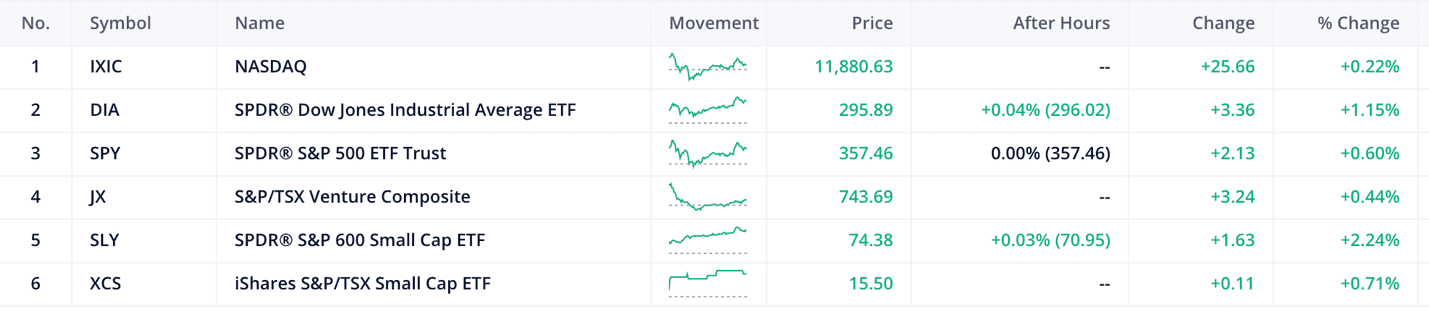

- The S&P 600 & TSX20 are up by 1.63% and 0.71% respectively

- The Canadian 10-year bond up by 0.03% and the US 10-year bond up by 0.04%

Today’s stock pick of the day is Bluesky Digital Assets (BTC.C) formally know as Gunpowder Capital a Toronto-based firm that owns and operates as a digital asset and AI software-focused virtual mining company. As of June 30, 2020, Bluesky was able to generate a grand total of $209,000 in revenues utilizing negative $1 Million in tangible assets.

Bluesky was a merchant bank and advisory services firm until September 2019, when it implemented its new business model under the leadership of a new management team. Since September of 2019, the company has been focused on pivoting from being a merchant bank to becoming a technology-based company with its primary focus on digital assets and AI software.

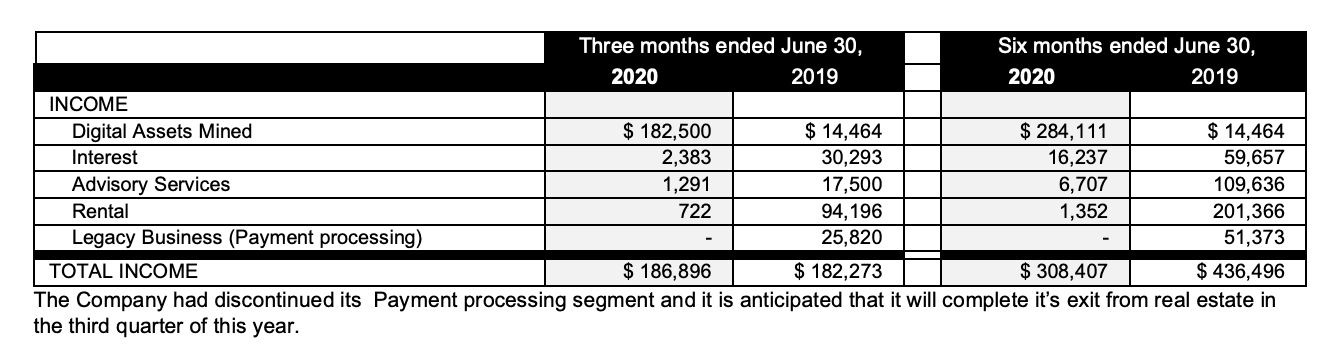

As can be seen from the table below this transition is in full effect as 97% of their income is from digital assets.

The market has voted on a new market capitalization of 3 million dollars as of today. The stock rushed up by 57% based on Bitcoins’ recent performance and this has occurred as investors move into the digital asset industry and many miners like Bluesky have benefited.

Below is a great article that was written by Vishal Toora where he talks about the recent move in bitcoin and where he thinks the market will be: Netcents(NC) breaks out as Bitcoin touches 15000!

This move could be because of the big drop in the US Dollar, which is aiding in propping up Gold and Silver as well as the US stock markets. Or the move in crypto’s could be for two other larger events coming down the horizon.

a) …it could just be a way to get out of fiat currency, similar to the Gold and Silver.

b)..market participants could be making moves to front-run the eventual digital currency.

