“BERKSHIRE HATHAWAY’S ARBITRAGE ACTIVITIES DIFFER FROM THOSE OF MANY ARBITRAGEURS. FIRST, WE PARTICIPATE IN ONLY A FEW, AND USUALLY VERY LARGE, TRANSACTIONS EACH YEAR. MOST PRACTITIONERS BUY INTO A GREAT MANY DEALS PERHAPS 50 OR MORE PER YEAR. WITH THAT MANY IRONS IN THE FIRE, THEY MUST SPEND MOST OF THEIR TIME MONITORING BOTH THE PROGRESS OF DEALS AND THE MARKET MOVEMENTS OF THE RELATED STOCKS. THIS IS NOT HOW CHARLIE NOR I WISH TO SPEND OUR LIVES. (WHAT’S THE SENSE IN GETTING RICH JUST TO STARE AT A TICKER TAPE ALL DAY?)”

Warren Buffet

Arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices at which the unit is traded.

This process of arbitraging can be done in any asset class where inefficiencies in the market exist. These market inefficiencies occur when large and small investors analyze past and public information differently. The process usually follows a similar pattern:

- The speculators (those who buy and sell securities on the price action or news) will bid up or push down the price of the asset violently. Usually, they may react emotionally and oversubscribe to ceratin information disrupting value and reality.

- As time passes and traders process the information more ‘rationally’ and then the price of the asset will consolidate to a more appropriate level and those who purchase at this point will occasionally profit from the risk-free arbitrage return and the speculators will profit from the rapid increase in prices.

The process can be very difficult and time-consuming so the casual investor need not bother themselves with operations of this level, those more adept in the intricacies of the securities market are free to dip their toes occasionally in the special situations provided by this type of investment.

Those who do partake in arbitrage should trade the information and not the news and secure themselves a ‘risk-free return’.

We will go through a live case with the reader to show the thought process behind the arbitrage of a Merger and Acquisition(M&A) announcement of a publicly traded firm.

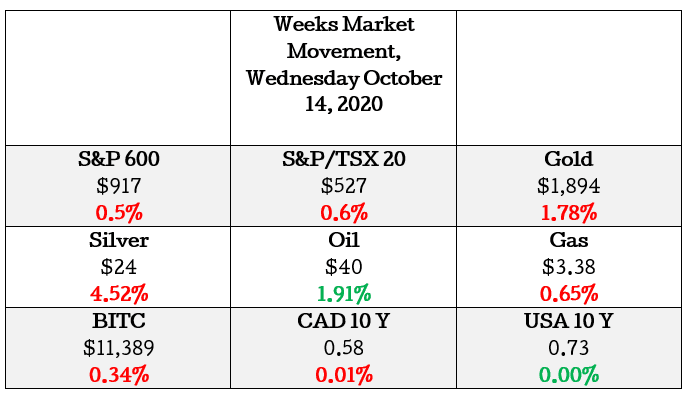

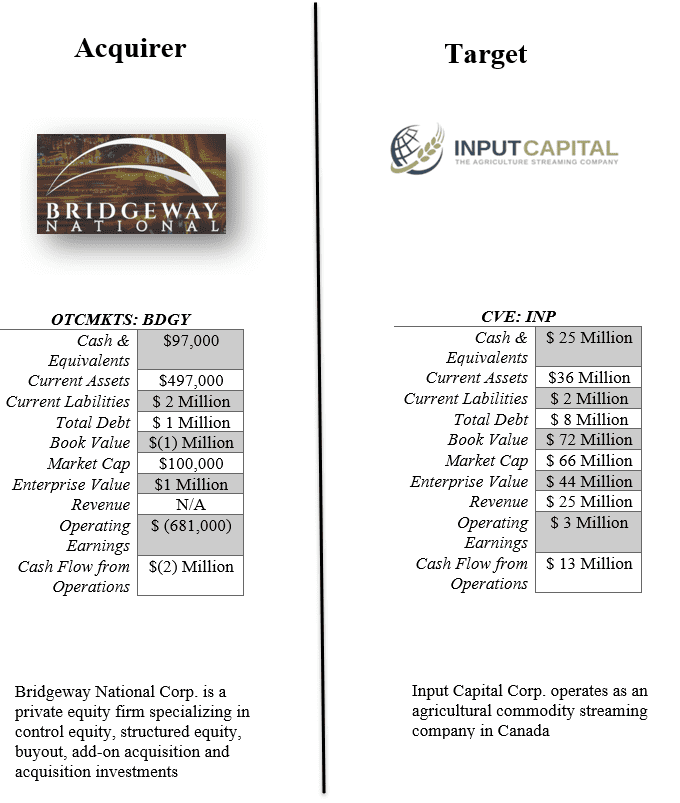

Firms and Key data

The two firms involved in this deal are Bridgeway(BDGY) and Input Capital(INP). The data below is taken from the latest reports and compares the acquirer to the target company.

