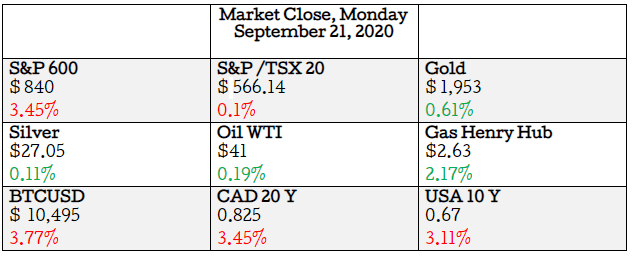

Hey investors, interesting day to be an Asset Allocator as the market gives back gains, the marginal opinion by investors today was to give away the USA and American large caps for a 1% and 1.06% discount respectively :

- S&P 600 (USA Small Caps) down by 3.45% and S&P 500(USA Large Caps) by 1% for the day

- S&P/TSX 20(CAD Small Cap) down by 0.1% and the S&P/TSX 60 (CAD Large Cap) by 1% intraday

- Bitcoin down by 3.77% as investors move to precious metals for “safety”, Gold up 0.61%, and oil up 0.19%

- Demand for safe assets pushed the bond yields down for the day in both the USA and Canada, 3.11% and 3.45% respectively, pushing their prices higher. USA bonds at a 49% premium and Canadian Bonds at a 21% premium.

Market Movers

Today we have a big winner as the market bleeds some of those speculative gains :

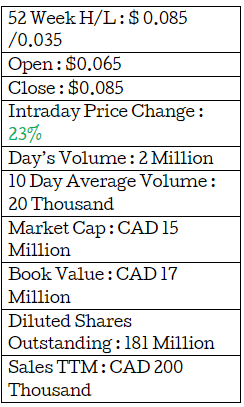

New Millennium Iron Corp (TSE: NML)

Business Summary

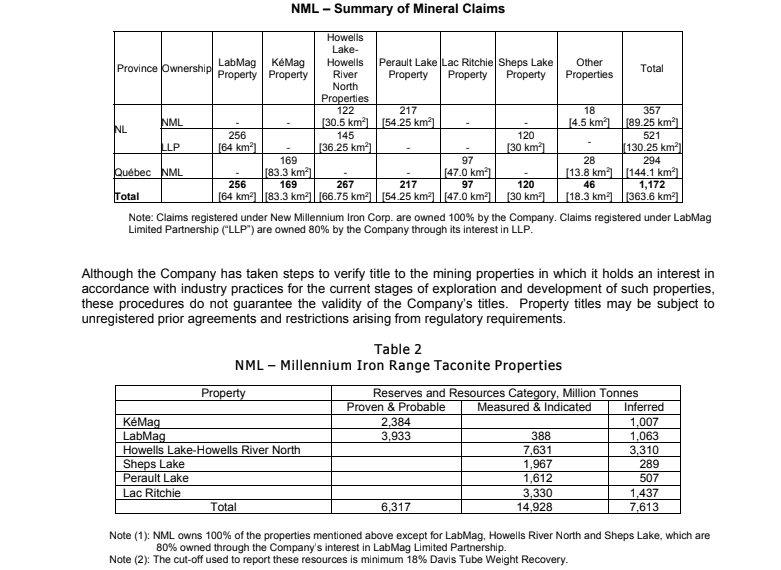

New Millennium Iron Corp. has actively explored properties in Canada’s Labrador Trough and is now at the development stage. NML’s largest shareholder and strategic partner is Tata Steel(26% Owner).

NML also has a minority interest in a direct shipping ore project that produces and ships sinter fines.

The company actively deals with iron ore(SEE PICTURE ABOVE), and its main asset is the Millennium Iron Range which is located in the principal iron ore district in Canada (Labrador Trough,

straddling the Province of Newfoundland and Labrador and the Province of Quebec) this gives the business a competitive advantage as these are very resource-rich deposits.

The company has done us a favor and provided us with a list of their main deposits and the ownership structure in their Annual and Quarterly reports:

Their main customers are Steel manufacturing firms.

Since the 1950s the demand for iron ore has come from well-known names such as the U.S. Steel & Nucor in the US and Labmag Limited Partnership, Naskapi Nation of Kawawachikamach, and Tata Steel Minerals Canada Limited(26% Owner).

The Canadian firms mentioned above are actual customers of NML and have all experienced a decrease in the demand for their products affecting the business volume of NML.

Management states in there most recent report that :

With regard to the company’s main business, in the currently challenging market environment for new greenfield iron ore projects, NML’s main projects are on hold and NML has implemented cash conservation measures while protecting its mineral claims and iron ore development positioning.

New Millennium Announces Proposed Reverse Take-Over with Abaxx Technologies.CALGARY, Alberta, Canada (September 18, 2020) – New Millennium Iron Corp. (the “Company” or

“NML”) (TSX: NML) is pleased to announce, further to the previously announced reorganization with

the Tata Steel Group, that it has arrived at an agreement with Abaxx Technologies Inc. (“Abaxx”) to

enter into a business combination agreement (the “Agreement”). Under the terms of the Agreement,

NML and Abaxx will effect a transaction that will result in a reverse takeover of NML by the

shareholders of Abaxx (the “Transaction”) to ultimately form the resulting issuer (“Resulting Issuer”),

subject to the terms and conditions outlined below. Upon completion of the Transaction, it is the

intention of the parties that the Resulting Issuer will continue the business of Abaxx. The Resulting

The issuer will apply to list on the TSX Venture Exchange (“TSXV”). Assuming completion of the

The transaction, it is anticipated that the Resulting Issuer will be listed on the TSXV as a Tier 2 technology issuer. The Transaction is anticipated to close on or around November 30, 2020.