Some investors have opted for an alternative route when it comes to gaining exposure to the bitcoin rush. They have attempted to gain this exposure by investing in a diversified set of bitcoin mining or technology companies. Viewed in this light the new appraisal by the market for Bluesky makes more sense as bitcoin is poised to hit record highs even after it slowed down as of today.

But as with anything in investing we will view this new price with skepticism and we will attempt to briefly come up with our own intrinsic value.

Since Bluesky has not achieved profitability and has a negative tangible net worth our only method of appraisal is by comparing its sales with peers in its industry but as we’ll see later on this essentially arbitrary.

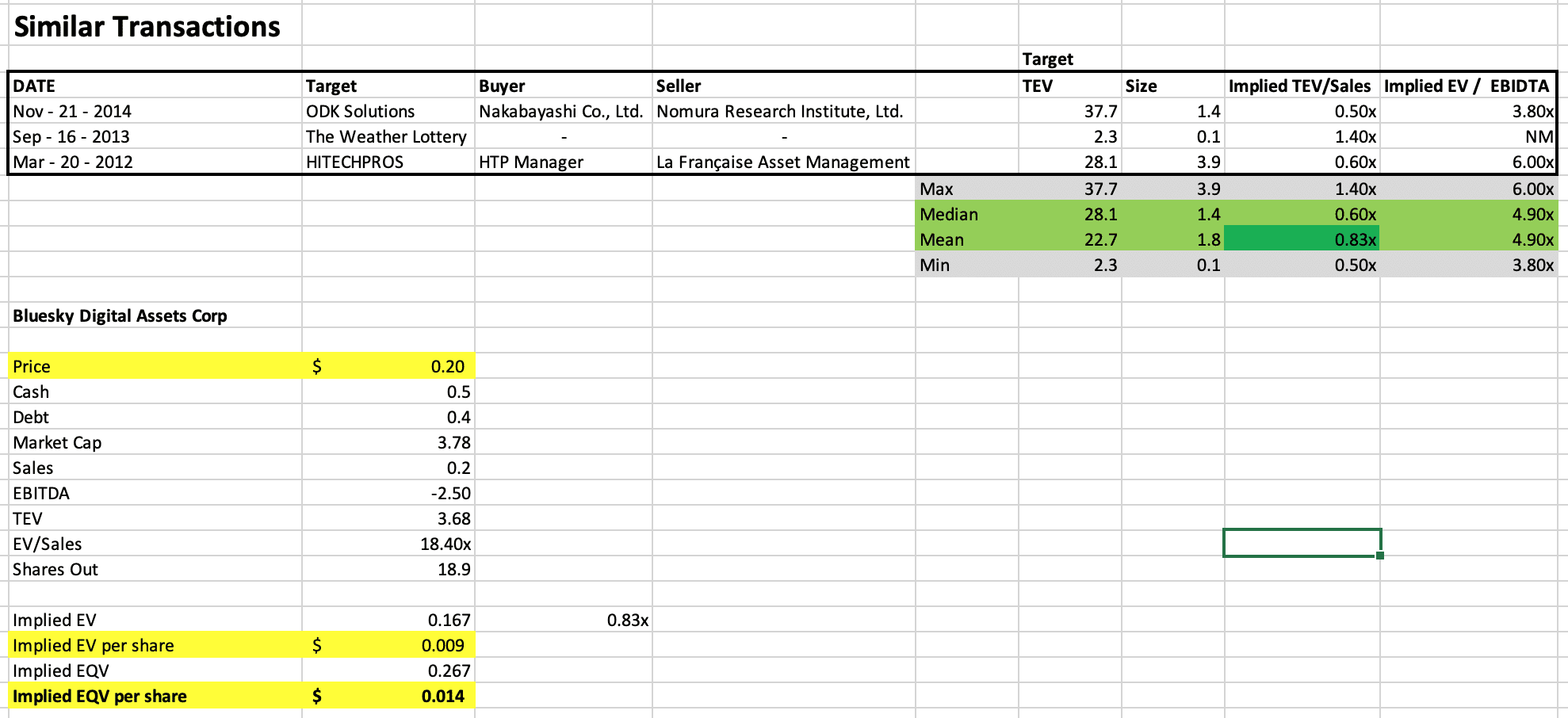

So, for simplicity, we will introduce precedent transaction analysis. This is a valuation method in which the price paid for similar companies in the past is considered an indicator of a company’s value. Precedent transaction analysis creates an estimate of what a share of stock would be worth in the case of an acquisition.

Using the assumption, we come up with the table above named appropriately similar transactions. As can be seen, the similar transactions that occurred had an enterprise value to sales ratio of 0.83x on average compared to Bluesky’s 18.4x ratio.