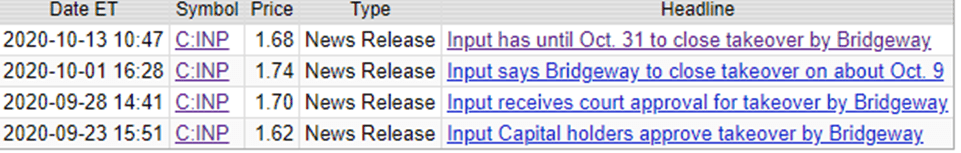

Press Releases and Timeline

For a business combination to occur there needs to be a few things that happen before the agreed date.

1. Firstly the Take-over bid between Bridgeway the ‘Acquirer’ and Input the ‘Target’, needs to approved by both boards of directors. The terms of the agreement are set that the deal is an all-cash transaction or a mixture of stock and cash.

The boards of both firms have approved and unanimously determined that the Transaction is in the best interests of Input and is recommending that Input Shareholders vote in favor of the Transaction. Under the terms of the Agreement, each Input shareholder will receive cash consideration of $1.75 for each Input Share.

2. Shareholder Approval, The Agreement will be implemented by way of a statutory plan of arrangement under The Business Corporations Act of Saskatchewan and is subject to the approval of 66 2/3% of the votes cast by Input Shareholders at a special meeting of Input Shareholders to be called to approve the Transaction

99.99% of the Input shareholders have voted in favor of the deal and this is well above the 66% needed by the Business Corporations Act of Saskatchewan.

3. Lastly the approval from the Saskatchewan Court of Queen’s Bench

On September 28, 2020, Input and Bridgeway received the needed approvals from the Superior court. And more recently the deadline of the deal has been set to October 31st taken from the press release below.

News Releases

Input Capital Corp. Provides Shareholder Update

REGINA, SK, Oct. 13, 2020,/CNW/ – Input Capital Corp. (TSXV: INP) (US: INPCF) (“Input”, “Company”)today provided an update to shareholders regarding the timing that the Plan of Arrangement sets out for the sale of the Company to Bridgeway National Corp. (the “Purchaser”).

The transaction did not close on October 9, 2020. The Arrangement Agreement provides an outside date of October 31, 2020, for the parties to complete the Plan of Arrangement. Closing remains subject to certain customary closing conditions.

Valuation and Purchase Price

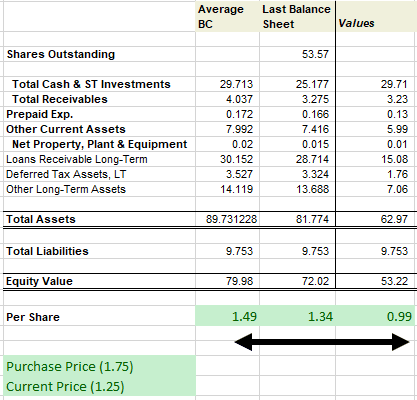

For our purposes, I will briefly touch on valuation but since this deal already has a purchase price set our analysis merely adds to the marginal safety of the investment process.

Since Bridgeway is purchasing the entire business in this agreement what they pay in the transaction is referred to as the ‘fair value’. The formula for this is very simple on paper but can be difficult in reality. To start of Bridgeway needed to identify the tangible assets of the business they are purchasing net of any debt obligations being carried by Input.

Once they have done that they will make any adjustments to get the fair value of the assets. In accounting, fair value is a reference to the estimated worth of a company’s assets and liabilities that are listed on a company’s financial statement. We have visualized this part of the due diligence in the diagram above and came with a fair value for the entire business in the range of $0.99 – $1.49.

Once Bridgeway has done its due diligence it knows that shareholders of Input will not tender their shares unless the purchase price is above both the fair value($0.99 – $1.49) and market price($1.25). They will offer something above this range to incentivize shareholders to sell their shares to them at a premium. This premium is known as goodwill. Goodwill is the portion of the purchase price that is higher than the sum of the net fair value of all of the assets purchased in the acquisition and the liabilities assumed in the process. In our case study goodwill will be about $0.5 from the market price and $0.76- $0.26 from the fair value calculations.

Hold Investment or Arbitrage

“Under the terms of the Agreement, each Input shareholder will receive cash consideration of $1.75 for each Input Share held, representing aggregate consideration of approximately $97.5 million on a fully diluted basis. “

This is taken directly from the press release and is important for our thought process in this section. Simply Bridgeway will buy all the shares for cash and will not restructure into new shares or other securities. The advantage here is that the Input shareholder will not need to make any choices between holding the stock in the new business or taking full-on cash, but they do have the disadvantage of reinvestment risk. Reinvestment risk refers to the possibility that an investor will be unable to reinvest cash flows (e.g., cash from M&A deal) at a rate comparable to their current rate of return.

The best procedure here would be for the wise Investor to conduct the pure arbitrage play and wait for the cash consideration of $1.75 before taxes and other https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses and deploy the capital into new investments that are appropriate for the risk appetite of the specific investor.

Expected Return

Purchase Price @ October 31, 2020: $1.75

Current Market price @ October 14, 2020: $1.25

This constitutes an expected return of 40%. The annual average rate for a 40% return on investment in 1 month is 5569.39%.

But again, this is merely a guess. The reality of the beauty contest is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!