In the fall of 2008, 40 million teenagers witnessed their parents weeping as the stock markets bled $6 trillion in value and U.S. homeowners lost a cumulative $3.3 trillion in home equity. This violent family psycho-trauma is often cited as an explanation for Millennials relatively low participation in the stock market (30% of Millennials own stocks).

But that is starting to change.

And it turns out, Millennials are model investors: they don’t “chase stories”, they research heavily – and they take big risks on stocks that they understand.

That includes social media giants like Facebook (FB.NASDAQ). For a lot of Millennials, the FB IPO was a delicious way to lose their virginity. Facebook went public 5 years ago with a market cap of $104 billion and has since grown to $490 billion.

Many Millennial investors are still feeling that post coital glow. According to BlackRock Asset Management, 33% of Millennials now invest in ETFs. A surge of Millennials are opening accounts with low fee brokers. They prefer to use their smart phones to buy and sell stocks.

When Snap (SNAP.NASDAQ) had its initial public offering, Stockpile – a company that has an app that creates gift cards to buy stock – saw its usage increase 1,000%.

According to a recent survey from eTrade, a third of Millennial investors are planning to move out of cash and into the stock market in the next year.

This trend was confirmed by a survey from Legg Mason that determined nearly 80% of Millennial investors plan to take on more risk in 2017, with 66% of them preferring equities.

Are Millennials important to the stock market?

Does Mark Zuckerberg have disposable income?

Is water wet?

When your participants die off without being replaced by younger ones – that’s a problem.

Don’t believe us? Ask the Metropolitan Opera. Twenty years ago, you’d have to bludgeon someone to get a ticket. Now 40% of the seats are vacant. Young people aren’t interested in classical music. Too slow – too boring – not relevant. Virtuoso Hungarian violinists gaze out at an undulating ocean of white hair and hearing aids.

The historical coolness between Millennials and equity markets isn’t healthy for either party.

Wall Street pundits love to recount that stocks have been better investments than cash and bonds over the last century.

Big cap stocks have generated compound annual returns of 10% since 1925 vs. a 6% return on bonds and 3% for cash. A $1 investment in stocks 100 years ago is worth about $6,000 now, compared with just $140 for bonds and $25 for cash.

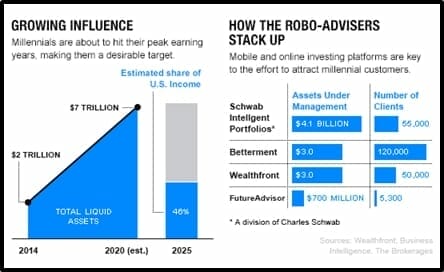

The 75 million Millennials need to start saving for retirement. And the stock market needs their money.

Quotes from a potpourri of financial advisors confirm this notion:

“Millennials need to be able to leverage the long-term growth potential of the stock market”

“The biggest risk for Millennials is not investing for growth.”

“You want to make sure this generation is as engaged in the market as their parents were.”

“Millennials should not fear the stock market.”

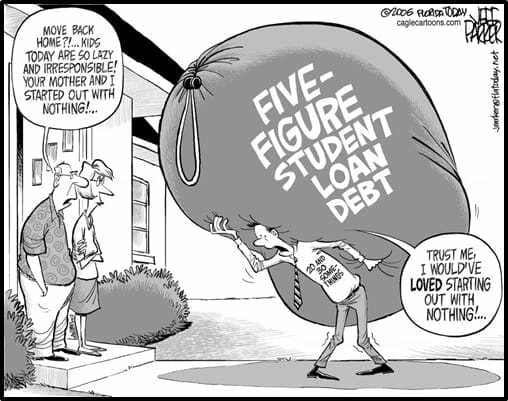

But Millennials aren’t chickens or deadbeats. They are debtors. Median university debt is $20,000, according to a Bankers Millennial Study – that’s 300% higher than 25 years earlier.

Fidelity Investments has reported that Millennials are opening trading accounts at a faster rate than Gen X or Boomers – accounting for 40% of new accounts.

Hard data on Millennial home owners also debunks the theory that Millennials are behind in investing compared with Boomers at the stage in their lives.

Households headed by Millennials made their initial mutual fund purchase at an average age of 23, compared with Boomers who didn’t buy in until they were well into their thirties.

Many Millennials can thank their employers for introducing them to stocks and bonds through 401(k)s – the default payroll deduction plans broadly diversified among stocks, bonds and other assets.

At Equity Guru, we already know that millennials buy stocks.

We can confirm that they are most comfortable investing in sectors that intersect with their lives: weed, solar power & technology.

But we’ve also discovered that Millennials are hungry for information about unfamiliar sectors. Like mining, weapons detection, fertiliser and precious metals derivatives.

The Equity Guru writers tell them everything we know. They buy what they like. As it should be.

We depend on our parents to protect us. It’s traumatic to see your father – a Budweiser-drinking shipyard welder – perusing his financial statement and weeping like a wronged child. But for many, the financial agonies of 2008 are now a distant memory.

The Millennials are coming.

I would guess these millennials will be even worse investors than those before them.All they know is how to socialize,so they are mainly salesmen.Salesmen are the easiest to sell to.Likely very short term,trade oriented.Best to get out of stocks after they have used their cash.