This implies that relative to the recent transactions if we adjust the value for Bluesky we will come up with a stock value closer to $0.014 per share. Currently, Bluesky is trading for $0.2 and started the day at $0.095 per share.

All this can be confusing but essentially our analysis is indicating an overvaluation of 13 times. Meaning for the share of Bluesky you are paying more of a premium for its cashflows or potential class cashflows in this situation. And for our case, the cashflows are the sales.

It would be simple here to end with the conclusion that the stock might have overreacted to the bitcoin rush. But the savvy investor will ask why use transactions that occurred years ago instead of comparing with companies who have accounting figures as of today.

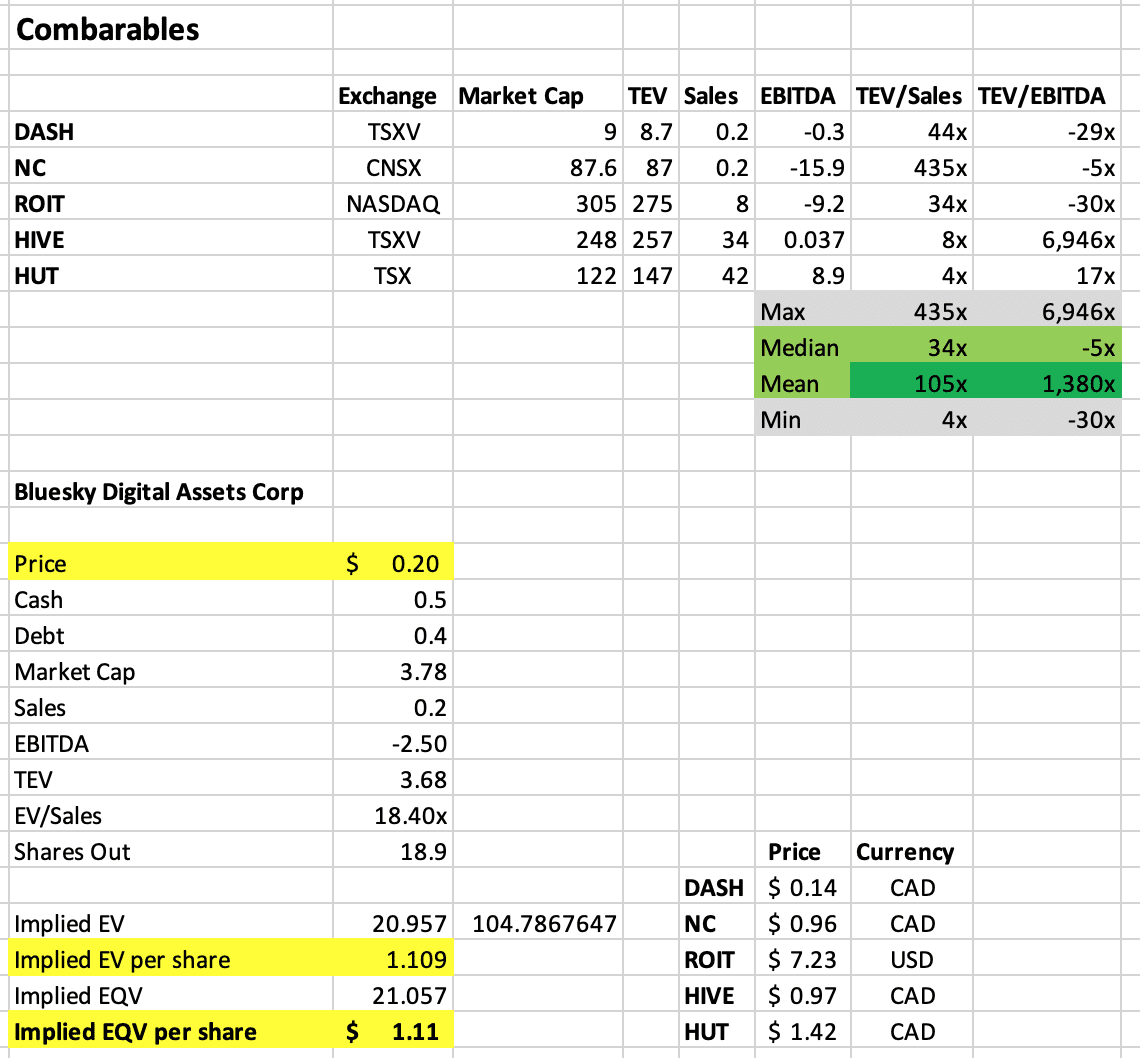

The savvy investor is right, and we will compare companies who have reported their numbers as of today. The selection of these companies had only a few filters :

- they had to be directly involved in the mining or value-added technology sector related to Bitcoin

- The businesses had to be public and traded on the New York Stock Exchange or the Toronto Stock Exchange.