NML was also in the news this past week having completed a deal that will create a new business combination where each share of NML stock will be traded for $0.08 CAD. The structure of the deal is a reverse takeover agreement with Abaxx Technologies. This process is where a private company will buy the majority stake in a public company to consolidate operations creating a”new entity”. Companies do this to avoid the costs associated with IPOs.

How would a current or potential shareholder in NML check if management has implemented these strategies and created value?

Balance Sheet

The Company’s working capital has been invested in cash, debentures of a public corporation, and equity investments in public corporations. These investments have been classified as current assets. The Company intends to use a portion of its cash and investment income to fulfill the assessment work required to maintain claims and pay corporate operating expenses.

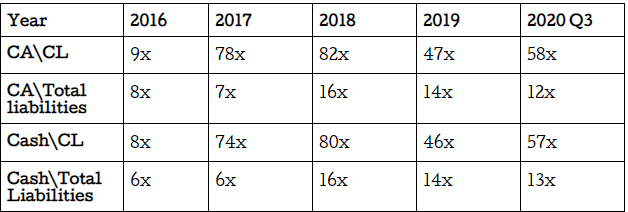

TABLE1

To assess the current health of the business it’s important to take a look at its ability to meet its short term obligations.

These short term obligations could be suppliers and other creditors of the firm.

We can look at the Current asset / Current liabilities to see how many times the cash and receivables of the business cover the liabilities. The best would be a 2:1 ratio. Meaning they have double the assets to cover their short term obligations.

From TABLE1 we can see the business is in a very liquid position and has the ability to meet its short term and long term obligations.

The quality of these assets used to meet the obligations will also need to be looked at deeply to know how likely it is the numbers reflected in the accounts are real.

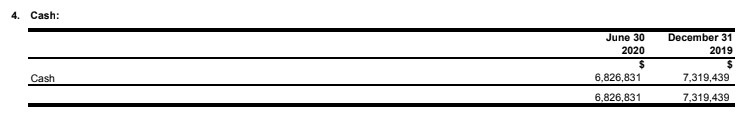

The company has over 6 million in cash that is in the bank and ready to be deployed. This cash is easier to take out of the business and is the most liquid asset.

The company has over 6 million in cash that is in the bank and ready to be deployed. This cash is easier to take out of the business and is the most liquid asset.

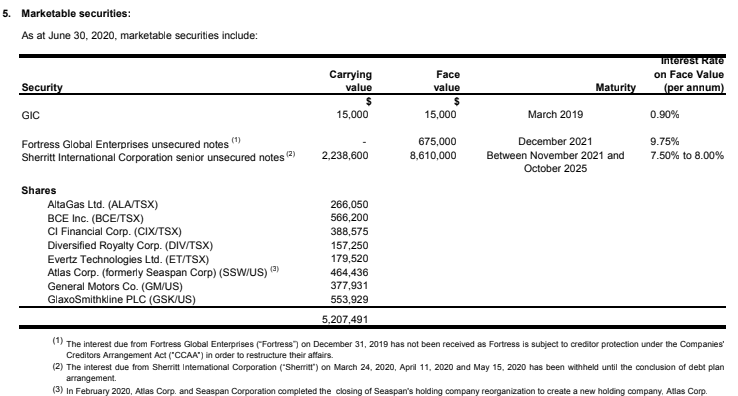

The rest of the money is invested in marketable securities that can be sold in the market at the prevailing market prices. The full amount will depend on the market sentiment at the time of the sale but since we are in a “bull” market currently they would be able to realize the full amount on the sale of their investments.

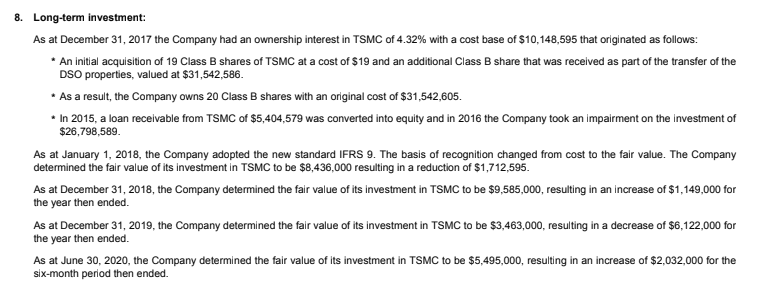

They also have a $5 million dollar strategic investment in Tata Steels Corp. This is also similar to investing in common stock by individuals but there are lock-up periods and certain agreements that will limit the companies ability to sell these assets quickly

The company does not have any debt so if the business was liquidated or sold the total proceeds less any liabilities would go to the shareholders.

In the investment world, the institutional investors would call this an asset play, buying a business for its valuable assets instead of its cash flow.

NML has a net worth of $17 million and the current market cap is $15 Million giving the investor a discount of at least 13%. Meaning the net worth translated to shares is $0.09 compared to the market price of $0.085 which means it might be undervalued by 5%

Most institutional investors look for a discount of about 33% to 67% to have a relative margin of safety if their research is wrong due to human error.

The market at the open had judged NML as, “better dead than alive” but has recently reappraised it to a valuation that is closer to the value of the assets in the business.

HAPPY HUNTING!