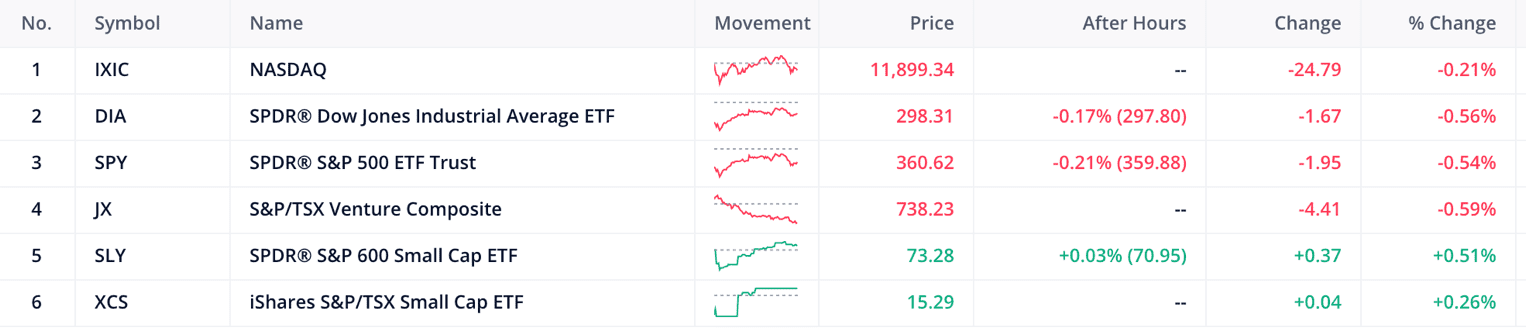

- The S&P 600 & TSX20 are up by 0.51% and 0.26% respectively

- Bonds see a rush of capital inflows as investors move out ‘riskier’ assets.