- The businesses had to have recorded sales in the last reported statements.

The investor here has full discretion to pick and select their own comparable companies. Knowing this our valuations might come to two different conclusions, but the analysis is still fruitful and sheds light on the case.

This sort of analysis is similar to precedented transactions but is referred to as comparative analysis. This a process used to evaluate the value of a company using the metrics of other businesses of similar size in the same industry.

Using this technique, we come to an equity value per share of $1.11. Which is high and well above the current market price. So is this stock Undervalued?

But the investor should look at the definition above carefully, the companies needed to do this analysis need to be of similar size, and because market cap is a measure influenced by the dynamics of the securities market the size comparison here should be sales.

Having said that the sales figures above range from $200,000 to $42 million which is a very wide range and plenty of room for many arbitrary calculations and assumptions. Rendering our analysis above obsolete and inconclusive leaving us in the same position as at the start.

This just goes to show that the correct appraisal of stock can only be done when an investor understands what they’re doing and what they’re looking for. This can be easily said but difficult to actually do in practice.

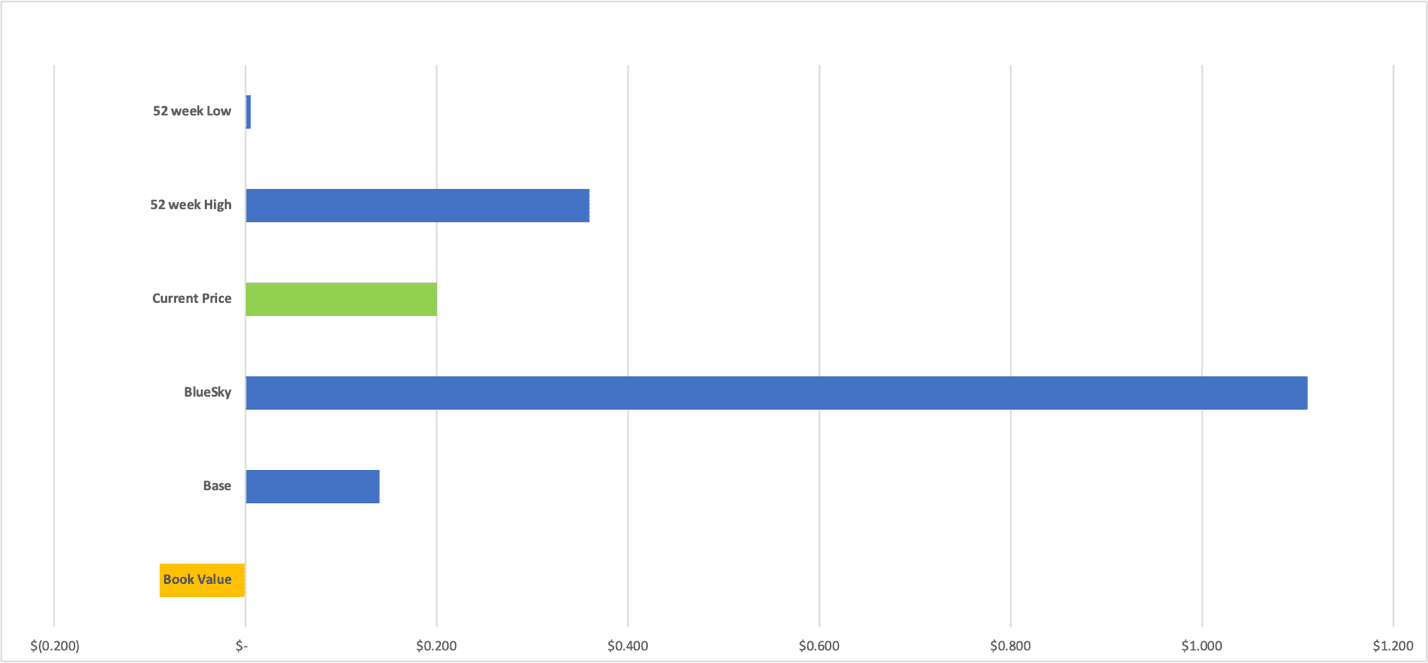

This point is made even clearer once you combine all our methods of valuation from the president transactions, to the comparable transactions, to looking at the book value of the business the actual assets that it holds.

The last excruciating table is a summary of the different values that the market is trying to appraise for a piece of the Bluesky business. The lowest is the 52-week low price of $0.06 and a high figure of $1.11 from our Bullish case.

This can be seen as a $1.05 cent room for error. For us to have a stronger conviction that our analysis is correct we would have loved this simple and brief price range analysis to be narrower.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.