A new company on the exchange is always a bit of a rollercoaster. Companies sometimes hit with a splash and double, others hit with a gentle sploosh and drop beneath the surface. Most of those companies are doing business with experienced traders, which adds to the volatility.

Peekaboo Beans (PBB.V), a high quality children’s wear direct sales company based out of Richmond, BC, came out a little differently. They had tons of legacy media coverage, a load of employees and distributors buying stock for the first time, and because they’re in an industry that doesn’t involve marijuana or gold or lithium, the market ignored it.

That left the share price at basically the same place it debuted for a long time. There was a little selling here, a little buying there, but nothing too dramatic. The problem is, when trading volume is low, the chance for a big swing is amplified if someone sells or buys a bunch.

Today and yesterday, that happened, with the stock dropping from the $0.90 range to $0.69.

Because a lot of those PBB investors are first timers, I’m sure they’re looking at the share price and freaking out around now. They shouldn’t, for several reasons.

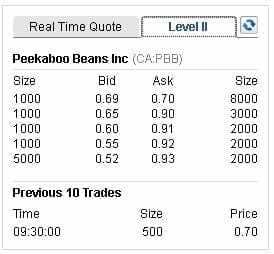

First, the drop came on the back of a 1000-share sale right at the close yesterday, to bring the stock down on the day, and a 500 share sale first thing in the trading day today to open it with another drop. With not a lot of bids out there, the seller chewed through them all and left the rest of his stock sitting a single cent above the next level of bids – $0.70.

If he really wanted value for his stock, he’d have put the rest up for sale at $0.89, because the next levels of asks (IE: sellers) have their stock listed for sale up at $0.90 (see pictured).

If he really wanted value for his stock, he’d have put the rest up for sale at $0.89, because the next levels of asks (IE: sellers) have their stock listed for sale up at $0.90 (see pictured).

But that’s not what he did. He set it as low as he could, without actually selling his stock. Why? Because he wants those first time investors to sell, and sell in big numbers. He wants it to look like the new base for PBB is at $0.69/$0.70 because, if he can cause a panic, if he can convince others to sell at the low price, he can maybe get that share price down way lower and then begin grabbing all that stock back for pennies.

For $1500 in actual stock sales, this guy has removed about $1 million from PBB’s market valuation. You’d think that would be considered fraudulent, but it’s not. That’s just how some people make their money on the public markets. Instead of picking value buys, they run good companies down so they can get them cheaper, hoping nobody will talk about it as it’s happening.

Wrong bet, friend.

But his trick only works if people are gullible enough to play into it, and PBB’s employees and distributors bought into CEO Traci Costa’s company because they believe in it long term. They didn’t buy for a 10% profit. They’re not looking to ‘trade.’ What this guy, whoever he is, hasn’t factored in is those people are looking three years down the road for their investments, and if you’re offering stock at a 20% discount, those people will likely take you up on the offer.

To be sure, PBB is $8001 away from a 25% share price jump. If I wasn’t doubling my money on weed stocks every few days, I’d absolutely be his huckleberry and take his cheap stock off his hands.

Long holders would do well the be reminded that they haven’t lost a cent on PBB until they’ve sold. And, as a holder of the stock personally, I’m not even thinking about that for the next year, regardless of where the ne’er-do-wells among us want to play their reindeer games.

I’ve got a podcast with Costa in editing right now, due out shortly, and I’ll be covering their news as it rolls out. I hear distributor numbers are up and the Christmas season is coming, so now would be a good time to play the company, not the market.

— Chris Parry

FULL DISCLOSURE: Peekaboo Beans is not an Equity.Guru marketing client, but the CEO bought me champagne a few times, I own the stock, and my kids wear her clothes because they’re great. Long.

UPDATE: I took down some of that discount stock. Sorry if you had your eye on it. Too cheap to ignore.

UPDATE: You guys apparently took down the rest and the stock climbed to $0.84 by close. Well played, bargain hunters. I’ll let you know when the next blue light special makes itself clear.