- The Canadian 10-year bond up by 0.05% and the US 10-year bond down by 0.02%

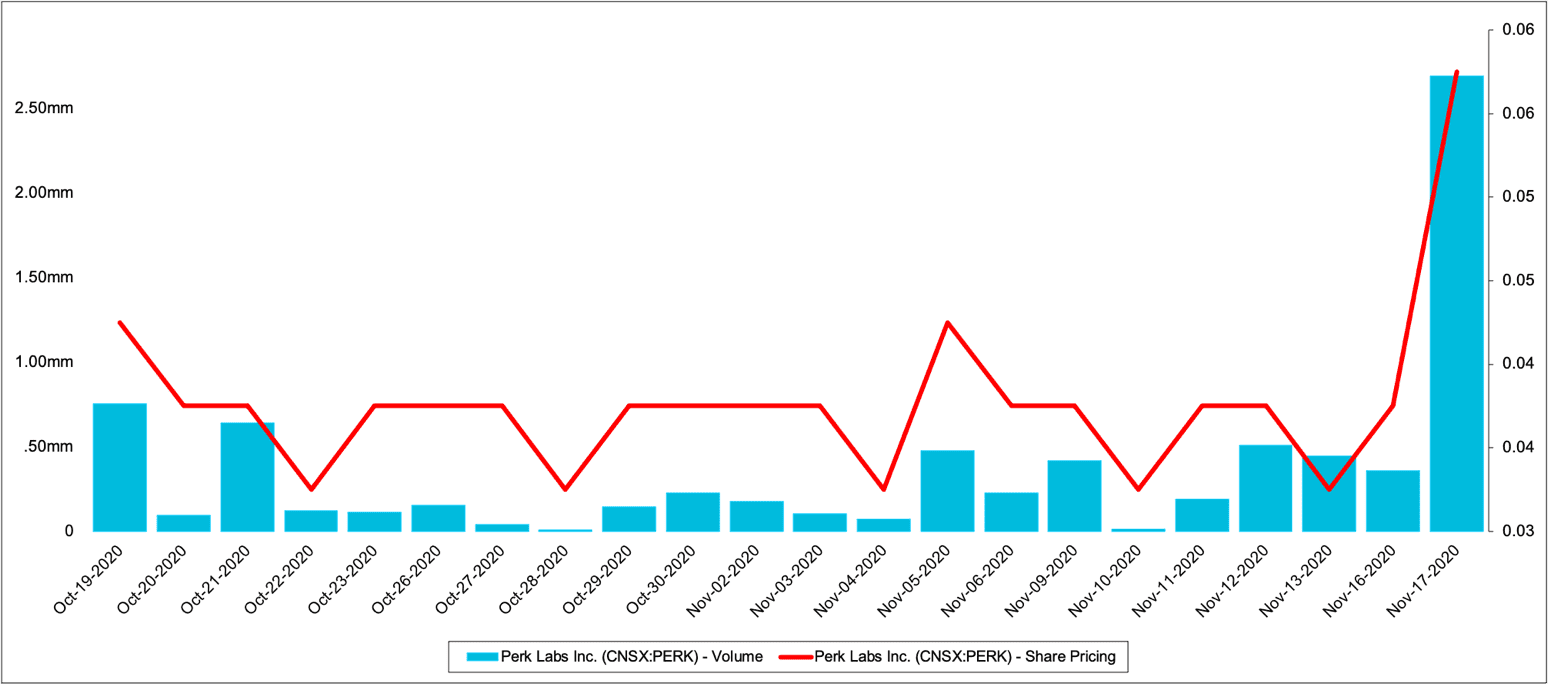

Today’s stock pick of the day is Perk Labs (PERK.C) formally know as Glance Technologies a Vancouver-based firm that owns and operates a mobile ordering, contactless payments, and loyalty app in Canada and the United States. As of November 2019 Perk was able to generate a grand total of $32,000 in revenues utilizing $4 Million in tangible assets.

The stock ended the day with a 50% boost in its market capitalization as investors approved the shareholder annual report that was published earlier and commend the management for meeting their goals.

The report starts with a key organizational goal that leads us into today’s topic, shareholder value.

Dear Shareholders,

In October 2019, I released my first Letter to Shareholders setting out our plan to put the Company on a new path for growth and emphasizing our determination to focus on the right priorities and revenue drivers in order to improve business operations and ultimately, maximize shareholder value.

– Jonathan Hoyles CEO & Director

This might sound like an oversimplification, but investing is a two-step process. The first of which is the selection of appropriate securities for the portfolio. This process usually takes the longest and is the main reason academics have studied portfolio allocation and corporate management since the beginning of large scale asset allocation.

The second part of the process is being an active shareholder or better-said shareowner. This part is not given its fair share of time when it comes to the investment process. Not only do institutional and retail investors pay little to no attention to this part of the process, but academics also ignore it completely as an essential part of the investing activities.

Different sides have posed many reasons why this is so. The most common is the introduction of the passive style of investing that is now commonplace in the general stock market. This might be true but ignores the individual choices made by each market participant.

Having said this it is obvious that the author believes the most important part of being an investor is being an active shareholder. The selection of companies is important but keeping up to date with what management is doing is an even mightier task.

Today we are taking on the challenge of quantifying shareholder value. It should be noted shareholder value can be both qualitative and quantitative. Most of the time it is easier to get quantitative information as we have access to the financial statements of the business. Some of the most popular quantitative measures are total revenue or earnings per share.

But for the purposes of the individual investor, we want to take a granular look at the numbers and find more efficient ways to calculate shareholder value.

Shareholder Value is the value delivered to the equity owners of a corporation due to management’s ability to increase sales, earnings, and free cash flow, which leads to an increase in dividends and capital gains for the shareholders.

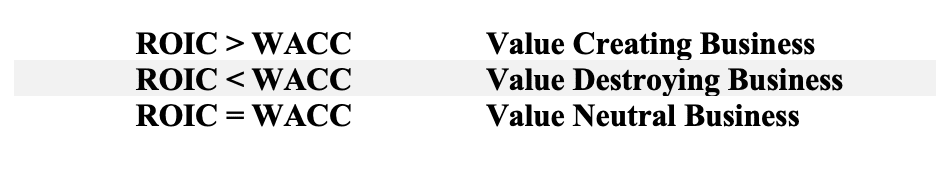

The top financial analysts rely on 2 measures when it comes to calculating shareholder value. They look at the return on invested capital (ROIC ) and the weighted average cost of capital (WACC).

For simplicity, we will ignore the intricacies of the calculations but should come to the realization that ROIC measures the return from utilizing the assets of the business and the WACC computes an estimate of the cost of accumulating capital using equity or debt financing.

The table above summarizes generally how analysts look at these two measures. It’s simple enough to understand that the investor would rather have a business with an ROIC of 15% and a WACC of 3% than one with an ROIC of 15% and a WACC of 20%.

Although both options have a return of 15%, one has the potential to create 12% of the value and the other has the potential to destroy 5% of the shareholder value over time.

So, if these two measures are very difficult to calculate what does the normal investor have in their toolbox?

This is where experience in the market comes to play. Many businesses have fundamentally different economics that affects them in various ways. For example, in banking, it is very difficult to calculate a gross margin % because banks do not have a cost of production or service. Instead to calculate the return for banks we use a net interest margin calculation. This is the difference between the average earned from the income-earning assets and the average paid out to the depositors and debt holders.

This is just one example of many techniques that can be used to calculate the return for shareholders as the investors’ experience and knowledge compounds. But there are some universal truths that can be used, and these are the ones that will help us govern our shareholder value analysis.

