Remember YDreams, the Brazilian interactive tech company that I’ve been talking about for a year now? The one that has a thick catalogue of 3-D, immersive, business-friendly, user-amazing, profitable-even-in-crapped-economy-Brazil exclusive tech with which to go client shopping in North America?

The one that hasn’t put out barely any news in months, leading to investors wandering off and the share price leaning downward? The one that, despite that, has balls to the wall wonder-tech and an A-level client list?

Well, we’re into phase II. Thursday, YDreams announced that it has licensed some of its tech to an event in New York that will run for two weeks, and the stock took a busy turn.

The first project sold in the United States will be released in the second week of December and will debut in New York for a two-week event.

“Our goal for 2017 is to accelerate our virtual reality growth strategy in North America, focusing on our Fortune 500 relationships in place already. We are extremely pleased upon closing our first project in the United States and we feel this is a great sign that the U.S. market is primed for the rapid and scalable international expansion of YDreams Global,” declared the chief executive officer of the company, Daniel Japiassu.

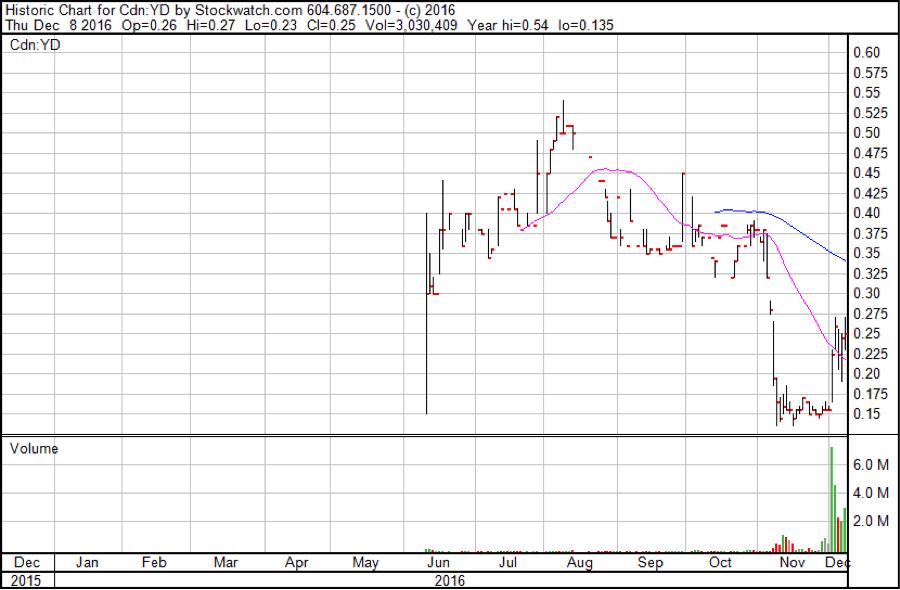

The stock has been a very active trader since their $0.15 cent private placement of some 18 million shares came free trading this month, and it appears the stock took a bump from the usual private placement profit takers, but the stock price has since risen from that low of about $0.145 to $0.25 on the news.

The daily volume has increased massively of late and YD.V is now appearing regularly on the top ten volume traders list.

For fundamental chart techies, the 30 day shows the slump and ensuing rise, with millions traded per day.

YD.V appears to be swinging back up nicely. I jumped in for some in the < $0.20 range myself.

In South America, this company has done a roaring trade with clients such as Adidas, Cisco, Nokia, Nike, Mercedes Benz, Coca-Cola, Santander, AmBev, Qualcomm, Unilever, the City of Rio, and Fiat.

Now that they’ve announced their first US deal, I would expect to see more to come.

–Chris Parry