Big Fail”.