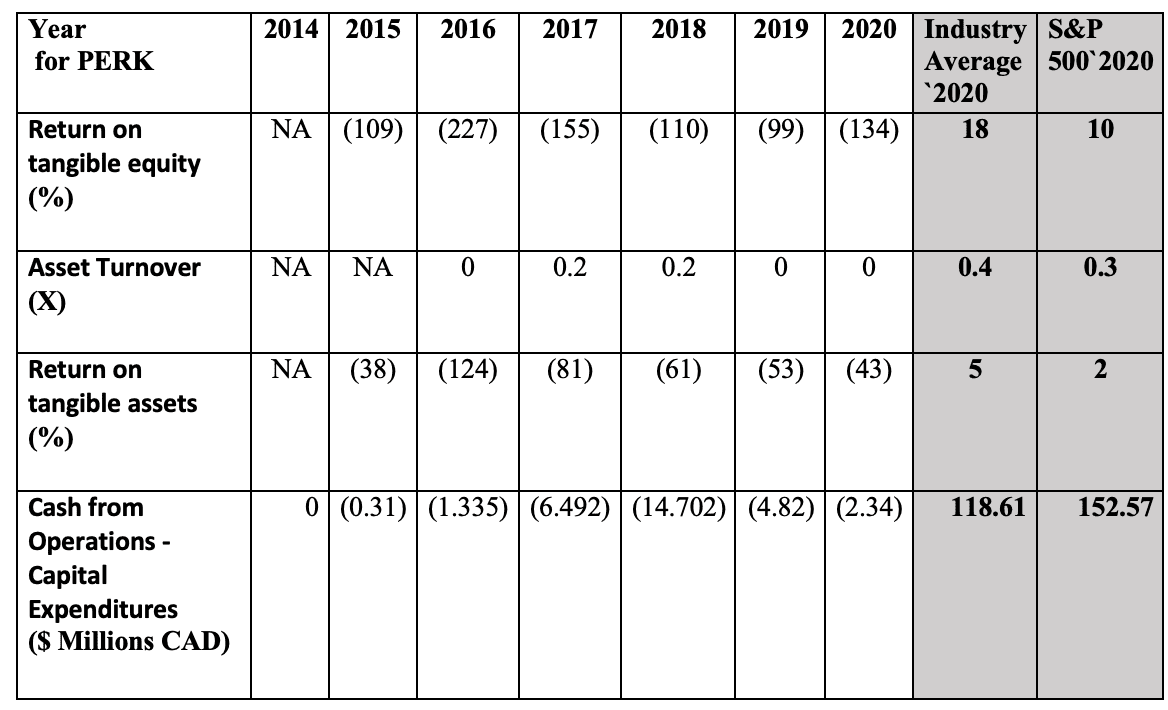

1. Return on tangible equity

Return on tangible equity is the return or earnings of a business divided by the tangible equity which is the book value minus any intangibles like goodwill and patents. This is a measure of the profitability of the business related to the tangible equity used in the business.

Whether ROE is seen as good or bad depends on the peer group analyzed and the trend of ROE of the business over time. For most businesses, it is easy to assume 10% is a fair cut off. Using this metric though it should be noted that most financial institutions are well below this 10% cut off so a new metric would be needed. But for our case, a 10% figure is just right.

2. Asset Turnover

Asset turnover or turnover can be calculated by taking the total revenue for the year or the period divided by the assets utilized to generate that revenue. This metric is more intuitive and it is basically taking that revenue generated and using an average amount of the assets efficiently.

This again can only be seen by looking at the trend over time of the peer group and by looking at the trend of the company itself overtime.

For the shareholder, it is important to calculate this measure as it shows how effectively management is using the money invested by you as a shareholder in productive assets rather than less productive assets.

3. Return on tangible assets

Return on tangible assets is somewhat similar to the ROE. The only difference between the two is that one accounts for leverage and the other does not. So, the investor can think of the return on equity as the leveraged measure and the return on assets as the unleveraged measure so to speak.

The calculation is the same but instead of using equity as the denominator, we use the tangible assets. Knowing this we will have assets like cash, property plant and equipment, marketable securities, and other tangible assets minus goodwill and other intangible assets.

4. Cash from Operations – Capital Expenditures

This last measure is probably one of the most important.

To keep the article short, we will assume it is a measure of the cash an investor can actually take out of the business once all expenses have been paid for, the business has reinvested in more productive assets and capital projects, and the working capital position has been maintained.

This is a metric of cash flow. Usually, it is a more powerful indicator of a successful business compared to earnings which can be limited in its scope because of accounting policies.

It goes without saying that these four-line items are not all-inclusive. They are merely indicators and should not be taken as the Holy Grail of shareholder value measures. With a deeper understanding of the business, the investor is given the freedom to choose measures that are more appropriate and can adjust the four-line items to meet the demands of the business and its economics or apply specific industry measures that will help the investor on their course of figuring out if the business is value-destroying or value-creating.

To finish off this article I have added a table for Perk labs below. Current shareowner of Perk labs and potential owners now have the daunting task of coming to their own conclusion if this is a business that would have an ROIC greater than WACC or an ROIC less than WACC.

The American stockholder was the most docile animal in captivity who never thinks of asserting his individual rights as owner of the business. They vote in a sheeplike fashion for whatever the management recommends, no matter how poor the management’s record of accomplishment may be.

-Investor and Teacher

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.