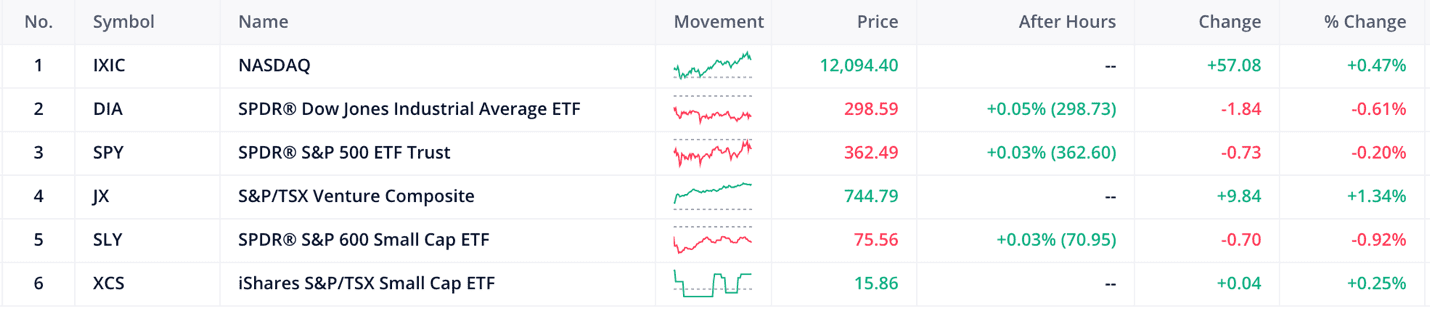

- The S&P 600 is down by 0.92% and TSX20 is up by 0.25%

- The Canadian 10-year bond down by 0.01% and the US 10-year bond down by 0.00%

What Is Coattail Investing?

Coattail or copycat investing is an investment strategy of echoing the trades of well-known and historically successful investors. By using this strategy, investors “ride the coattails” of respected investors in hopes of making money in their own accounts.

How can I Implement it?

Through the abundant availability of public filings, media coverage, and reports written by fund managers, the average investor can quickly learn where these big investors are placing their money.

The most popular and most accurate document to use would be the 13F. Form 13F is a quarterly report required by the United States Securities and Exchange Commission regulations, by institutional investment managers with control over $100M in assets to the SEC, listing all equity assets under management. They only need to list their long position of All US-listed equity securities.

By leafing through these filings, investors can keep track of the investment decisions of historically successful investors such as Bill Ackman or Ray Dalio.

In doing so, however, you should be aware that because of the 90-day delay in obtaining new information, they may be acting on outdated information depending on the investment strategy used by the fund.

Investors who wish to execute a coattail investing strategy should also be careful when deciding which fund manager to follow as they all have very different strategies. We will see an example of this in our live case.

Live Case

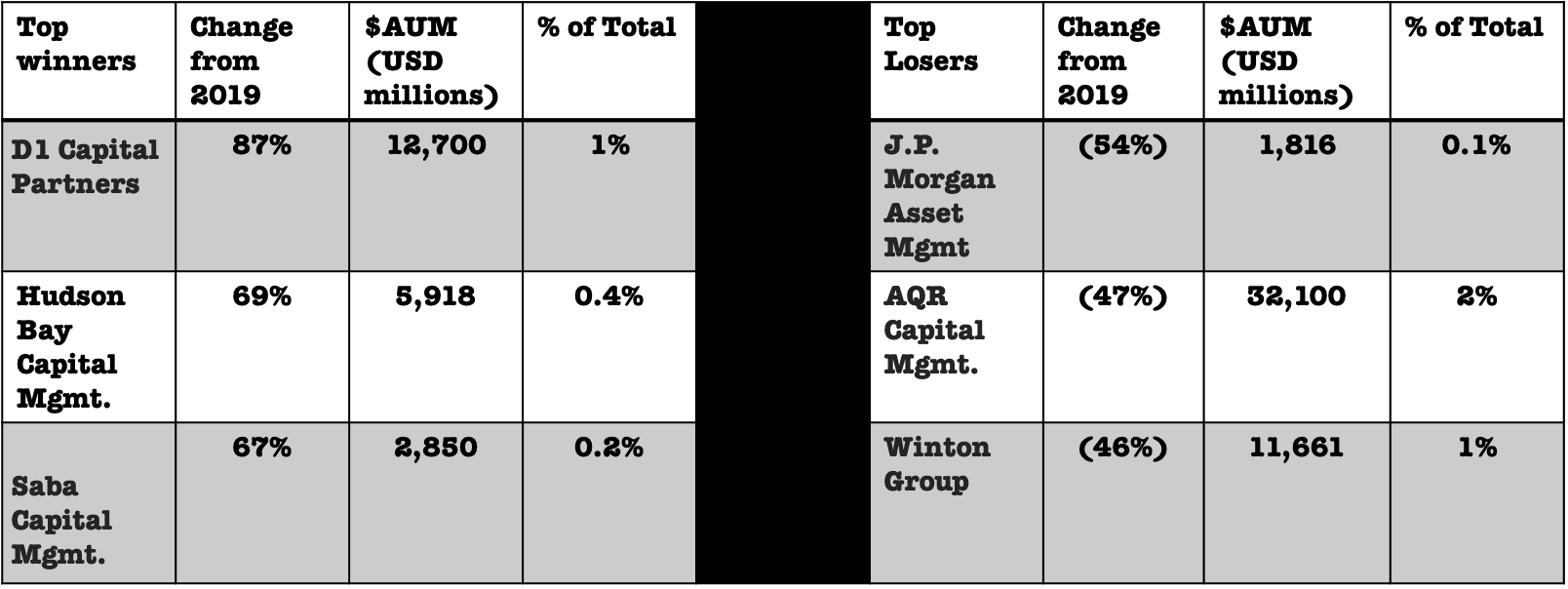

We will start by selecting the fund managers who have done well but also list the funds that have not done so well in 2019 as a comparison. Once we know who the top winners are we need to go through their most recent filing and look at the investments that they have recently added and their largest holdings in the past and currenlty.

D1 Capital Partners is based out of New York. D1 Capital Partners is a hedge fund with 12 clients and discretionary assets under management of $12 Billion. The Company has a fundamental investment strategy with a focus on medium to long-term returns across the consumer, business and financial services, healthcare, industrials, real estate and technology, media, and telecom sectors.

The funds’ top holding(9% of the AUM) as of their most recent 13F is JD.com (JD.NASDAQ) and they paid an estimated average price of $35 and the current price is $87.

From this same filing, the new addition to the portfolio is Unity Software(U.NY) which is now 6% of the total AUM and they paid an estimated average price of $87 and the current price is $134.

Hudson BAY Capital Management is based out of New York. Hudson BAY Capital Management is a hedge fund with 4 clients and discretionary assets under management of $8 Billion. They try to achieve profitability by developing a portfolio of diversified, independent, limited risk, high conviction investments.

The funds’ top holding(17% 0f the AUM) as of their most recent 13F is Tesla Inc Credit (Tesla Inc. NOTE 2.000%) and is their most recent purchase. They also sold their Tesla stock and bought Tesla put options betting against the company.

Saba Capital Management is based out of New York. Saba Capital Management is a hedge fund with 31 clients and discretionary assets under management of $3 Billion focused on credit and equity relative value strategies.

The funds’ top holding(18% of the AUM) as of their most recent 13F is iShares iBoxx $ High Yield Corp Bond ETF(HYG) and is their most recent purchase

Once we have done the research into the funds and their investment strategies the easy part is done. This is where the difference between great and average copycat investors is distinguished, the due diligence of the top holding of the respective funds.

Copying the investment strategies of successful investors comes with its benefits and risks. A coattail investor should consider the following when implementing the investing strategies of successful investors:

- Conduct due diligence and do your homework

- Don’t follow a single investor, diversify the number of credited investors you follow

- Follow tested and credible investors who have a long track record of beating their respective benchmarks

- Be patient

The biggest risk to always remember is that this style has a long maturity period and there are many people following these big money managers since the information is public.

At the risk of being seen as braggadocious, one of the very few things I am good at is riding coattails. Behind every successful investor is me, smiling and taking partial credit.

Like a football coach at the end of the season who does nothing but select wonderful players for his team who do most of the work, we all get to celebrate my brilliance at the end.

HAPPY HUNTING!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.